Measuring Factor Exposures: Uses and Abuses

- Ronen Israel and Adrienne Ross

- The Journal of Alternative Investments

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

- USES: Can investors really separate “alpha” from “beta”? What are the ins-and-outs of understanding the exposures in a portfolio and their contribution to “alpha”?

- ABUSES: Are there differences in the way strategies are constructed in academic articles vs. the way practitioners actually implement those strategies that are consequential for investors?

What are the Academic Insights?

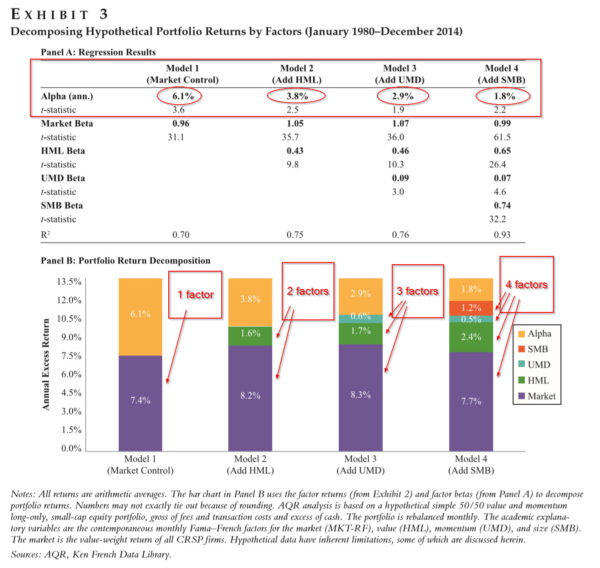

- YES. But it’s a bit complicated. Two things are needed to separate alpha from beta: first, a risk model and second, use of regression to match the returns from a portfolio to the risk exposures present in that portfolio. What are the appropriate risk factors (CAPM, Fama-French, etc.) that are associated with or explain returns produced by a portfolio? Once identified, then regression analysis is conducted to decompose portfolio returns into their component sources of risk as they exist in the portfolio. Portfolio returns are regressed again the returns of the risk variables which accomplishes the separation need to isolate alpha. Any return that is not separated and associated with a risk exposure is real alpha. The results of several such regressions are presented in Exhibit 3. Four risk models are estimated beginning with the basic CAPM (model 1) and three Fama-French factors are added sequentially (models 2,3,4). Note that as risk variables are added, alpha decreases from 6.1% to 1.8% as it is essentially being reassigned to the risk exposures actually embedded in the portfolio.

- YES. While not intuitively obvious, the way that academics conduct research is designed to illustrate or test a theory and hopefully get the results published. The studies are definitely not designed to illustrate how investors should implement their significant results. Be aware of the following potential sources of discrepancies in the performance of actual portfolios and the academic results that are published. First, academics may not account for the costs of implementation including management fees, transactions costs, and taxes. Second, practitioners are generally interested in large and mid-cap universes for reasons of investibility. Academics may construct their studies to encompass all capitalization classes. Therefore, their results may be a function of the proportion of smaller capitalization ranges included in the study. Academic studies are often unconcerned about industry exposures and, for the most part, they utilize equal weighting schemes. And while the studies are very concerned with making risk adjustments to their results (i.e., determining the presence of “alpha”) they are not concerned with the practical requirements of maintaining a particular active risk stance in the portfolio. Factor studies generally construct portfolios using dollar and market neutral long-short positions to test their theories. And although practitioners may also construct long-short portfolios, they are often constrained by practical considerations such as the need to control active risk exposures and the need to maintain asset allocations. Finally, differences in how factors are measured (single component factors vs. multiple components) may produce more or less robust results.

Why does it matter?

When investors are choosing among managers and the various products offered, the comparison of alpha and beta can be tricky. Are the factors constructed similarly across managers and consistent with respect to implementation costs? Is the manager delivering a portfolio of factor tilts and is that consistent with the investment objective? Can any of the differences in performance relative to published research on factors be explained by the factor and portfolio construction process? Ultimately the investor will want to distinguish between managers offering a portfolio of factor tilts vs. managers delivering real alpha.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

A growing number of investors have come to view their portfolios (especially equity portfolios) as a collection of exposures to risk factors. The most prevalent and widely harvested of these risk factors is the market (equity risk premium); but there are also others, such as value and momentum (style premia). Measuring exposures to these factors can be a challenge. Investors need to understand how factors are constructed and implemented in their portfolios. They also need to know how statistical analysis may be best applied. Without the proper model, rewards for factor exposures may be misconstrued as alpha, and investors may be misinformed about the risks their portfolios truly face. This paper should serve as a practical guide for investors looking to measure portfolio factor exposures. We discuss some of the pitfalls associated with regression analysis, and how factor design can matter a lot more than expected. Ultimately, investors with a clear understanding of the risk sources in an existing portfolio, as well as the risk exposures of other portfolios under consideration, may have an edge in building better diversified portfolios.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.