Toward ESG Alpha: Analyzing ESG Exposures through a Factor Lens

- Ananth Madhavan, Aleksander Sobczyk and Andrew Ang

- Financial Analyst Journal, 2021

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions

Environmental, Social, and Governance (ESG) investing has become a priority for a lot of investors. We have previously written on ESG being combined with factor investing here and here. However, if one chooses to ignore our previous musings on the subject and only pursue ESG, how would that decision impact the overall factor exposure of the portfolio?

In this paper, the authors address the question:

- To what extent are factors linked to environmental, social, and governance (ESG) performance?

What are the Academic Insights?

By analyzing (holdings based analysis) the MSCI ESG scoring system, which covers 1,312 active US equity mutual funds (representing $3.9 trillion AUM or 93% of the total AUM of US equity mutual funds) and more than 600,000 equity and fixed-income securities which the scoring system measures on three ESG categories (sustainable impact, values alignment, and risks), compared to factors (value, size, quality, momentum, and volatility) the authors find:

1. There is little relation between funds sorts on individual ESG components and active returns, however there is a significant relationship between ESG components and factor exposures. In fact,

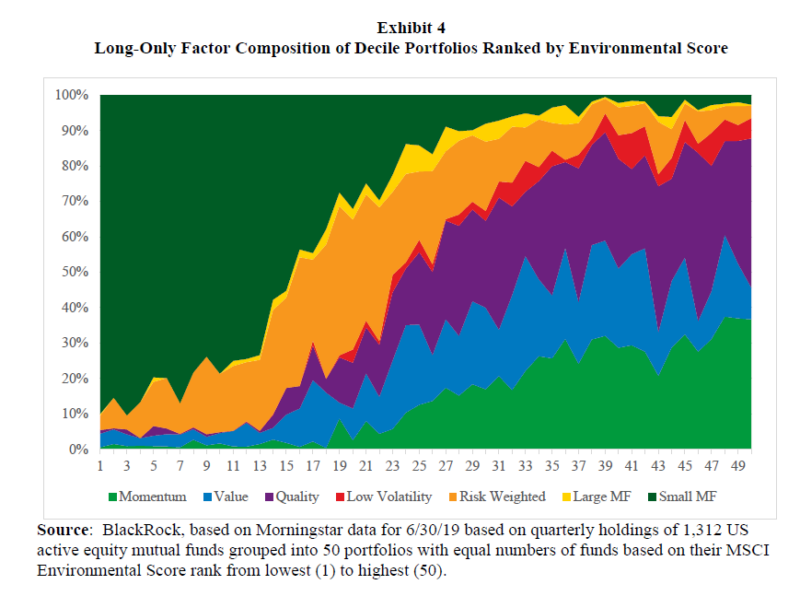

2. Funds with significantly large ESG attributes have factor exposures that differ from the market. Specifically, funds with high environmental (E) scores tend to load up with quality and momentum factor stocks. Some 75% of “E” scores can be explained by style factors, but factors explain only 25% of “S” scores and a mere 14% of “G” scores. Funds with high E scores also overweight low volatility and larger companies.

3. Fund alphas and active returns are linked to factor ESG components, but there is no link between fund alphas and active returns to ESG components unrelated to style factors.

Why does it matter?

An important takeaway from this paper is not to conclude that the factor traits of ESG are set in stone. Factor traits of ESG investing could certainly change over time. This paper only analyzes data from June 2014 to June 2019. A period in which ESG investing has dramatically risen in popularity, which could be driving some of the factor exposures.

This research highlights the need for investors and/or their advisors to be aware that ESG portfolio construction may lead to factor tilts that differ from the market as a whole. Therefore it’s imperative for investors to be conscious of not only the ESG exposure they seek but also overall market exposures. If the overweighting of specific factors is not desired in the portfolio, investors will need to mitigate the increased factor exposure in which ESG investing favors.

The Most Important Chart from the Paper:

Abstract

Using data on 1,312 active US equity mutual funds with $3.9 trillion in assets under management, we analyzed the link between funds’ bottom-up, holdings-based environmental, social, and governance (ESG) scores and funds’ active returns, style factor loadings, and alphas. We found that funds with high ESG scores have profiles of factor loadings that are different from those of low-scoring ESG funds. In particular, funds with high environmental scores tend to have high quality and momentum factor loadings. In partitioning the ESG scores into components that are related to factors and idiosyncratic components, we found strong positive relationships between fund alphas and factor ESG scores

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.