One of the oldest and most persuasive arguments in the stock market is that small stocks outperform large stocks.(1) Warren Buffett, speaking at the 2013 Berkshire Hathaway Annual Meeting, summarized the sentiment when discussing the disadvantages of managing a huge amount of capital:

There’s no question size is an anchor to performance.

The implication is that managing a huge asset base prevents an investor from exploring the more intriguing opportunities available in smaller and more illiquid stocks.(2)

We agree with Buffett: having a fat wallet makes it tough to outperform. If investors are focused on long-term outperformance, small stocks are a good place to find outsized returns. Of course, you still need a solid underlying investment process – small stocks won’t cure bad ideas. But coupling a reasonable process with smaller stocks can be a wonderful approach. For example, almost all popular investment factors, including value and momentum, have historically worked much better in smaller stocks than they do in mega-cap stocks.

And while Warren Buffett’s quote seems to suggest that the debate over the outsized potential of small caps is settled, it turns out there is substantial debate on the topic. Investors looking to make more informed portfolio decisions should be aware of these arguments before grasping small caps with both hands.

A Short History of the “Size Effect”

First, a little history on the research into the so-called “size effect.” Rolf Banz pioneered the exploration of the size premium in his 1981 paper, “The Relationship Between Return and Market Value of Common Stocks.” Prof. Banz found that, on average, small-cap stock portfolios outperform large-cap portfolios on a risk-adjusted basis. This research is often cited as the original “size effect” paper, but even in this original work the good professor highlights that there are 1) no theoretical foundations for the size effect and 2) his results could be proxying for a hidden factor. In other words, further research needed to be conducted.

Following the Banz paper, asset managers started developing products built on the premise that size matters. In today’s market there are plenty of mutual funds, ETFs, and indexes where size is the core component of the process.

Is the Research on the Size Effect “Fake News?”

More recent research has dug even deeper, even questioning the data source from which many of the results are derived. In 2009 Professor Edward McQuarrie wrote a paper titled “The Myth of 1926: How Much Do We Know About Long-Term Returns on U.S. Stocks?” where he brought up some of the complications with the data-set for CRSP, specifically for small-cap stocks. CRSP, which stands for the Center for Research in Security Prices, provides data for almost all the research done on equity prices in the United States. Prof. McQuarrie’s concern is that the outperformance of small caps is concentrated in the very early years just after the Great Depression, exactly when there are the most issues in the CRSP database. (A more detailed look on these results are available here).

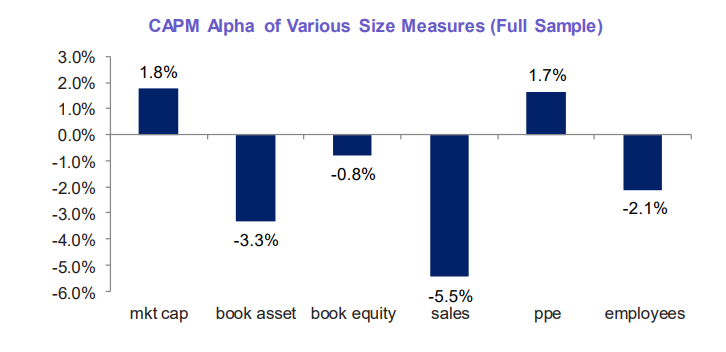

Perhaps the most interesting entrant into the discussion comes from the monster quantitative-focused asset manager, AQR. In their paper, “Fact, Fiction, and the Size Effect,” the authors question if there ever was a size effect, after properly controlling for data issues, liquidity concerns, and proper adjustments for risk. In short, perhaps Banz’s size effect never really existed! To many investors, who invest in products focused on small-cap stocks, this will surely come as a not-so-welcome surprise. (below is a chart from the paper that summarizes much of the analysis).

So, Does Size Matter in the Stock Market?

Perhaps not all is lost when it comes to investing in small-caps. Even the AQR researchers left some wiggle room for anyone who still wants to hang onto their beliefs regarding small stocks. For example, the authors find that size can enhance other strategies, such as value, momentum, and quality. This “wiggle room” has been confirmed in cutting edge academic research such as the paper, “Replicating Anomalies,” by professors Kewei Hou, Chen Xue, and Lu Zhang, who replicate 447 anomalies in the stock market and identify that the biggest opportunities for market-beating returns are concentrated in smaller stocks. Our own internal research confirms the same thing. Size matters – especially when mixed with strategies that look at cheap stocks (i.e., “value”) or strong performing stocks (i.e., “momentum”).

The conclusion? We think focusing exclusively on size is misguided. But that doesn’t imply that small-caps are a waste of time. If your investment portfolio is set up to exploit popular factors, such as value and momentum, make sure you check out the small/mid-cap versions before you jump into the mega-cap edition – your long-term investment performance might depend on it!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.