Factor Exposure Variation and Mutual Fund Performance

- Ammann, Fischer and Weigert

- Financial Analyst Journal, 2020

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Last week Tommi looked into whether hedge funds could time factors. The conclusion? Probably.

This week we’re going to see if Mutual Fund managers have any skill at cracking the factor timing code. The conclusion? They aren’t great factor timers!

The authors of the paper study a large sample of US equity mutual funds from late 2000 through 2016 and ask the following research question:

- Do performance differences exist between funds with high Factor Exposure Variation (FEV) and funds with low FEV? FEV is measured by the volatility of the factor loadings on each of four factors ( market, size, book-to-market, and momentum) during the estimation period.

- If they exist, why so?

What are the Academic Insights?

The authors find that:

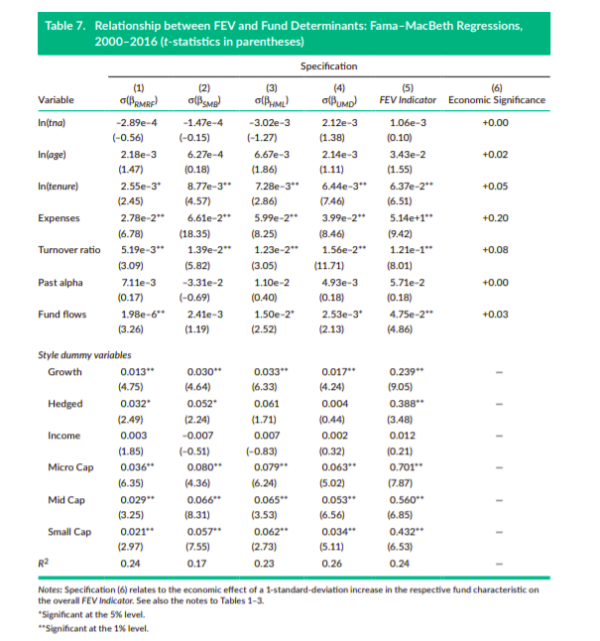

1. YES- Funds’ FEVs are associated with future fund underperformance: A portfolio of the 20% of funds with the highest FEV indicators underperformed the 20% of funds with the lowest FEV indicators by 147 bps a year with a statistical significance at the 1% level when the returns are benchmarked against the Carhart (1997) four-factor model. Additionally, YES- When sorting funds on individual MKT, HML, or UMD factor exposure variations, the authors found underperformance of the most volatile funds by, respectively, 102 bps, 82 bps, and 120 bps, with statistical significance at least at the 5% level. The performance differences between high-FEV and low-FEV funds remained statistically and economically significant when they applied the Fama and French (2015) five-factor model.

2. The authors investigated two possible explanations for the underperformance of high-FEV mutual Funds. First, they tested the factor exposure variation of the funds’ underlying long equity portfolio holdings, assuming that maybe it was the underlying equities that were having factor variation changes rather than the funds themselves. Secondly the research team looked into forced trading of funds as a result of substantial investor inflows/outflows. Neither of these reasons explains the underperformance. Thus, they show that that fund managers voluntarily attempt to time factors but they are unsuccessful at doing so. Specifically, they find that factor timing is particularly prevalent among funds with long management tenures, high turnover, and high total expense ratios.

Why does it matter?

The results of this paper are important for both investors and fund managers. Investors can directly assess a fund’s FEV in relation to various factors without relying on costly and low-frequency portfolio holdings data. Additionally, investors can use the FEV Indicator for manager selection, keeping in mind that factor timing is a difficult skill to find in practice. Similarly, fund managers can apply the FEV Indicator to evaluate their own intended or unintended trading activity in relation to various risk and behavioral factors.

The Most Important Chart from the Paper:

Abstract

We investigated the relationship between a mutual fund’s variation in factor exposures and its future performance. Using a dynamic state-space version of the Carhart (1997) four-factor model to capture factor variations, we found that funds with volatile factor exposures underperform funds with stable factor exposures by 147 bps a year. This underperformance is explained neither by volatile factor loadings of a fund’s equity holdings nor by a fund’s forced trading through investor flows. We conclude that fund managers voluntarily attempt to time factors but are unsuccessful at doing so.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.