Passive Sustainable Funds: the Global Landscape

- Hortense Bioy and Kenneth Lamont

- The Journal of Index Investing, 2018

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the Research Questions?

Assets under management in portfolios that incorporate environmental, social, and governance (ESG) factors have grown to an estimated $23 trillion globally, an increase of more than 600% over the past decade (Global Sustainable Investment Alliance 2016). Additionally, thanks to improved ESG data on companies, index and fund providers have developed new index-tracking products to meet investor demand.

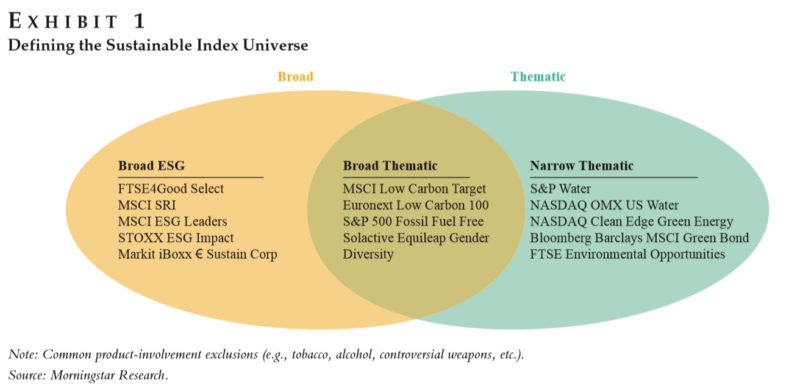

The authors survey the passively managed ESG side of the industry and develop a taxonomy by dividing the types of strategies in three categories: broad ESG, broad-thematic, narrow-thematic.

What are the Academic Insights?

BROAD-BASED ESG FUNDS

These indexes tend to employ a best-in-class approach, which involves screening for the top ESG performers within a given investment universe. Differences between best-in-class indexes are reflected in differences in terms of security selection and weighting schemes. Securities are typically selected based on their ESG ratings or key performance indicators (KPIs) and subsequently weighted according to their ESG ratings/KPIs or market capitalization. Examples are the MSCI SRI, MSCI ESG Leaders, and the FTSE4GOOD Select. An alternative to the best-in-class approach, which can lead to high active risk relative to market-cap benchmarks, is to select and weight constituents through optimization. Examples are the MSCI ESG Focus and the Vanguard SRI Global.

THEMATIC ESG FUNDS: BROAD AND NARROW

These funds are designed to deliver impact. The various approaches to ESG thematic investing can be represented on a spectrum, with broad-thematic indexes that provide a tilt at one end and narrow-thematic or quasi-sector indexes at the other end. Narrow-thematic funds currently hold more assets under management in the United States, while broadthematic funds are favored in Europe. Examples of broad thematic are the MSCI World Low Carbon Target Index and the SPDR SSGA Gender Diversity exchange-traded fund. Examples of narrow thematic are the PowerShares Water Resources ETF and the VanEck Vectors Green Bond ETF.

Why does it matter?

There are currently about $104 billion invested in 287 passive sustainable funds. This figure increased threefold over five years. Growth across regions was not uniform. Over the past five years, US assets quadrupled, but European funds dominated inflows over that same span and retained the majority of assets—accounting for 83% of the global total. The number and AUM of fixed-income funds make up a small fraction of the universe of passive sustainable funds. Passive sustainable funds tend to charge higher fees than their plain-vanilla peers. The authors anticipate that cost competition in this space will become more prominent in the years to come.

The Most Important Chart from the Paper:

Abstract

In this article, we provide an overview of the global landscape of index-tracking sustainable funds, looking at trends in asset growth, asset flows, and product development. We focus on the two regions where these funds have seen the greatest adoption, Europe and the United States. We also examine the broad range of approaches that aim to address various sustainability and investment objectives.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.