Low Volatility Needs Little Trading

- Pim van Vliet

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

- What is the relationship between turnover and returns from a low volatility portfolio that integrates value and momentum exposures with low volatility?

- Does the relationship change if a only one factor is integrated with a low volatility strategy?

Note: This is a follow up piece to this blog piece.

What are the Academic Insights?

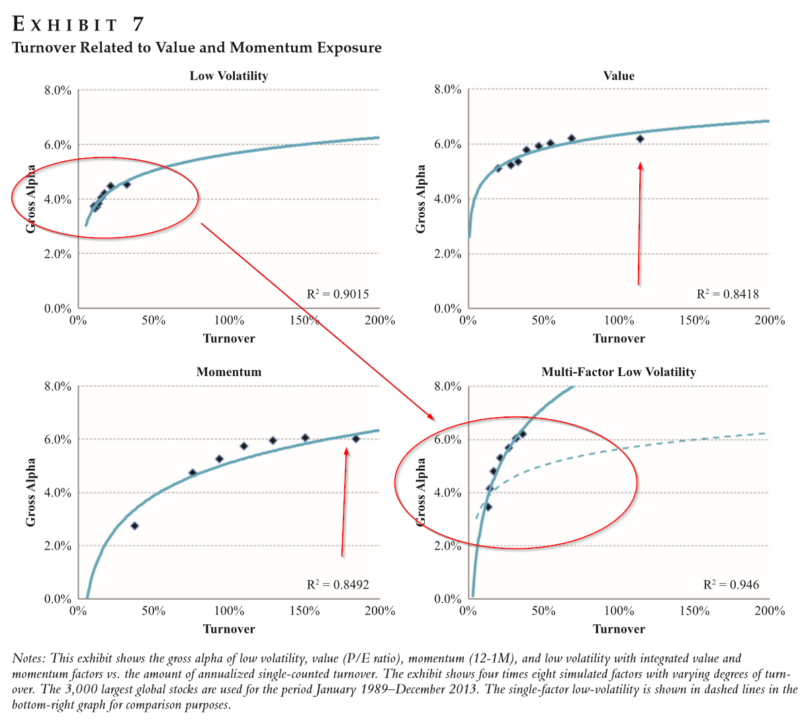

- CONCAVE WITH DIMINISHING RETURNS. Similar to the low volatility simulations (Exhibit 7 upper left hand corner), the low volatility + value + momentum simulations (Exhibit 7, lower right hand corner) exhibit a concave function with diminishing returns, however with a much steeper slope. As might be expected the tradeoff between alpha and turnover is quite a bit more favorable, although both exhibit declining marginal benefits.

- YES. IT IS LESS EFFICIENT. As shown in Exhibit 7 , in the lower right hand corner, the slope of the multifactor/low volatility (low V) strategy is dramatically steeper than the slope indicated by the single factor/low V strategy (dotted line). This suggests the efficiency as measured by units of alpha gained per unit of turnover for the multifactor/low V vastly exceeds that of the single factor/low V strategy. The authors cite an example where the single factor turnover rate is more than twice that of the multifactor portfolio. Specifically, the multifactor/low V portfolio with an alpha objective of 4.5% delivered a minimum turnover of 15% versus a single factor/low V portfolio with the same alpha objective that delivered a minimum turnover of 35%. On the other hand, fixing turnover at 20% and then 30% produced an additional 2% alpha.

Why does it matter?

Higher turnover in a low volatility strategy can be justified by integrating other factors such as value and momentum. The additional alpha generated thereby can also be done at low trading costs. This is especially true for multifactor approaches, rather than mixing a single factor with low volatility.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

An efficient low-volatility strategy only needs a little amount of trading. The empirical literature on low-volatility investing reveals a concave relation between the amount of trading and the risk reduction. Portfolio simulations confirm this non-linear pattern in which each increase in turnover results in smaller marginal reductions in volatility. In general a moderate trading level of 30% is enough to reduce portfolio volatility by 25% compared with the market index. In addition, low-volatility stocks are relatively liquid and cheap to trade, primarily because they are much larger than the average stock. The law of diminishing returns also applies to other alpha factors such as value and momentum and integrating them into a multi-factor low-volatility strategy is an efficient way to increase factor exposure at low trading costs.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.