Predicting Bond Returns: 70 Years of International Evidence

- Guido Baltussen, Martin Martens, Olaf Penninga

- Working Paper

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions

Can the excess returns of government bonds be predicted? This is a classic research question in finance academic research circles. Sometimes practitioners, who are often buried in the more exciting parts of the financial markets, tend to forget that government bonds (do they even belong in your portfolio) are a large global asset class, representing a whopping 30% of market capitalizations across asset classes ( Doeswijk, Lam, and Swinkels, 2019 ).

To date, studying the performance of government bonds is challenging and has faced three main criticisms: 1) researchers focus on the US sample; 2) they start post-1980 ( a period characterized by declining yields) and they 3) use techniques more subject to p-hacking (i.e., predictive regressions).

The authors of this study try to eliminate the critiques of earlier studies by analyzing a deep sample of 70 years of international bond returns starting in 1950, a period characterized by two secular rate cycles. In addition, they use a testing framework that builds upon trading strategies, which allows the team to overcome estimation problems of the predictive regressions critiques (e.g. overlapping data, persistent regressors), and examine practical aspects relevant for practitioners like trading costs.

They also investigate whether it is possible to time international bond markets.

What are the Academic Insights?

By looking at predictors like the 1) steepness of the yield curve (i.e. yield spread), 2) past bond returns (i.e. bond trend), 3) past equity returns, and 4) past commodity returns, as well as their combination to study joint forecasting power, the authors find:

- Consistent evidence for bond market predictability, with economically strong and generally statistically significant Sharpe ratios for each of the four variables on the “combined” equal-weighted aggregate of 6 countries.

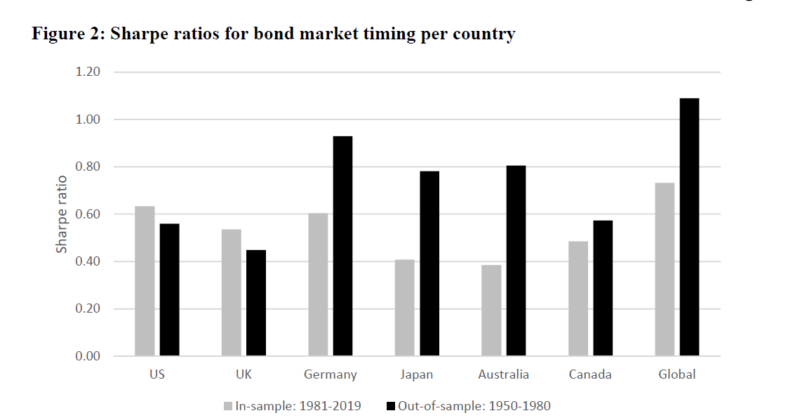

- These results are robust over both the post-1980 period, which is mainly characterized by declining yields and the pre-1980 period, the ‘new sample’ period with mainly rising yields with no evidence of decay ‘out-of-sample’.

- Similar results confirmed at the single country level ( the six countries in the aggregate sample+ 9 additional -never tested- developed markets)

- The predictability is also robust across recessionary and expansionary periods, high and low inflation periods, and equity bull and bear markets. Further tests reveal that the predictability is not due to structural bond risk, but to true bond market timing (higher bond beta in rising markets than in falling markets), with bigger performance in times of larger market moves.

- The authors conduct additional robustness tests that confirm the above results.

- In terms of practical applications of this predictability:

- When adding a bond timing strategy, to a traditional equity-bond portfolio, the Sharpe ratio doubles. Hence, international bond market timing adds value to a global investor.

- The above results are confirmed after t-costs are taken into account.

Why does it matter?

Government bond returns display predictable dynamics. According to the authors, an interesting venue for future research is the development of asset pricing theories that account for these predictable dynamics. From a practitioner perspective, the timing of international bond market returns offers substantial and exploitable opportunities to investors. Active management of government bonds, if successful, can therefore add value by predicting the direction of yield changes.

The most Important Chart

Abstract

We examine the predictability of government bond returns using a deep sample spanning 70 years of international data across the major bond markets. Using an economic, trading-based testing framework we find strong economic and statistical evidence of bond return predictability with a Sharpe ratio of 0.87 since 1950. This finding is robust over markets and time periods, including 30 years of out-of-sample data on international bond markets and a set of nine additional countries. Furthermore, the results are consistent over economic environments, including prolonged periods of rising or falling rates, and is exploitable after transaction costs. The predictability relates to predictability in inflation and economic growth. Overall, government bond premia display predictable dynamics and the timing of international bond market returns offers exploitable opportunities to investors.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.