The Use and Value of Financial Advice for Retirement Planning

- W.V. Arlow, K.C. Brown, and S.E. Jenks

- Journal of Retirement, Winter 2020

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Planning for the expenditures needed to fund a successful retirement is one of the most important tasks individuals face, and it’s not an easy one. In fact, it is pretty common (and smart) for some investors to turn to a professional advisor to help guide them through several aspects of the retirement planning process.(1) According to Foerster et al. (2017), half of American and Canadian households use an investment professional to help them.

The authors of this study look to answer two important research questions:

- What are the demographic and behavioral factors that characterize the recipients of financial advice?

- And what is the economic value of financial advice and does it significantly increase the investment outcomes of those who use it?

In this post, we focus on question 1. We will delve deeper into question 2 in a follow-up post.

What are the Academic Insights?

The authors use a unique dataset, a survey of more than four thousand working Americans, 25 to 65 years of age, distributed in January 2015. This survey consisted of eighty-one multipart questions (!) designed to establish a complete financial picture of each respondent’s current household circumstances, as well as a considerable amount of additional demographic and attitudinal data.

The authors find the following:

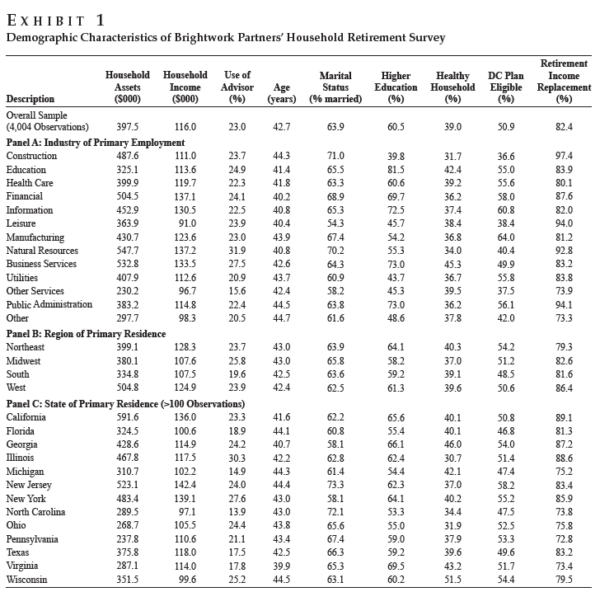

- The average age of the respondents was 42.7 years old with average accumulated assets for retirement and average current annual income respectively at $ 397,5000 and $ 116,000.

- 23% of the households had used a paid financial advisor in some aspect of their retirement financial planning process during the past 5 years.

- Exhibit 1 also indicates that there is a considerable amount of cross-sectional variation in these outcomes when viewed by either occupation or location. In fact,

- The average accumulated wealth varies by industry of employment (max of $ 547,700 in natural resources and min $ 230,200 in other services)

- House assets also diverge depending on location ( max $591,600 in California and min $237,800 in Pennsylvania)

- As far as the use of financial advice it follows the same industry min and max ( 32% in natural resources and 15.6% in other services). As far as location: max 30% in Illinois and min 14% in North Carolina

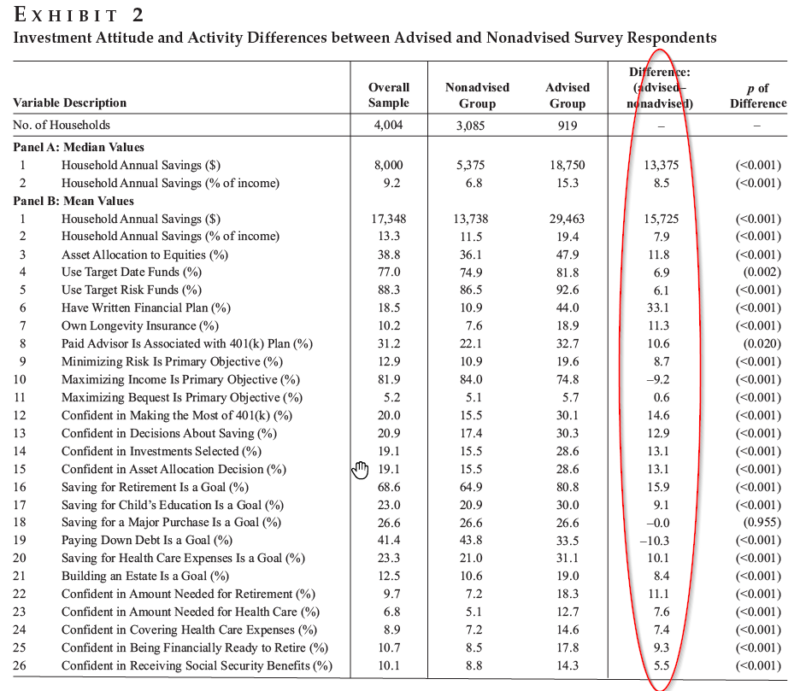

- As far as the characteristics that differentiate those who receive financial advice (23%) from those who do not (77%), Exhibit 2 shows:

- The advised group made a substantially greater commitment to accumulating wealth, with mean annual savings of $15,725

- The advised group had a significantly higher allocation to equity (48% vs 36%) (“Money Doctors” are delivering the medicine!)

- The advised group was far more likely to have a formal financial plan in place (44% vs 11%)

- The advised group recognized savings as an explicit financial goal to a greater degree ( 81% vs 65%)

- The advised group was significantly more confident in all aspects of the financial planning process

The authors perform robustness tests to solve the caveat that some variables may reflect the effect of receiving advice rather than a determinant of why a household might have sought professional advice to begin with. They find that wealthier households are significantly more likely to seek financial advice. Similar linkage for older, married and better-educated respondents.

Why does it matter?

This post highlighted the descriptive characteristics of a unique dataset analysis into the use of financial advice. The authors find and document that households in the advised group tended to be: wealthier in terms of accumulated assets and annual income, married, more highly educated, more confident in their retirement planning, and more disciplined in their investment process. This is consistent with Collins’s (2012) observation that financial advice is more likely a complement to existing financial competency than a substitute. In my next post, we will delve deeper into the value of financial advice.

The Most Important Chart from the Paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Offering professional advice around the retirement planning process represents an important component of the financial services industry. We examine the demographic, investment, and behavioral characteristics of individuals who obtain this advice as well as the economic value that it ultimately adds. Using a survey of more than 4,000 working households, we find that wealth and income levels are positively correlated with the decision to engage a professional advisor, as are such factors as marital status, age, and education level. To assess the value added by this advice, we develop a unique metric of retirement income replacement which incorporates health-based life expectancy and household-specific financial circumstances. The approach estimates the percentage of annual pre-retirement income that a household will be able to spend each year in retirement. We establish the unconditional finding that advised households generate significantly larger proportions of post-employment spending (both gross and net of Social Security benefits) than do non-advised households. Controlling for additional explanatory factors, we find that an advisor adds more than 15 percentage points of income replacement in retirement. These findings support the conclusion that obtaining and implementing financial advice in the retirement planning process leads to a demonstrable increase in the level of sustainable retirement spending.

References[+]

| ↑1 | You can also attempt this via books. We wrote a book more focused on DIY investing — DIY Financial Advising — and here is a good one by Larry et al. |

|---|

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.