Intermediation in Private Equity: The Role of Placement Agents

- Matthew D. Cain, Stephen B. McKeon, and Steven Davidoff Solomon

- Journal of Financial and Quantitative Analysis

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

The authors attempt to explain the drivers of the dramatic increase in the use of placement agents in private equity that has occurred since the early 1990s. The discussion is framed around two competing hypotheses: Are agents simple influence peddlers or do they represent a value proposition to GPs in search of information and/or certification of reputation? Interestingly, this research finds support for both. Using a database of 32,526 investments in 4,335 PE funds, the authors can uniquely lay claim to results specific to a universe of entirely professional investors.

- What is the value proposition for using a placement agent (PA) in private equity?

- Under what conditions is a general partner (GP) likely to employ a placement agent?

- Does the use of placement agents result in higher returns for investors?

What are the Academic Insights?

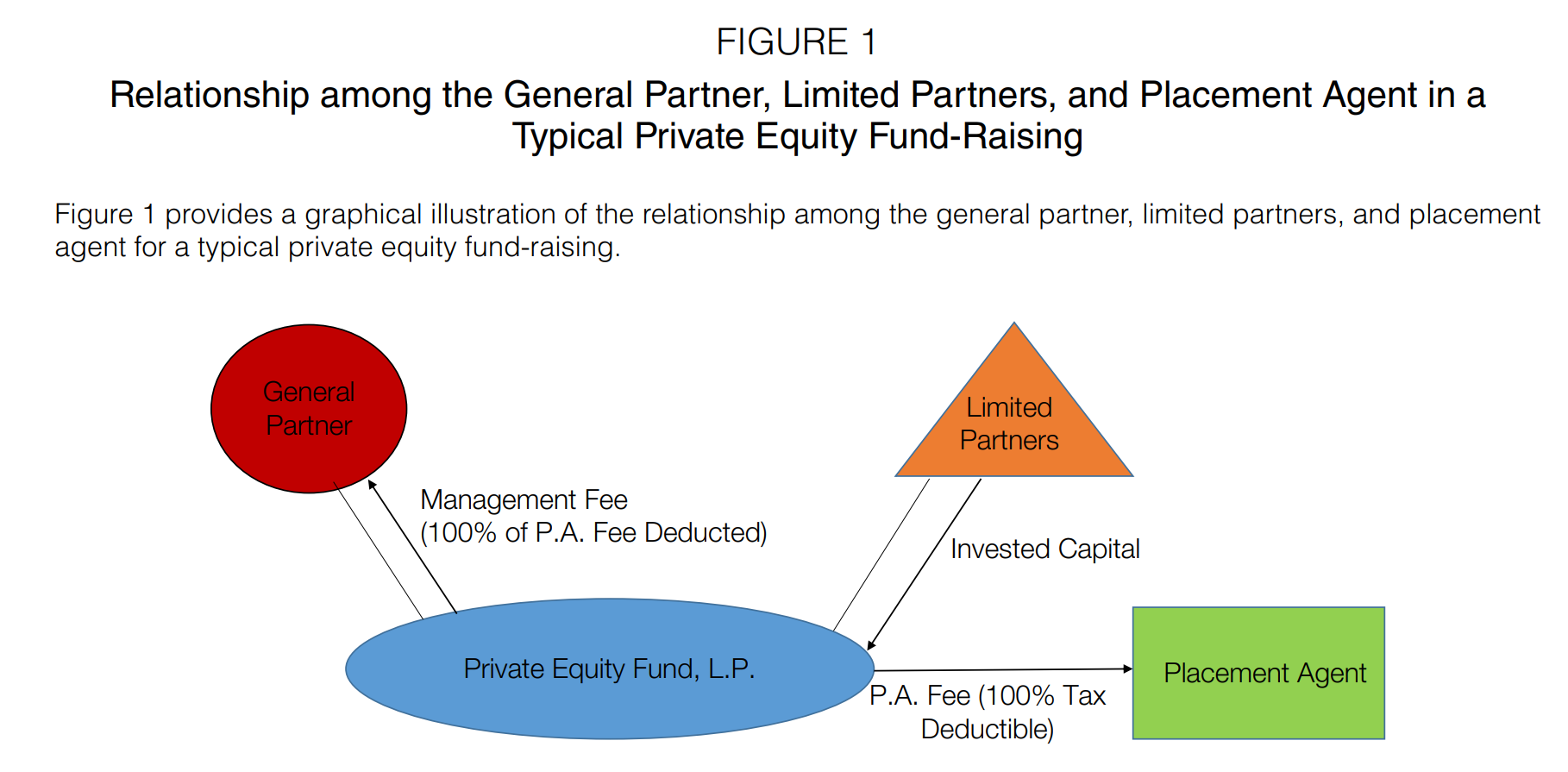

- Placement agents generally provide services to general partners that effectively reduce the cost of information searches and reduce the required labor as the fund-raising process moves forward. For example: (1) PAs are well able to identify sources of capital from a deep bench of institution investor contacts; (2) PAs are also a reliable source of information on the current state of market conditions as they relate to fund-raising including fee structures, distribution rights, governance issues, clawback provisions and so on; (3) they often assist in creating the ‘narrative’ for GP’s intended use of funds and in the preparation of marketing materials; (4) PAs may act as facilitators for investor meetings and communications between GPs and LPs; and (5) they provide valuable assistance with due diligence. The newer the GP, the more likely is the GP to take advantage of some or all of the services of placement agents. For those unfamiliar with the relationship structure, Figure 1 provides a graphical representation what is typical between GPs, LPs, the Fund, and PAs.

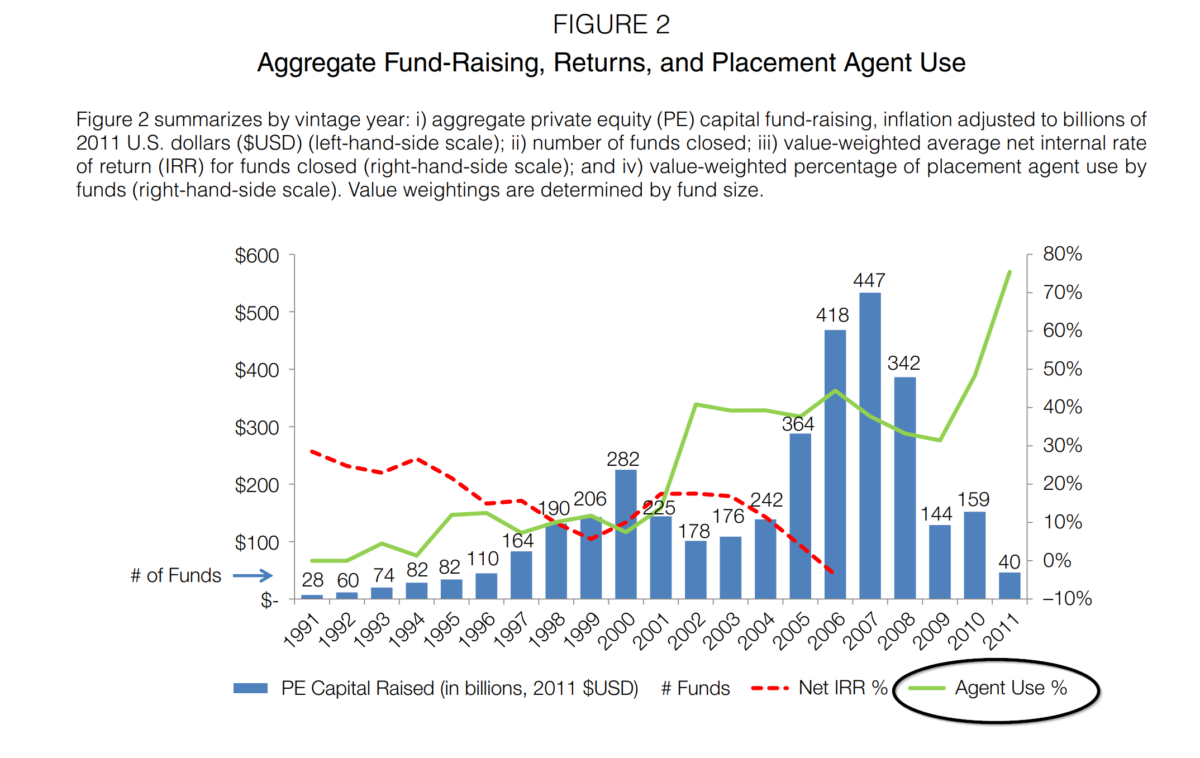

2. The decision to use a PA is driven by a myriad of reasons. primarily driven by characteristics internal to the GP, the authors document that PAs are associated with larger Funds and with Fund of Fund (FOF) structure types on the LP side. The later result is somewhat surprising as FOFs embed 3 levels of intermediation: in addition to the PA, intermediation is also practiced by the FOF and the PE fund that invests in the portfolio companies. Not exactly a value-add proposition. However, when combined with the expectation that PAs are more closely affiliated with complex fund-raisings it does seem less disconcerting. For example, the authors find that GPs domiciled in different countries than LPs are more likely to agents experienced with cross-country norms and standards. Public pensions and endowments apparently have a lower likelihood to use agents, perhaps due to the predominance of consultant advice among those organizations. The authors find PAs are used more often during periods of higher inflows to the PE asset class (see chart below), With respect to fund type, buyout funds are more likely than venture or real estate funds to use PAs. This was pronounced if the fund had a greater diversity of LP countries of origin. Same relationship if the fund is either at it’s initial offering or otherwise early in the sequence of offerings. However, the use of agents is lower among GPs with US headquarters. All in all, it appears that the evidence is consistent with two hypotheses. First, the authors present data supporting the idea that PAs perform an important role in the information sourcing and certification/due diligence portions within the fund-raising process. However, the finding that PA affiliated funds are increasingly associated with poor returns leads to a different, more troubling conclusion. The authors explain:

We document further evidence supporting investor capture and influence peddling among certain placement agents. We find that the strength of investor– agent relationships is negatively correlated with returns. In other words, the higher frequency with which an LP invests in funds affiliated with a given placement agent, the worse the returns are for that LP.

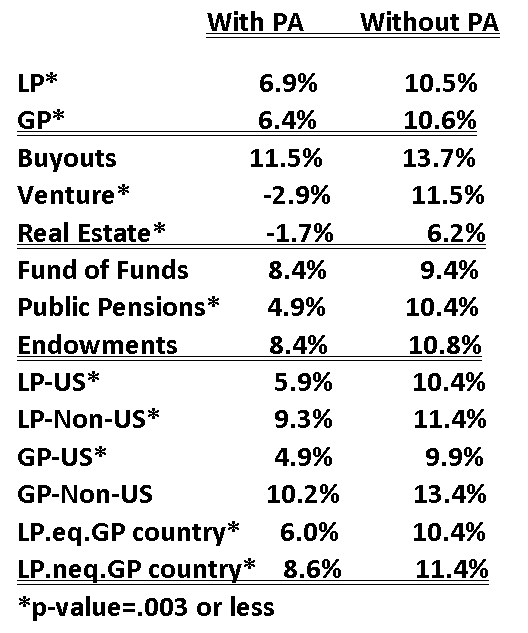

3. NO. The analysis of the relationship between fund returns and placement agents tested the difference between equally weighted IRRs for fund with PAs and those without PAs. They are sorted on fund type, investor type and geographic location of GP to LP. For all conditions, IRRs were higher for funds without agents than for funds with at least one agent. Take a look. The details are not pretty if one is a placement agent.

However, the authors also present evidence that investors in agent affiliated funds exhibit lower volatility and lower drawdowns. Perhaps PAs contribute to the tradeoff between risk and return and should be viewed with that lens.

Why does it matter?

As the first study to identify the characteristics of LPs/GPs using placement agents and the resulting returns to investors to affiliated funds with and unaffiliated funds, it implies context to policy makers and regulators. For example, an outright ban on agents may produce negative, although unintended, consequences. Top-tier agents may indeed provide value to investors in terms of providing information and due diligence, as well as a conduit to mitigate return volatility.

The most important chart from the paper

Abstract

Intermediation in private equity involves illiquid investments, professional investors, and high information asymmetry. We use this unique setting to empirically evaluate theoretical predictions regarding intermediation. Using placement agents has become nearly ubiquitous, but agents are associated with significantly lower abnormal returns in venture and real estate funds, consistent with investor capture and influence peddling. However, returns are higher for buyout funds employing a top-tier agent and for first-time real estate and venture funds employing an agent, and are less volatile for agent-affiliated funds, consistent with a certification role. Our results suggest heterogeneous motives for intermediation in the private equity industry.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.