What are the two most annoying words in forecasting?

IT DEPENDS.

In this piece we look at the “value” of value, which has been beaten down recently.

A few questions arise in this scenario:

- How does this beat down look relative to history?

- Is this a tactical opportunity to shift into a value exposure?

Here are the conclusions:

- It depends. We are “unprecedented” on some measures, but only at the “this is getting interesting” stage on other value metrics.

- Who knows. But one thing is clear: the opportunity is much better now than it was several months ago.

What Do We Mean by “Value”?

When we talk about the value of something, there are two components that come into play:

- A fundamental metric

- The price.

The numerator and the denominator. This is true for the stock market as it is on any asset. When you look at a house that dropped 50% in price and deem it “a steal at that price” you’re basing that off the price going down 50%. However, the house is only a better value if the amount of rent you could charge for it has remained the same.

Let’s talk about that house in terms of Rent/Price. If the rent was $1000 per month ($12,000 per year), and the house was $200,000 then the rent/price is $12,000/$200,000 = 6%. The house is “yielding” you 6%. Sticking with our example then, let’s say the house dropped by 50% in price, so it is now $100,000. And we’ll assume you know you can still get $1,000 per month in rent because your cousin already agreed to pay you that if you bought the house. Now your Rent/Price = $12,000/$100,000 = 12%. Your house is yielding 12%. It is indeed “cheaper” relative to what it was before. But is it a good buy?

Ya see… *it depends* because what if the house next door is also yielding 12% but also has $10,000 in cash buried in the basement that comes as part of the home purchase?(1) And the house across the street is yielding 14% but it has to have its roof replaced in a year? Damn!(2) Which house are you buying now? These are all simplified examples of what we’re taking into account when comparing whether certain valuation ratios are undervalued. Total up all the houses and now we’ll have the Rent/Price Valuation ratio for the nation.

To summarize, two things matter when we’re talking about the value of something: Its price (which can also be defined as total enterprise value) and some underlying fundamental metric (rent in the house example). Then, to declare something undervalued, that means it is undervalued RELATIVE to something else (other houses in this example). In the stock world, if we want to declare value stocks undervalued then we care if they are undervalued relative to the rest of the stock market. Even better if they are undervalued to other stocks relative to other points in history.(3)

Now, let’s get to the fun part and take a look at the various valuation ratios we track using our Visual Value Factor Tool. We’ll see what insight they give us on if value stocks are undervalued relative to the broader stock market.

The Value Factor’s Valuation Ratio Through Time

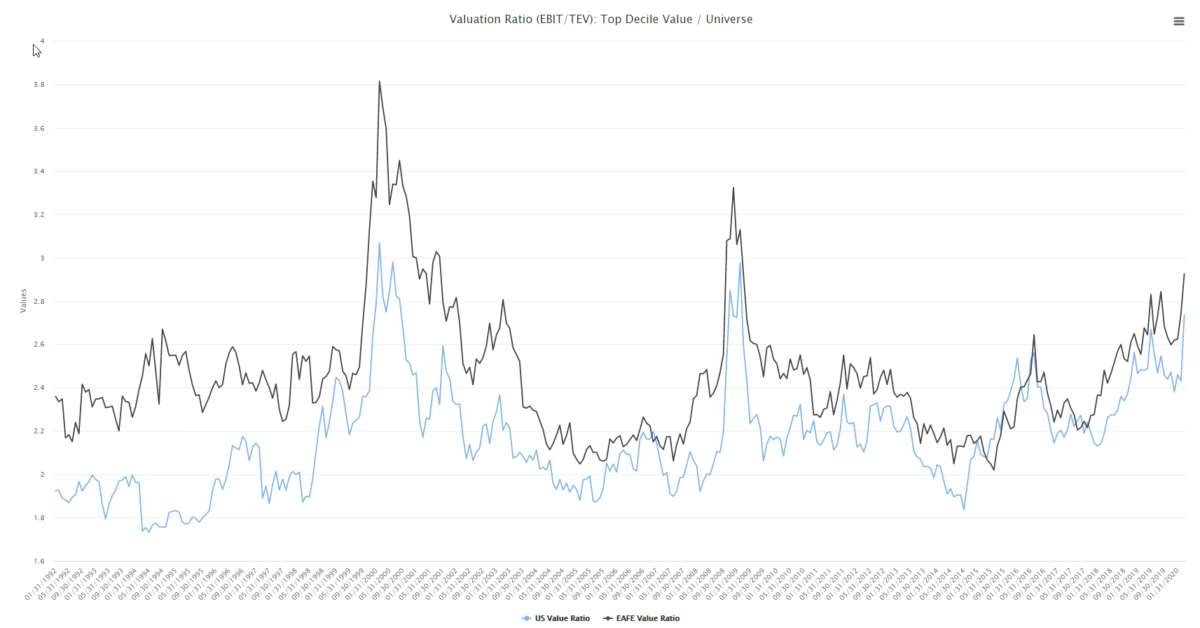

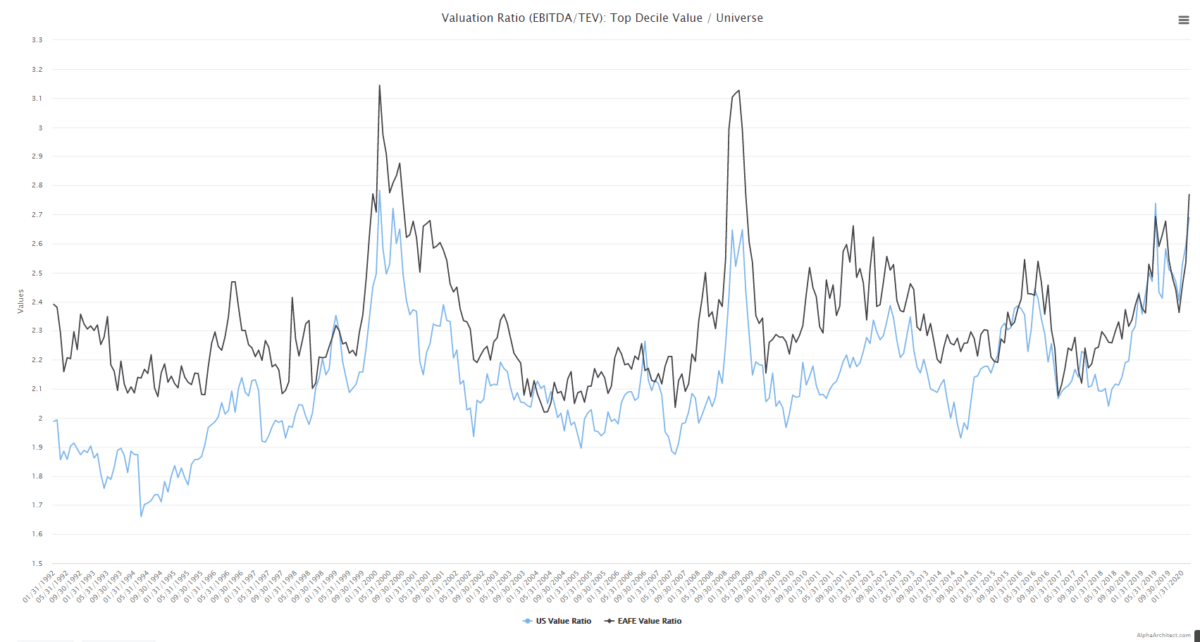

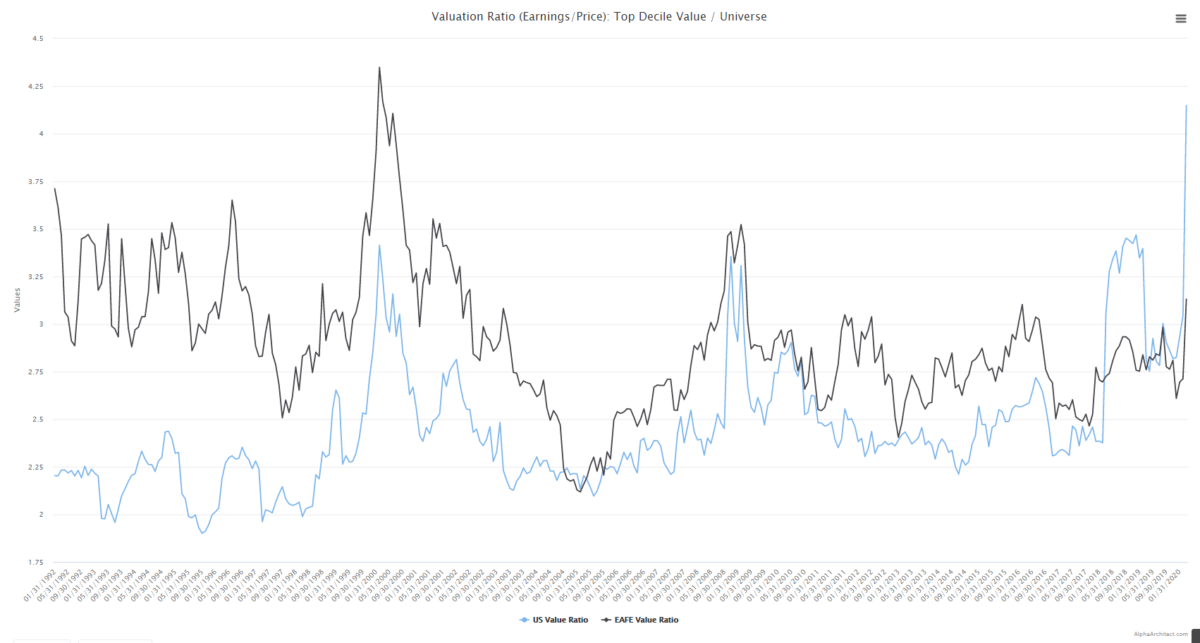

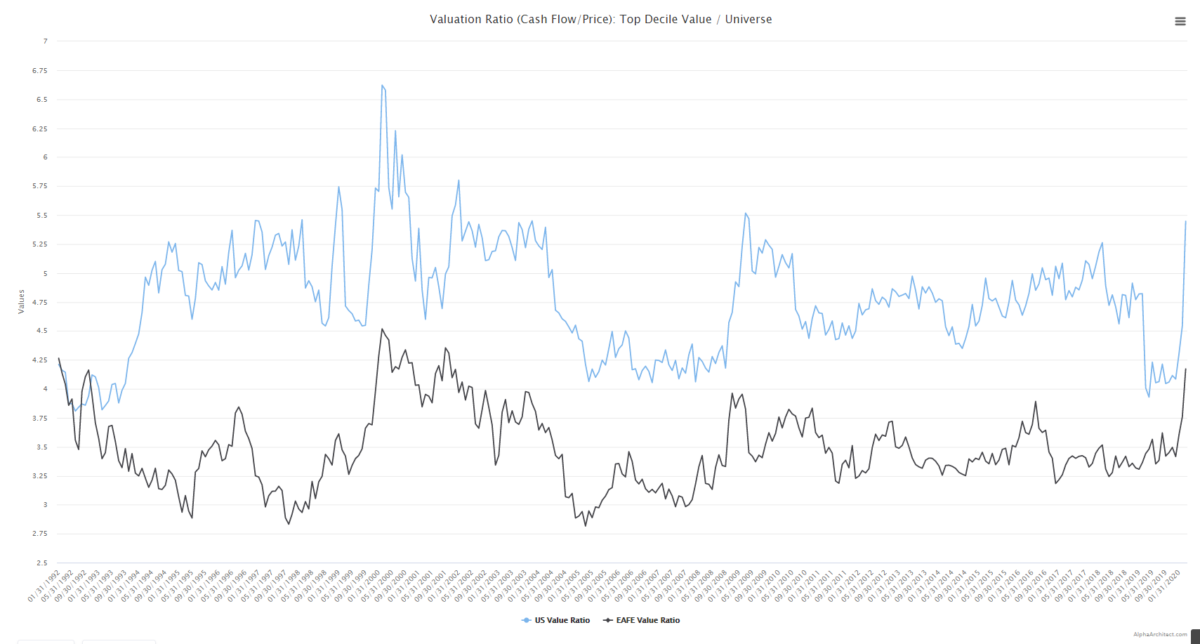

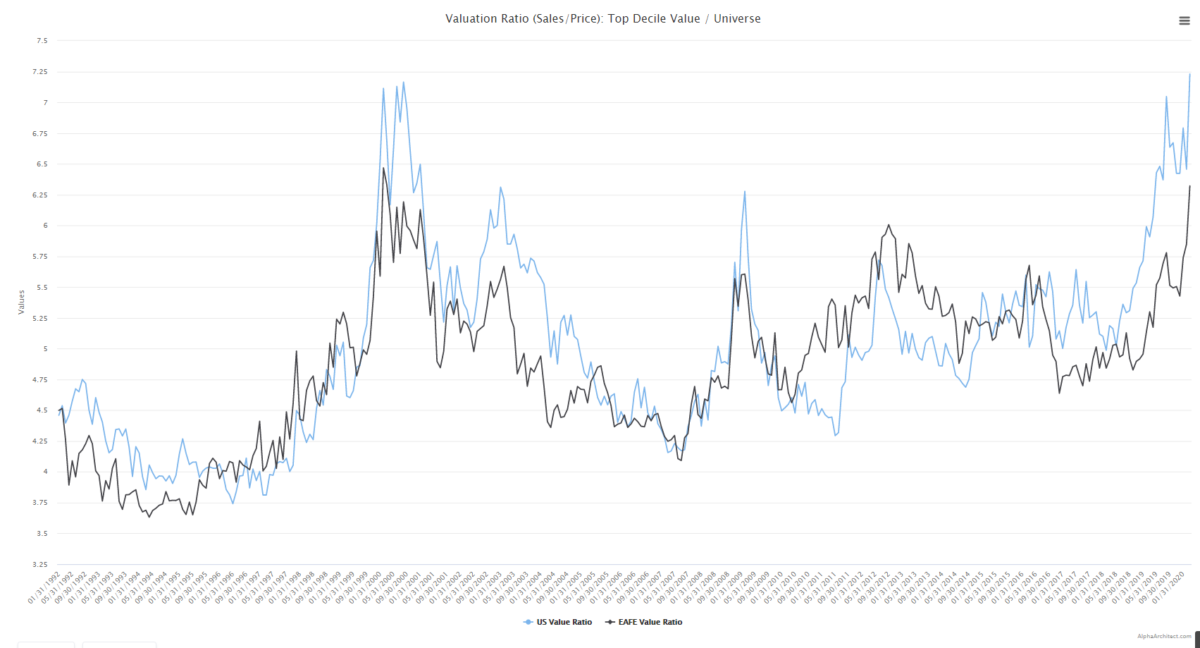

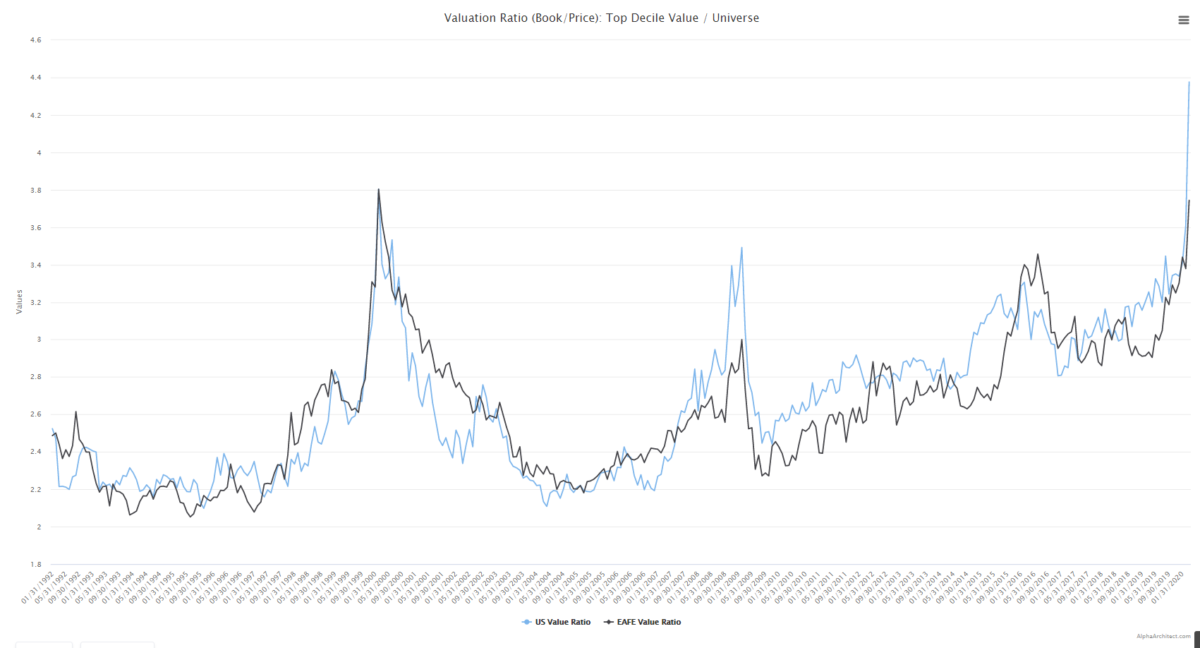

The images below map out the ratio between the median valuations for the top decile “cheap stock” portfolios (e.g., EBIT/TEV or Sales/Price) and the median valuations for different universes (e.g., US or EAFE countries). These are all as of 3/31/2020.

- A ratio of 1 would imply that the valuation on the value factor is equal to the valuation on a broad market portfolio. A value of 2 would imply value is half the cost of the broad market.

- An increasing ratio means value is getting cheaper relative to the universe.

- A decreasing ratio means value is getting more expensive relative to the universe.

Another important note is that the ratio for the US market and the International market won’t tell you anything about absolute valuations. i.e., if the US ratio is above the International ratio, this merely says that US value is cheaper relative to the US market than International value is relative to the International market. However, this does not say anything about absolute valuations. On an absolute basis, International value (and the underlying market) are cheaper than the US counterparts (at least recently).

I’ve devise a “super complex” system to grade each screen. I call it the “eyeball” technique:

- On each screen, I’ll eyeball each chart and rank the visual from 1 to 5, with one being extremely expensive and 5 being extremely cheap.

EBIT to TEV

The spread between the cheapest and most expensive stocks is high, but not as high as 2000/2008. International stocks on this metric are more undervalued than US stocks. As rough as this ride has been then…it can and has been worse! Yeesh. The upshot (if there is an upshot) is that the mania periods tend to be very short-lived as you can see those peaks in 2000 and 2008 are very narrow. Meaning, the expensive stocks became wildly more expensive to undervalued stocks, but quickly came back to more reasonable levels.

Score: US value stocks and International Developed Stocks = 4 (Cheap)

EBITDA to TEV:

As would be expected, this is the same story as the slightly simpler valuation screen EBIT/TEV. The spread is wide, but not as wide as 2000 or 2008 (though still wider than anytime outside of that from our data).

Score: US value stocks and International Developed Stocks = 4 (Cheap)

Earnings to Price

Certainly a different look here. By Earnings to Price, the ratio is wider than 2008 and almost as wide as 2000 for US stocks. Lots of speculation for how this could come about, but we can definitely tally one in the win column here for “the undervalued stocks are really undervalued.”

Internationally, it is not as extreme. Eyeballing it international stocks look to be average even. Interesting! Tally this as international value stocks are merely average relative to history.

Score: US Stocks = 5 (Extreme Cheap); International Developed Stocks = 3 (Average)

Cash Flow to Price

Whether cash is king or cash is trash, cash flow to price in both the US and international developed stocks is showing us its about the same as the financial crisis, but not quite as bad as 1999. We’ll call being basically tied with the worst point of the financial crisis as value stocks being extremely undervalued. Though I really want to give a 4.5, bc it’s not quite there. As the Czar of these rules, I’ll make it just that.

Score: US Value Stocks and International Developed Stocks = 4.5 (Almost Extremely Cheap)

Sales to Price

{Siren Sounds} We found one! By Sales to Price, value stocks are looking cheap, cheap, cheap. Both in the US and internationally, stocks are mirroring the spread between the cheapest and the most expensive that we saw in the tech bubble.

Score: US and International Developed Stocks = 5 (Extreme Cheap)

Book to Price

{Siren Sounds, but louder this time} Looking at US stocks by Book to Price, the spread between value and growth is as wide as our data shows. Wider than both 1999 and 2008/2009. For international developed stocks, the spread is just shy of the tech bubble.

Score: US and International Stocks = 5 (Extreme Cheap)

The Results

Using the Kirlin Scoring System (the average of all the valuation screens), stocks in the US have a score of 4.58.(4) This puts the spread between growth and value at extremely wide. Things are certainly looking cheap(5) International stocks receive a score of 4.25, making the value stocks “cheap” on my 1-5 scale. The difference in scores comes from international stocks looking merely average relative to history when looking at them by Earnings to Price.

So is this the time to buy value? It depends! We’re not believers in trying to time when is good time to get in or out of value stocks, which leads this to being a fun exercise to gain an understanding of where we are at and why, but not much more. We believe the most effective approach is to build a portfolio that has the amount of risk you are willing to bear. If you’re a tactical investor, this could be a signal to add some concentrated value bets. If you’re buy and hold, you have a little more perspective on where we’re at. Either way be prepared for volatility and a rough ride.

References[+]

| ↑1 | This is a complaint of using E/P as it doesn’t take into account cash the company has. This is one of the reasons we prefer EBIT/TEV as Total Enterprise Value takes into account the amount of cash a company has. |

|---|---|

| ↑2 | A simplified example of why we like to look for high-quality companies that are undervalued, and not just “cheap” |

| ↑3 | In the investment world overall though, we are deciding between stocks, houses, commodities, bonds, art, beanie babies, and more when we are deciding where to put our money. I’m confident beanie babies are in a 99.9% drawdown right now. With no fundamentals to support it, I’d recommend you stay clear…Woof! The investment world is extremely dynamic. It depends. |

| ↑4 | my 1-5 scoring system on how cheap or expensive the value stocks are |

| ↑5 | though they always could get cheaper! |

About the Author: Ryan Kirlin

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.