Dynamic Strategy Migration and the Evolution of Risk Premia

- David E. Kuenzi

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

In this article, the author argues that alternative risk premia (ARP) strategies undergo an evolution that begins with their inception as a pure alpha -based strategy, continuing its metamorphosis into a pure beta strategy. The inevitable transformation is brought on by a number of factors and also presents an opportunity for managers and investors alike to reassess their position on the alpha-beta continuum and their preferences with respect to new strategies. Several propositions are presented, discussed and to a limited degree, tested.(1)

- There is an inevitable transformation of pure alpha premia into pure beta risk premia. The author describes a stylized transformation of alpha into beta that includes 4 stages.

- Is there empirical evidence consistent with the author’s propositions?

What are the Academic Insights?

- The author describes a stylized transformation of alpha into beta comprised of 4 stages.

- Stage 1: “Alpha. Innovation and unique market insight leading to alpha-producing trading strategies”. Alpha, in this case, refers to a pricing anomaly or an informational advantage that is discovered or otherwise known to only a few investors/managers. It is a return that is unexplained by other equity risk factors and therefore a source of alpha unrecognized by a majority of market participants.

- Stage 2: “Late Alpha beginning to morph into Early Risk Premia: Competitors discover this alpha and exploit the same opportunity, perhaps more systematically”. As the information about alpha in Stage 1 becomes more transparent and dispersed across markets, the signal begins to deteriorate. Increased transparency into the source of alpha attracts other quantitatively oriented managers who begin the process of automating alpha-capture strategies, which leads to …

- Stage 3: “Risk Premia: Other, new competitors create systems to exploit this alpha even more methodically possibly by leveraging better technology“. Resulting increases in investment capital during Stage 3 contribute to crowding and the ultimate commoditization of the alpha strategy, thus producing the final stage.

- Stage 4: “Late Risk Premia morphing into Beta: The strategy becomes highly, maybe completely, commoditized and more correlated to the global risk factor“.

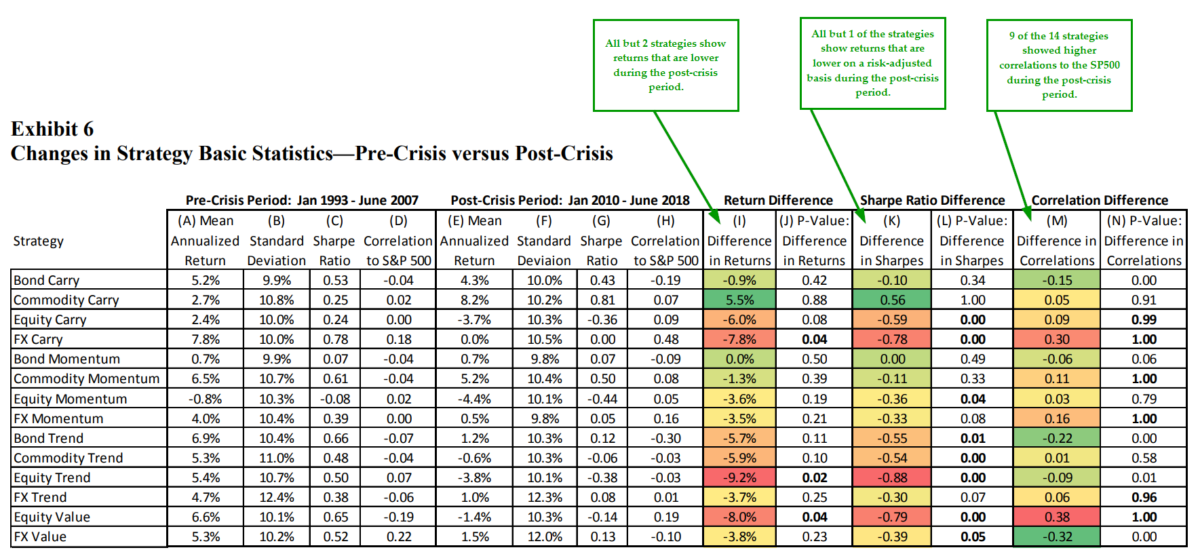

- YES. But it is limited, to the recent 25 years. The author tests 14 strategies utilizing 4 risk premia (carry, momentum, value, and trend) across four asset classes (stocks, bonds, commodities, and currencies) to determine the presence and extent of decay in strategy results. Since these quant strategies are a recent phenomenon, it appears that the relatively short sample is justified. Two periods are analyzed, pre- and post the 2008 financial crisis (1993 to mid-2007 and 2010 to mid-2018). The 2 ½ year crisis and recovery period were excluded to avoid the impact of the substantial quantitative easing by central banks and the extreme performance of the strategies, both positive and negative. The focus is therefore on differences in returns during the pre- and post-crisis periods and although a short time frame, they do represent steady-state market conditions. The results are presented in Exhibit 6 below. Behavior consistent with differences predicted between Stages 1&2 and 3&4 was observed. There was a large and significant downward shift in both absolute and risk-adjusted returns of the strategies overall. Twelve of the 14 strategies exhibited lower returns in the post-crisis period (see column I), with 3 significant at 5%. Stronger evidence is found in columns K and L, where Sharpe ratios show that 8 of the 12 strategies showed a significantly lower risk-adjusted return. In addition, there was a significant increase in correlations with the market. Correlation to the SP&500 increased for 9 of the 14 strategies, and for 6, the correlations were statistically significant.

Why does it matter?

I thought this was an interesting take on the mechanics behind the “commoditization” of quantitative strategies. Although, it does not tell us which risk model is theoretically correct, nor does it answer the question of: “is it alpha or is it beta?”, it does provide an explanation of how the migration from alpha to beta might occur. Very helpful. As for application, the author suggests that investors and managers may benefit by providing such a context (“big picture”) when considering their current strategies. Where are their current strategies positioned with respect to the stylized stages? How does that position impact the development of new strategies and management of strategy timing? How does this framework interact with the recent literature associated with issues of factor crowding? Good questions to consider for all asset allocators.

The most important chart from the paper

Abstract

The author creates a conceptual model for risk premia strategies, focusing on the notion of a continuum running from pure alpha to pure beta and where on this continuum a given manager or investor would like to engage with the markets. He suggests that a risk premium that is nearly completely unknown is really a source of alpha, which then becomes more risk premia–like as it gains market acceptance. As such, there is an inexorable pull toward commoditization for any known and profitable investment strategy. A key question for both risk premia asset managers and investors is how to operate in this dynamic environment. The investment manager might consider how to adapt and perhaps research and migrate to new, less-commoditized strategies over time. The investor must decide what mix of managers along this continuum to select. Finally, the author provides empirical evidence that naïve versions of some of the most known risk premia strategies have indeed shown signs of commoditization in the post-crisis period as compared to the pre-crisis period. Broadly, he suggests that in the face of investment strategy degradation, investors and managers must consider adaptive approaches to the markets and to upgrading their strategies or strategy allocations.

References[+]

| ↑1 | See the Incredible Shrinking Alpha for a broader discussion on these topics. |

|---|

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.