Timing is money: The factor timing ability of hedge fund managers

- Albert Jakob Osinga, Marc B.J. Schauten, Remco C.J. Zwinkels

- Journal of Empirical Finance

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

This study pulls together several threads in the academic literature: (1) the persistence of hedge fund outperformance; (2) the apparent use of time-varying beta exposures by hedge funds, where betas are predicated on conditions such as leverage, carry trade, major events and conditions in the equity market; and (3) the timing of equity and market factors, as a strategy. The research summarized in this post is concerned with the notion that time-varying beta exposures are the result of direct attempts at factor timing by hedge funds.

Specifically, this study extends previous research on factor timing in hedge funds by determining whether all of the Fung-Hsieh (2004) factors can be timed. The Fung-Hsieh model is widely used to evaluate hedge funds and consists of 8 factors: equity market, size, bond market, credit-spread, trend-following factors for bonds, currencies, commodities, and an emerging market factor. Robustness tests including other factors are well integrated into the empirical design and suggest quite a bit of confidence in the reported results. The authors do find that timing ability exists, so they also examine the source of that timing ability and whether or not the selection, by investors, of hedge funds can be enhanced using this information. The timing measure used is based on a method developed by Treynor and Mazuy (1966), which is based on an implied convex relationship between fund returns and market exposure. Basically, the fund’s exposure to market beta is increased (or decreased), when the manager’s forecast signals a positive (or negative) market movement. Using the Lipper hedge fund (TASS) dataset, with monthly data from January 1994 to January 2018, and controlling for survivorship bias and backfilling bias, the authors examine the following questions:

- Can managers of hedge funds time factors?

- Is the persistence in hedge fund performance related to persistence in factor timing skill?

- What conditions appear necessary to achieve factor timing skill?

What are the Academic Insights?

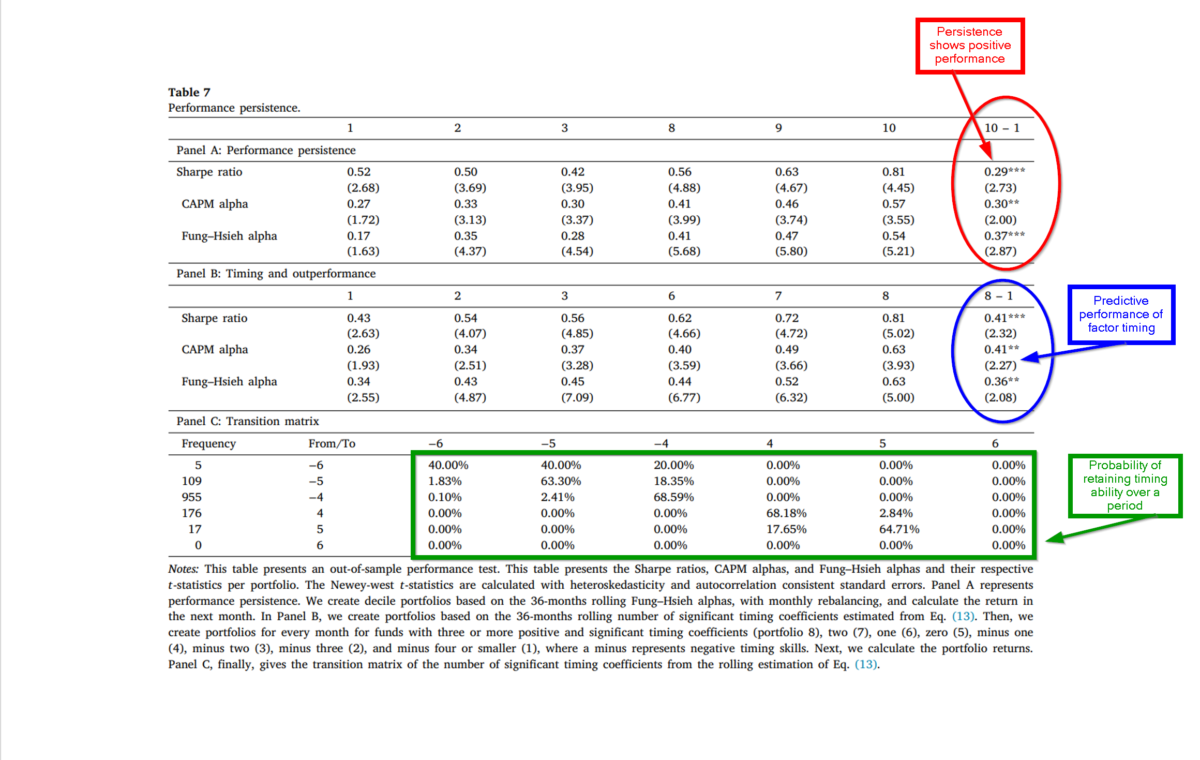

- YES. The out-of-sample performance of the tests of timing and persistence are presented in Table 7 and indicate that timing ability is persistent and is predictive for future alpha. In Panel A, portfolios are formed and sorted into deciles every month given the Fung-Hsieh alpha, then held for one-month and portfolio returns are calculated. The spread for Portfolios #10 – #1 produced an excess return of 0.37% for the Fung-Hsieh risk adjustment with similar results for the CAPM and Sharpe ratio. Almost 34% of hedge fund managers exhibited timing skills for at least one factor. For specific factors, “Size” stood out: 9.2% of managers/funds exhibited market timing skills, 15% exhibited SMB timing skills and 9.6% exhibited bond-tbill spreads. The remaining factors exhibited lower percentages. Timing skill among hedge fund managers appears to be persistent.

- YES. In Panel B, the returns for factor timing portfolios are presented in columns 1 to 8, from low to high alpha. The spread returns for Portfolio #8 – #1 range from 0.41% for Sharpe and CAPM models and .37% for the Fung-Hsieh model. The evidence presented In Panel C provides additional support. The “transition matrix” in Panel C represent the probability that timing ability will be retained over time, where timing ability is calculated as the number of significant squared factors estimated over a 36 month (rolling) period. The highest level of persistent occurs around time period zero. The authors report the L/S alpha based on the Fung-Hsieh model was 4.45% annually, and 4.32% out-of-sample for the best performing/worst performing factor timing funds. Factor timing skills are not only persistent but also add alpha for investors.

- The results of cross-sectional analysis of the factor timing ability of hedge fund managers and fund characteristics illustrate what it takes to achieve timing skill: (1) Have experience–The age of the fund is positively related to skill, particularly for the market and size factors. However, age is negatively related to bond, currency and commodity trend-following factors; (2) Use derivatives; (3) Eliminate lock-up periods and and real auditing.

Why does it matter?

Given the strong evidence for factor timing among all types of hedge funds, the value-add for investors is roughly along the lines of 4.32% excess returns, on an annual basis. One question from the investors’ point of view then, is whether or not they are able to select managers with timing ability. The answer appears to be no. The empirical relationship between fund flows into hedges is unrelated to the timing measure used in this study. The authors speculate their measure of timing may be too “specific” for investors to incorporate into investment choices and suggest instead concentrating on stock selection as a measure of skill. Although, there is sufficient literature suggesting that choosing managers who will outperform in the future may be a fools’ errand. In any case, the research does provide support that continued efforts in the service of factor timing may be possible with strategies other than those afforded by hedge funds.

The most important chart from the paper

Abstract

This paper studies the level, determinants, and implications of the factor timing ability of hedge fund managers. We find that approximately 34% of hedge funds display factor timing ability on at least one factor over the full sample, concentrated especially at the market, size, and bond factors. Better factor timing skills are on average related to funds that are more experienced and more flexible, but the cross-factor heterogeneity is considerable. Factor timing is associated with outperformance; the top factor timing funds outperform the bottom factor timing funds with a significant 4.32% per annum. Timing skills, though, do not directly lead to higher net flow.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.