Only Winners in Tough Times Repeat: Hedge Fund Performance Persistence over Different Market Conditions

- Zheng Sun, Ashley W. Wang, and Lu Zheng

- Journal of Financial and Quantitative Analysis

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

Whereas most investors evaluate hedge fund managers based on track record AND pay high fees for expected superior performance, the authors address a number of compelling questions in this article. Although previous studies have produced mixed results on the topic using mutual fund data, they have done so without examining the impact of market conditions on performance persistence.

- Does past performance predict future performance for hedge fund managers and is it related to conditions in the hedge fund market?

- Is performance persistence related to manager skill?

Two measures of conditional performance are used: (1) RET DOWN—the returns of funds when the overall hedge fund sector return is below its historical average; (2) RET UP—the returns of funds when the sector return is above its historical average. Hedge fund performance measures include a 7-factor alpha, the appraisal and Sharpe ratios.

What are the Academic Insights?

- YES and YES. Managers who perform well in down hedge fund markets “repeat” in subsequent periods. Performance persistence is documented for managers who perform well when hedge fund markets are generally weak. There is little evidence of performance persistence for managers who do well in strong hedge fund conditions. Managers of hedge funds with higher RET DOWN returns outperform their peers on all 3 performance measures for the following 3 months to 3 year forecast period. Managers with higher RET UP do not outperform in the subsequent period. Controls for fund characteristics and styles were used. Similar results were found when a sorting vs. regression methodologies were implemented.

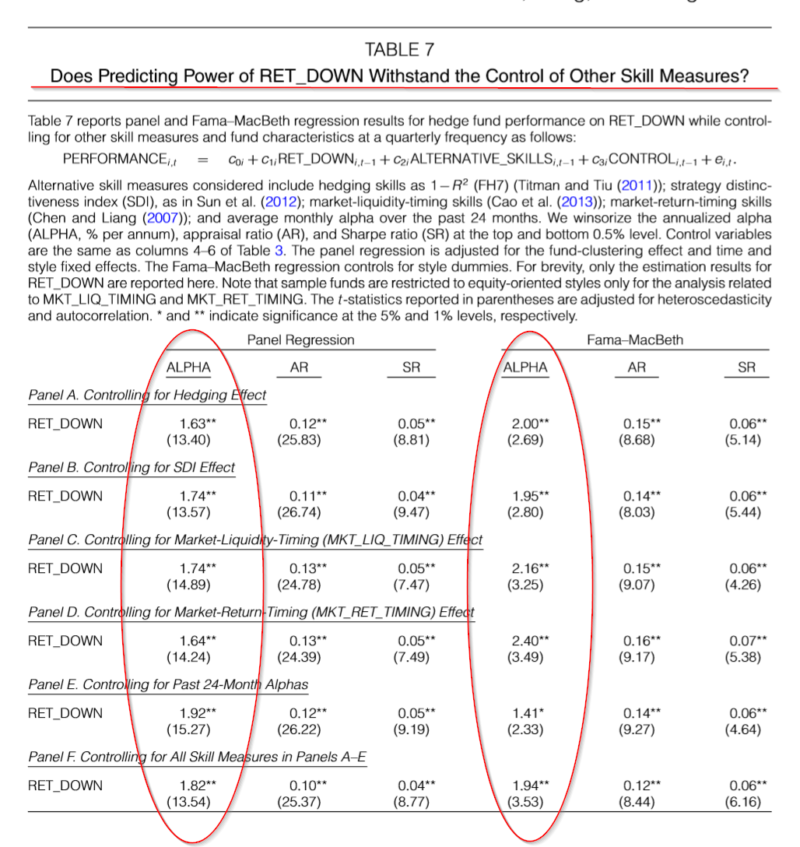

- YES. The results of tests of investment skill including hedging ability, strategy innovation, market liquidity timing, and market return timing are presented in the chart below. All skill measures were significant and positively related to RET DOWN, and results were robust to control measures and methodology. Skills measures were negatively related to RET UP, although not presented for brevity.

Why does it matter?

The RET DOWN hedge fund performance measure is a useful predictor of future hedge fund performance because it appears to reflect superior investment skills. Tests show competing hypotheses such as the use of strategies specific to hedge funds or exposures to unusual risks are not supported.

Investors who use track records to select hedge fund managers are advised to adopt the past RET DOWN calculation which is a conditional measure rather than a simple, unconditioned track record.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We provide novel evidence that hedge fund performance is persistent following weak hedge fund markets, but is not persistent following strong markets. Specifically, we construct two performance measures, RET_DOWN and RET_UP, conditioned on the level of overall hedge fund sector returns. After adjusting for risks, funds in the highest RET_DOWN quintile outperform funds in the lowest quintile by about 7% in the subsequent year, whereas funds with better RET_UP do not outperform subsequently. The RET_DOWN can predict future fund performance over a horizon as long as 3 years, for both winners and losers, and for funds with few share restrictions.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.