The dramatic underperformance of the value premium since 2018, among the largest drawdowns in history, has led many to question its existence. It is certainly possible that what economists call a “regime change” could cause assumptions for why the premium should exist/persist to have changed. For example, if it was purely behavioral-based, the publication of the findings of a premium could lead to its disappearance, as cash flows shift valuations, eliminating the anomaly. Or it could be that some change in the economy has led to the increasing rate of earnings growth of growth companies relative to the rate of earnings growth of value companies.

Thanks to the research team at AQR Capital Management, we can examine if there has been a regime change that would cause our belief in the value premium to change. For example, investors tend to be overly optimistic about the future of earnings growth for growth companies and too pessimistic about the future of earnings growth for value companies. This is the behavioral explanation for the value premium.(1) Or perhaps the value anomaly has disappeared because there has been a regime shift in fundamentals, and earnings surprises now favor growth companies.

The Signals Still Work: Value and Momentum Measures Still Predict Surprises

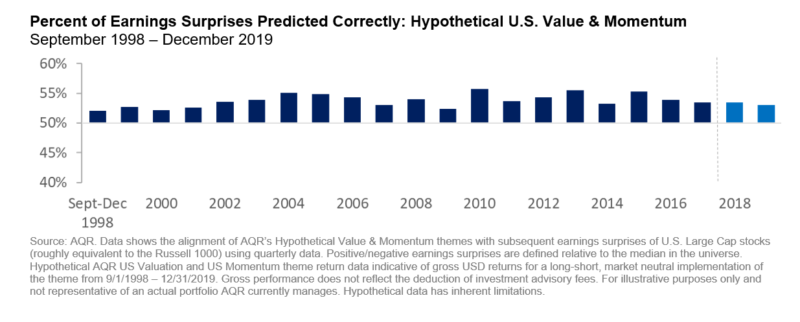

AQR’s analysis shows that, on average, the combination of value and momentum has historically predicted earnings surprises correctly around 54 percent of the time, meaning that cheap and improving stocks have tended to be companies that subsequently surprise to the upside on their quarterly earnings release. The following chart shows that the 2018-2019 period was no different.

Are Investors Too Focused on Aspirational Long-Term Growth?

The value premium has experienced its worst drawdown in 20 years despite the fact that the pattern of earnings surprises remains unchanged! Thus, we can conclude that, at least from this perspective, there is nothing that should change our belief in a future value premium.

If the ability of value and momentum to predict earnings fundamentals has not changed, then what has? Could it be investor preferences? In early 2018, there were some anecdotal observations regarding the relationship between returns and research and development (R&D) expenses as well as negative cash flows. Historically, the relationship between R&D and future returns has been mixed at best (slightly positive relationship), while negative cash flow has been a significant negative factor. However, during the tech bubble (1995-2000), companies with high R&D expenditures and negative cash flows were rewarded with large premiums. We’ve seen a less extreme but similar pattern over the past few years. This early work led to AQR’s broader observation of investors gravitating toward long-term future growth prospects over actual realized earnings today.

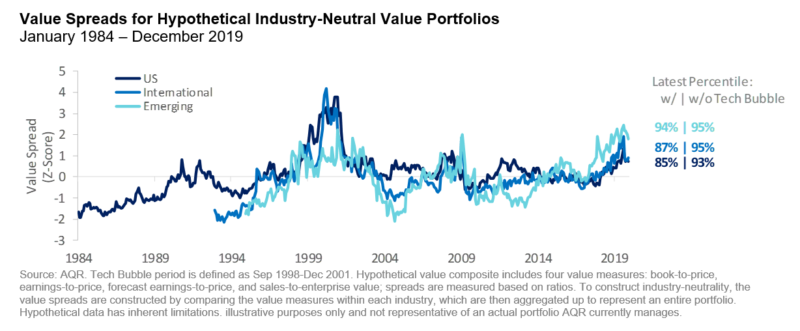

Once again, we see no reason to change our belief in a future value premium. What seems to have occurred is that investors have placed a disproportionate focus on innovation and longer-term aspirational growth while showing a willingness to overlook current earnings, cash flows, and valuations. In fact, all the outperformance of growth over the recent past has been due to the change in valuations, as the spread between value and growth stocks has widened dramatically. (2)

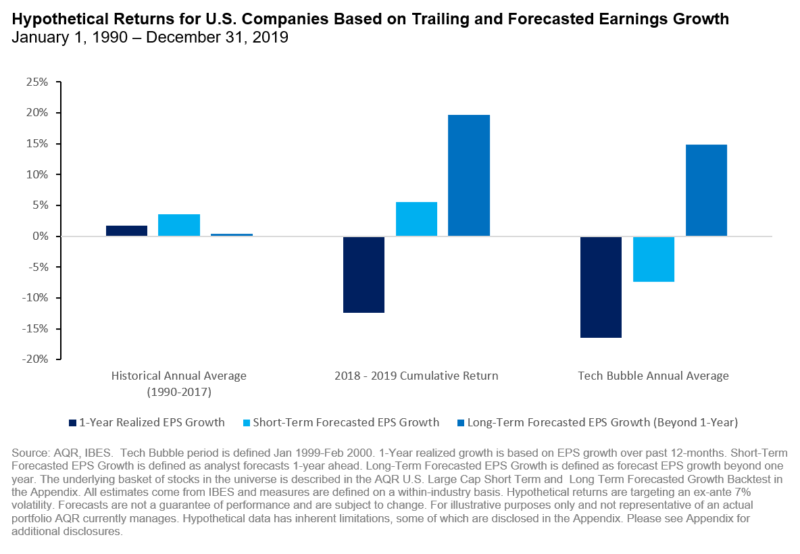

While investors have recently been emphasizing stocks with higher long-term earnings estimates, these companies only tend to perform in line with broader market returns, as these high expectations typically go unrealized. In other words, investors and analysts alike have been too optimistic.

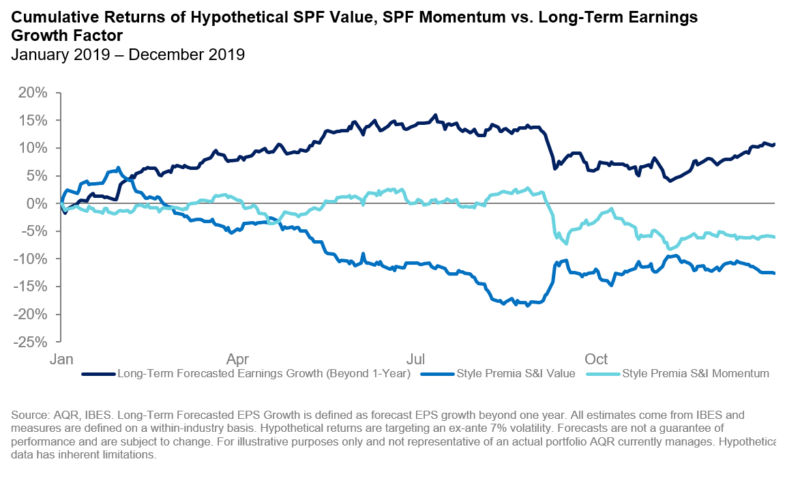

By examining the performance of companies based on their short-term realized earnings growth versus their long-term forecasted growth, we can see that investors have recently been focusing on the latter. In the recent period, companies with weak trailing 12-month earnings growth but higher future multiyear growth prospects have enjoyed the outstanding relative performance, which is in stark contrast to long-term history (apart from the tech bubble period) to which the recent period does bear some similarities. It should also be noted that the accuracy of these longer-term growth forecasts has generally been poor, with no evidence of recent improvement. Further, the expected growth advantage for high growers relative to low growers has not been large, and in fact slightly lower than historical averages, suggesting that analysts are not forecasting a “winner-take-all” scenario. Additionally, this strong recent performance has more specifically been on companies with high multiyear growth prospects and poor earnings quality characteristics.

Viewing the Question from Another Angle: Fundamental Momentum

We have yet another example of evidence that there has been no regime change that should cause a change in the belief that the value premium should persist. In his February 2015 NBER paper “Fundamentally, Momentum is Fundamental Momentum,” Professor Robert Novy-Marx presented evidence suggesting that momentum in stock prices isn’t an independent anomaly. Instead, it’s driven by fundamental momentum: It’s “a weak expression of earnings momentum, reflecting the tendency of stocks that have recently announced strong earnings to outperform, going forward, stocks that have recently announced weak earnings.” Novy-Marx found that momentum in firm fundamentals, i.e., earnings momentum, explains the performance of strategies based on price momentum. It holds for both large and small stocks. However, over the recent past, fundamental momentum has been negatively impacted by companies with underperforming short-term fundamentals being abnormally rewarded relative to better ones. This phenomenon has also caused the performance of momentum strategies that incorporate fundamental momentum in combination with price momentum to underperform over the recent past. Here too, there is no reason to change the belief in fundamental momentum as a factor.

Conclusion

Summarizing, while the performance of value over the past few years has been disappointing, there doesn’t appear to be any evidence of a regime change in fundamentals that has caused the premium to have disappeared. What has changed is how investors price the fundamentals of “value” firms relative to those of “growth” firms.

References[+]

| ↑1 | See here for my discussion of Piotroski and So. |

|---|---|

| ↑2 | Here is a tool that shows the “value of value” over time and across different measures. |

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.