One of the most well known and most beloved forms of literature is the fairy tale. Although most fairy tales are not about fairies, they are fictitious and highly fanciful tales of legendary deeds and creatures. They are often derived from oral folklore based on myths and legends. Fairy tales are usually intended for children.

One of the most popular fairy tales is the Grimm brothers’ “Snow White.” In order to eliminate her competition for “the fairest in the land,” the Evil Queen dresses as an old woman and offers Snow White a beautiful, shiny red apple. Despite a stern warning from the Seven Dwarfs, Snow White cannot resist the temptation of the apple. She takes the bite that sends her into a deep sleep.

Adult Fairy Tales

Wall Street’s product machine is continuously pumping out fairy tales. Their product innovations can also be called “fanciful tales of legendary deeds.” The only difference is that they are intended for adults. Like the Evil Queen’s apple, they have shiny features designed to entice naïve investors. And despite the many fanciful tales available, almost all of them have one thing in common: despite their seeming appeal, they have attributes that make them more attractive to the seller than the buyer. Typically, these products fall into the category of what are referred to as “structured products.”

Structured products are packages of synthetic investment instruments specifically designed to appeal to needs that investors perceive are not being met by available securities. They are often packaged as asset allocation tools that can be used to reduce portfolio risk. Structured products usually consist of a note and a derivative—the product derives its economic value by reference to the price of another asset, typically a bond, commodity, currency or equity. That derivative is often an option (a put or a call). The note pays the interest at a set rate and schedule, and the derivative establishes payment at maturity.

Because of the derivative component, structured products are often promoted to investors as debt securities. Depending on the structured product, full protection of the principal invested is sometimes offered. In other cases, only limited protection may be offered, or even no protection at all.

Since the 2008 drop in interest rates to historic lows, investors have been engaged in a search for yield. This is especially true for those who use a cash flow approach (instead of a total return approach, which I recommend) to spending. For years, regulators have cautioned that the complex products may be hard for a retail investor to evaluate and could be misleadingly marketed as conservative fixed-income investments. For example, in 2016 the SEC charged UBS Financial Services for unsuitable sales of $548 million of reverse convertibles to 8,700 inexperienced investors.

Despite such warnings, the 2018 Greenwich Associates survey of structured products reported that after a decline in the previous year, the volume of structured products distributed to U.S. retail and high-net-worth individuals in 2018 increased to just over $48 billion (annualized). Among the biggest suppliers of product were HSBC, J.P. Morgan, Barclays, Goldman Sachs, Credit Suisse and Morgan Stanley. And this is not just a U.S. phenomenon. In some countries (such as Germany and Switzerland) about 6 percent of all financial assets are held in structured products.

Unfortunately, these products are “popular” for the same reasons many financial products are popular—either they carry large commissions for the sellers, or they so greatly favor the issuers that they push the products on unsophisticated investors who cannot fathom the complexity (but are assured by the salespeople and the advertising that these are good and often safe products).

Fortunately, there’s a substantial amount of research on structured products. We know that sophisticated issuers create them because they lower their costs of capital and generate profits. Thus, whenever an individual investor buys a complex instrument from Wall Street, you can be certain they are being exploited. The reason is simple: If the issuer could raise capital more cheaply with a straightforward and simple debt instrument, they would do so. Thus, the question isn’t whether an investor is being taken advantage of, but only how badly. I’ll review the evidence from the academic research on these products.

The Evidence

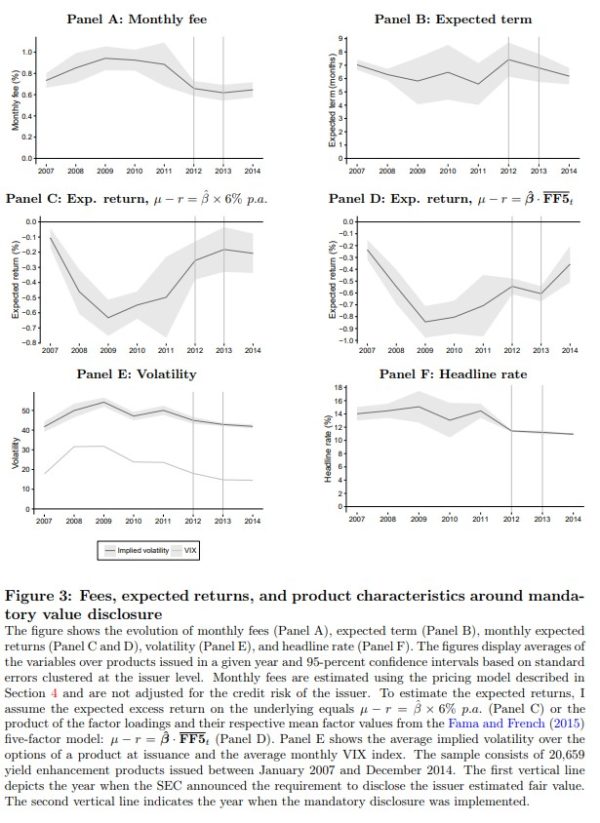

Petra Vokata contributed to the literature on structured notes with her June 2018 study “Engineering Lemons.”

She began by noting,

Since 2008, banks have engineered and sold over $100 billion of yield enhancement products (YEPs) to U.S. households. These products offer attractive yields—12% per annum on average—and represent the largest and fastest-growing category of retail structured notes. YEPs package high-coupon bonds with short positions in put options and embed a fee that is largely undisclosed and cannot be estimated without applying option pricing techniques.

She added that YEPs “represent the largest category in terms of the number of products of retail structured notes offered in the U.S. Their issuance volume accounts for more than 40 percent of the volume of structured notes registered with the SEC.” These products are distributed to the public through affiliated broker-dealers as well as through unaffiliated broker-dealers, private banks and registered investment advisers. Banks market the products under different names, such as reverse convertible notes, income securities, yield optimization notes, equity-linked securities and reverse exchangeable securities.

Vokata’s study covered the U.S. market for YEP products over the period January 2006 through September 2015. Her sample included more than 21,000 products. The following is a summary of her findings:

- Investors pay 7 percent in annual fees and subsequently lose 7 percent per year relative to risk-adjusted benchmark returns.

- The average realized returns over the decade are negative, and the losses are not restricted to the financial crisis of 2007-08.

- The bottom third of the products with the shortest maturity—and therefore the shortest time to recoup their fees—earn negative average returns in eight of the 10 sample years.

- YEP fees are large enough, and the product betas low enough, that even the expected returns of YEPs are negative.

- In some cases, embedded fees were well into double digits.

- YEP fees are several times larger than fees charged by a typical mutual fund and about twice as large as fees charged by hedge funds, private equity funds and venture capital funds.

- Fees remained large even after the SEC mandated disclosure of product values.

- The underlying securities are typically highly volatile stocks, with high idiosyncratic volatility, selected systematically to support high headline rates and moderate downside protection. Their average beta is over 1.5—a value common for the top beta decile of U.S. stocks.

- Investors in YEPs lost money on average. The volume-weighted average return is −4.6 percent over the holding period, or −0.7 percent monthly. More than a quarter of the products paid back less than the invested capital.

- The vast majority of the products are not listed on an exchange, are traded only over the counter, and are highly illiquid. In most cases, the only buyer of the notes before maturity is the issuing bank. The issuer, however, is not required to repurchase the notes or to quote their daily prices.

- The notes constitute a senior unsecured debt of the issuer and are therefore subject to its credit risk.

- Their tax treatment is complex, often uncertain, and the products do not appear to offer any tax benefits.

Sadly, but not surprisingly, Vokata reported that “YEPs are targeted at non-accredited retail investors. Evidence from regulatory investigations shows that some investors do not understand the terms of the products (U.S. Securities and Exchange Commission, 2011) and that some broker-dealers are aggressively marketing the products to elderly, non-English speaking investors, and to investors with conservative investment objectives, modest income or wealth, and little investing experience.” She found: “Conflicted payments—kickbacks and commissions to the brokers recommending the products—account for nearly half of all YEP fees.” This finding was consistent with that of Mark Egan, author of the study “Brokers vs. Retail Investors: Conflicting Interests and Dominated Products.” Egan showed that brokers’ incentives can explain the popularity of relatively inferior YEPs and that their buyers are not sophisticated enough to find “the best deal” in the market. Perhaps most disturbing of all is that Vokata noted the evidence that “brokers targeting YEP sales to elderly investors—for whom YEPs are less likely to be suitable—is consistent with broker efforts to exploit investors’ cognitive limitations.” This provides further support for the popular saying “When you deal with a broker, the one likely to be broker is you.” Perhaps it’s also why Woody Allen defined a broker as “someone who invests other people’s money until it is all gone.” That’s why stockbrokers changed their titles to “financial advisors.” But painting stripes on a horse doesn’t make it a zebra.(1) Vokata concluded: “The most plausible interpretation of my results is that banks issue YEPs to cater to yield-seeking investors who do not understand their high fees and poor performance.”

In my view, YEPs are products meant to be sold, never bought, because, by definition, they are bad products. Their issuance should be banned, or at least limited to institutional investors who have the resources to evaluate the offerings. Of course, that would likely drive demand to zero! In recognition of the problem, FINRA introduced rule 2111, broker-dealers can only sell products that are suitable for a customer based on the customer’s investment profile. FINRA encourages broker-dealers to consider the recommendation of a YEP suitable only if they have a reasonable basis to believe that the investor is capable of evaluating its risks based on knowledge and experience. Clearly, there are virtually no retail investors capable of analyzing the true risks and costs of these complex products (or there would be no sales). In fact, as Vokata noted, regulators in Belgium and Portugal have issued moratoriums on selling complex structured retail products.

Regulations Required

In their University of Chicago working paper, “An FDA for Financial Innovation: Applying the Insurable Interest Doctrine to 21st Century Financial Markets,” Eric Posner and E. Glen Weyl proposed that “when firms invent new financial products, they be forbidden to sell them until they receive approval from a new government agency designed along the lines of the FDA, which screens pharmaceutical innovations.” While the FDA can often take years to approve a product, the review of financial innovations should be much cheaper and faster because it should involve readily available public data and well-known mathematical calculations.

Investments in derivatives and other innovations can be as dangerous to your financial health as taking a bad medicine can be to your physical health. Naïve individuals need to be protected from exploitive financial firms who seek not to help investors but to plunder them, treating them like Muppets. Greg Smith, a former executive director at Goldman Sachs, in a New York Times editorial, “Why I Am Leaving Goldman Sachs,” claimed five different managing directors referred to their own clients as Muppets. Smith also said the firm’s culture had changed during his nearly 12 years at the company, from one that looked out for clients to one that seemed focused on liberating them from their money.

If the fiduciary standard of care was applied to the selling of financial products, it’s likely that virtually all structured notes would disappear. And if a person selling the product can’t demonstrate that its purchase is in the buyer’s best interest, why should that sale be allowed? This standard should be applied to all products, but especially the category of structured products such as equity-linked CDs and equity-indexed annuities, which were created by sophisticated financial institutions to sell to naïve investors. Their complexity allows the creators to embed fees that are exploitative at best and immoral at worst.

Just as broker-dealers can be fined for excessive markups on bonds, creators of structured products should be treated similarly and held to an established standard of what constitutes a reasonable fee. Unfortunately, as is the case with pharmaceuticals, full disclosures are simply not enough because some financial products are so complex that the typical investor can’t determine the nature of the fees or even the risks involved. How many investors will read a 70-page disclosure document, and why should they have to? This simple recommendation, to hold creators of structured products accountable, would go much further to protect investors and society than the 2,319-page Dodd-Frank Act.

Summary

The demand for structured products can only be explained by well-known behavioral factors such as loss aversion (studies suggest that losses are twice as powerful, psychologically, as gains), gambling to avoid sure losses, overpaying for the small possibility of a large gain, misestimating probabilities, overconfidence and the power of the marketing machines of Wall Street.

From the issuer’s perspective, the products are great because their complexity allows them to exploit the behavioral biases of investors and raise capital at well below market rates—the complexity increases the likelihood of investors misestimating probabilities. From the buyer’s perspective, they’re a disaster.

It’s clear that retail investors have no clue as to the underlying nature of the risks and true costs of these products. Given that Vokata conservatively estimated that U.S. retail investors lost more than $1.5 billion over the period studied, it’s time the SEC caught up with regulators in Belgium and Portugal and outlawed structured products. What are they waiting for? You can be virtually certain that no financial advisor who is held to a fiduciary standard, as are all registered investment advisors, would ever recommend any of these products. Unfortunately, the same cannot be said for those who work for broker-dealers or other non-fiduciaries. Forewarned is forearmed.

The perfect conclusion to this analysis is from the film “War Games.”

“A strange game. The only winning move is not to play. How about a nice game of chess?” – Joshua (the supercomputer) War Games, John Badham, MGM/UA Entertainment Company (1983)

For those interested in reading more about these products, the Appendix provides a summary of some of the research.

Appendix

Stefan Hunt, Neil Stewart and Redis Zaliauskas contribute to the literature on structured products with their March 2015 paper “Two Plus Two Makes Five? Survey Evidence that Investors Overvalue Structured Deposits.” The paper was written for the U.K.’s Financial Conduct Authority (FCA), which “is committed to encouraging debate among academics, practitioners and policymakers in all aspects of financial regulation.” Hunt and Zaliauskas are in the Chief Economist’s Department of the FCA, and Stewart is a professor in the Department of Psychology at the University of Warwick.

The authors begin by noting: “Innovation in retail financial markets has led to increasing product complexity over the past two decades, but there is little evidence of a comparable increase in consumers’ financial capability. Over the same period, there have been numerous instances of mis-selling that have led to regulatory action in the UK. For example, the FCA has repeatedly fined structured product providers and voiced concerns about market practices, indicating that the market is not working well for investors. The fines imposed on a major provider of retail structured products were related to failings in sales of structured capital at risk products and to misleading promotions of structured deposits. When examining whether the market for a particular complex financial product is working well, one of the things regulators need to ask is whether consumers can understand and adequately assess the products they consider buying.” Thus, the purpose of their paper was to investigate: how well consumers understand and value structured deposits; whether there are systematic biases in investors’ evaluation of the expected performance of the structured deposits; and whether giving targeted information improves this evaluation.

Hunt, Stewart and Zaliauskas conducted a survey of 384 retail investors who had relatively well-diversified portfolios and had previously bought or would consider buying structured deposits or other structured products. They showed these investors hypothetical examples of five popular types of products with returns linked to performance of the FTSE 100 Index. To distinguish between expected returns driven by overall optimism about the market and difficulty in understanding how structured deposit returns derive from an underlying index, they asked investors about their views on the performance of the FTSE 100 Index over the next five years. They then compared investors’ expectations about FTSE 100 returns with the returns they expected from different structured products. This allowed the authors to calculate bias in how investors evaluate the structured deposits relative to the index. They then asked investors to rank the structured deposits against a range of fixed-rate deposits, taking into account the risk of the different structured deposits. Finally, they looked at whether various types of disclosure altered respondents’ valuations. The following is a summary of their findings:

- While investors’ expectations of FTSE growth were on average well aligned with the assumptions used in the authors’ quantitative model, investors significantly overestimated the expected returns of all structured deposits, even the most simple.

- Investors overestimated expected product returns by 1.9 percentage points per year on average, adding up to 9.7 percentage points over the five-year term.

- Investors’ expectations were also significantly higher than returns from their quantitative model.

- Returns were overestimated for all five products. The overestimation ranged between 1-2.5 percent per annum, figures that are statistically significant. Only 1.6 percent of respondents did not overestimate any of the three products’ returns, while 70 percent of respondents overestimated all products’ returns, leading to returns of the products being overestimated in 86 percent of cases.

- Although all five structured deposits in the survey would have been unlikely to return more than simple fixed-term cash deposits, investors didn’t recognize this. In other words, they didn’t require a premium for the incremental risks of the products—investors were valuing structured products as if they were risk free.

- Once again demonstrating that overconfidence is an all-too-human trait, those who thought of themselves as above-average financial experts were 0.44 percentage points less accurate in translating their FTSE expectations into product returns.

- The disclosure of likely product returns and risk had some effect on investors’ ability to adjust for initial incorrect valuations. Investors who had initially overestimated returns or underestimated risk of return were more likely to adjust their valuations after more information.

“Scenarios disclosure”—giving the investors information on what would happen under hypothetical scenarios—had little effect on product revaluation, while quantitative model returns—telling investors what likely product returns are based on the authors’ quantitative model—on average induced a 0.41 percentage point larger devaluation of structured deposits.

The authors also noted that “an FCA analysis of a large sample of UK retail structured products, including but not limited to those based on the FTSE index, suggested that products issued since 2008 and that had a maturity of three to five years on average underperformed National Savings & Investments five-year deposit rates.” Hunt, Stewart and Zaliauskas concluded that behavioral biases, combined with features of structured deposits that can exploit these biases, led investors to have unrealistically high expectations of product returns and impede their ability to evaluate and compare structured products to each other and against other deposit-based alternatives. These product designs and distribution strategies (using commission-driven sales forces) exploit consumer weaknesses, likely leading consumers to make mistakes in comparing the options and thus buy overpriced products. Sadly, the authors also concluded: “Our findings suggest that there are limits to how much can be solved just by providing information.”

Their findings are entirely consistent with prior research on structured notes.

Further Evidence

The 2011 study “Why Do Investors Buy Structured Products?” by Thorsten Hens and Marc Rieger concluded that, for investors, any utility gains from structured products are typically much smaller than their fees.

If you’re wondering just how much smaller the benefits are, Brian Henderson and Neil Pearson, authors of the study “The Dark Side of Financial Innovation: A Case Study of the Pricing of a Retail Financial Product,” published in the May 2011 issue of the Journal of Financial Economics, found that the offering prices of 64 issues of a popular retail structured equity product were, on average, almost 8 percent greater than estimates of the products’ fair market values obtained using option pricing methods. As you might guess, given the 8 percent shortfall, they found that the mean expected return estimate on the structured products was slightly below zero. The authors concluded that the issuing firms either shroud some aspects of their innovative securities or introduce complexity to exploit uninformed investors.

Geng Deng, Ilan Guedj, Joshua Mallett and Craig McCann, authors of the July 2010 study “The Anatomy of Principal Protected Absolute Return Barrier Notes,” examined the evidence on a popular product called principal-protected absolute return barrier notes (ARBNs). ARBNs are structured products that guarantee to return the face value of the note at maturity and pay interest if the underlying security’s price doesn’t vary excessively. The principal protection feature guarantees the full payback of the note’s face value at maturity as long as the investor holds the note to maturity and the issuer does not default on the note. The study covered 214 ARBNs issued by six different investment banks. Most of the products were linked to indices such as the S&P 500 Index and the Russell 2000 Index.

Not surprisingly, the conclusion was that the ARBNs’ fair price was approximately 4.5 percent below the actual issue price—investors were paying $1 for something that was just 95.5 cents. Given that, generally speaking, ARBNs are short-term investments, with maturities typically ranging from 6 months to 3 years and most between 12 and 18 months, 4.5 percent is a hefty premium to pay.

The study also found that the yields on ARBNs were lower than the corresponding corporate yields. Many were even lower than the risk-free rate! The authors also cited a similar study that found that Lehman Brothers’ structured products generally had implied yields below the one-year London Interbank Offered Rate! This indicates that Lehman used structured products to finance its operations at submarket rates, even when the company’s credit quality had decreased sharply in 2007 and 2008.

As further evidence, Carole Bernard, Phelim Boyle and William Gornall, authors of the study “Locally-Capped Investment Products and the Retail Investor,” published in the Summer 2011 issue of the Journal of Derivatives, found that the contracts were on average overpriced relative to their fair values by about 6.5 percent.

And my book “The Only Guide to Alternative Investments You’ll Ever Need,” co-authored with my colleague, Jared Kizer, contains a chapter on structured notes that includes analysis of two products, showing how expensive they were as well as how investors could easily find more efficient alternatives.

The Summer 2015 edition of the Journal of Investing contains a study, “Ex Post Structured-Product Returns: Index Methodology and Analysis,” that contributes to the literature on structured notes. The authors, Geng Deng of Wells Fargo, Tim Dulaney, Tim Husson, Craig McCann and Mike Yan, all of the Securities and Litigation Consulting Group, analyzed the ex-post returns of over 20,000 individual structured products issued by 13 firms (Bank of America, Bank of Montreal, Barclays, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, J.P. Morgan, Lehman Brothers, Morgan Stanley, RBC and UBS) from 2007 through 2014. They constructed a structured product index and subindexes for reverse convertibles, single-observation reverse convertibles, tracking securities and autocallable securities by valuing each structured product in their database each day. The table below presents the mean returns, standard deviations and Sharpe ratios for the five structured product indexes as well as the comparable figures for the S&P 500 Index and the Barclay’s Aggregate Bond Index

| Mean Return (%) | Standard Deviation (%) | Sharpe Ratio | |

| Reverse Convertibles Index | -8.0 | 19.5 | -0.41 |

| SO Reverse Convertibles Index | 0.2 | 16.8 | 0.01 |

| Tracking Securities Index | 3.4 | 18.6 | 0.18 |

| Autocallable Securities Index | -4.4 | 17.7 | -0.25 |

| Aggregate Structured Product Index | -0.5 | 18.4 | -0.03 |

| Average | -1.9 | 18.2 | -0.10 |

| Barclays Aggregate Bond TR Index | 4.5 | 6.2 | 0.72 |

| S&P Total Return Index | 6.1 | 18.7 | 0.33 |

To isolate the performance results from the issue of overpricing on the date of issuance, the authors also calculated the initial “shortfall” in pricing:

| Product | Shortfall/Overpricing (%) |

| Reverse Convertibles Index | 7.8 |

| SO Reverse Convertibles Index | 3.9 |

| Tracking Securities Index | 7.5 |

| Autocallable Securities Index | 4.5 |

| Aggregate Structured Product Index | 5.7 |

| Average | 5.9 |

The results clearly show that structured products have dramatically underperformed alternative allocations to stocks and bonds because of overvaluing the products. The authors also showed that the excess returns of the structured product indexes exhibit a stronger linear relationship with the S&P 500 than to the bond index. Yet they are often sold as alternatives to bonds. The results also indicate that structured products are not a unique asset class. The authors concluded: “Ex-post analysis of structured product returns shows that a simple portfolio of stocks and bonds are better investments than structured products.” They added: “Results of our index analysis should cause investors and their advisers to avoid structured products.”

References[+]

| ↑1 | Check out Pat Cleary’s article on the lobbying against a Fiduciary Standard by bank lobbyists. Either you’re a fiduciary who only acts in the client’s best interests, or you’re not. |

|---|

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.