Industry Familiarity and Trading: Evidence from the Personal Portfolios of Industry Insiders

- Itzhak Ben-David, Justin Birru and Andrea Rossi

- Journal of Financial Economics, forthcoming

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

- Is industry familiarity an advantage in stock trading?

- What type of information are the insiders trading on?

What are the Academic Insights?

By studying a novel source (the trading records of 78,000 individual investors at a large discount broker from January 1991 to November 1996 where they are able to identify identify 105 accounts that belong to insiders of publicly traded firms.), the authors find the following:

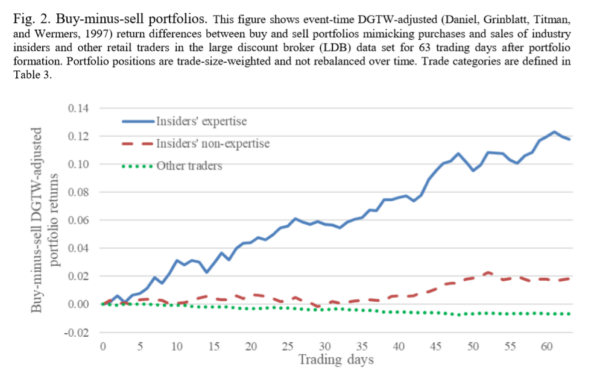

- YES- the authors find evidence that insiders exhibit skill only in their own-industry trades. These results are robust to various methods of measurement: holdings-based calendar-time portfolios, transactions-based calendar-time portfolios, and buy-and-hold abnormal returns. Differences are significant. A portfolio of own-industry purchases minus own-industry sales earns a Carhart alpha of 16% per year. In contrast, a portfolio of non-own-industry purchases minus non-own industry sales earns a statistically insignificant alpha of 3% per year.

- Prior research identifies information such as trading ahead of earnings announcements or merger and acquisition (M&A) announcements, or trading in conjunction with the trades of firm insiders. However, this study does not reveal any evidence that insider profits in industry stocks originate from any of the commonly identified sources. Instead, the analysis suggests that industry familiarity is the trading advantage that best explains our results. Specifically, insiders are better able to decipher public information about firms in their own industry. These results are consistent with recent evidence that industry expertise matters. Bradley, Gokkaya, and Liu (2017) determine that analyst forecasts are more accurate for firms in industries in which the analyst has previous work experience. In the mutual fund setting, Cici, Gehde-Trapp, Göricke, and Kempf (2014) find evidence that mutual fund managers’ trades in industries in which they have previous work experience outperform other trades.

Why does it matter?

This paper is the first analysis of insider trades in non-insider stocks. First, the authors show that insider trades disproportionately consist of stocks within the insider’s industry of expertise. This trading tilt toward same-industry stocks could represent a familiarity bias in which insiders invest in what they know. Alternatively, it could be the case that insiders possess a comparative advantage in trading stocks in their industry of expertise. What emerges is that consistent with the latter, as insider trades in own-industry stocks vastly outperform trades in non-own-industry stocks. Industry expertise is an advantage. The level of industry familiarity exhibited by insiders is a source of trading skill. The only caveat is the fact that data is a bit outdated and needs to be checked to see whether the documented effect is larger or smaller in recent years.

The Most Important Chart from the Paper:

Figure 2 shows returns for long buys and short sells: trades perform substantially better than non-expertise trades and the trades of all other traders.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We study whether industry familiarity is an advantage in stock trading by exploring the trading patterns of industry insiders in their own personal portfolios. To do so, we identify accounts of industry insiders in a large dataset provided by a retail discount broker. We find that insiders trade firms from their own industry more frequently. Furthermore, they earn abnormal returns exclusively when trading own-industry stocks, especially obscure stocks (small, low analyst coverage, high volatility). In a battery of tests, we find no evidence of the use of private information. The results are most consistent with the interpretation that industry familiarity is an advantage in stock trading

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.