In this original research, Elisabetta and I study data across 29 global markets and provide empirical data on the following question:

What percentage of CFO and CAO roles do women fill in the global marketplace?

Global Median Statistics

We analyzed 27,276 functional positions for the CFO and CAO roles in 29 countries and calculated the global medians as points of reference. The countries included 25 developed markets and the 4 BRICs. All public and private firms in the finance industry were included regardless of market capitalization or other exclusions.

We found the global medians of 23% for CFOs and 28% for CAOs are among the highest in terms of female representation in C-suite roles we have studied to date.

Remarkably, we noticed a fairly strong relationship across European countries with high representation in both of the 2 roles. Nine of 29 countries (31%) were above the median on both the CFO and CAO roles, simultaneously, and 6 of those 9 were European countries. Kudos to Austria, France, Norway, Finland, Sweden, and Luxembourg!

The Chief Financial Officer (CFO)

In 2020, the annual Crist|Kolder Volatility Report disclosed a doubling of the number of female CFOs in a sample of America’s leading companies over the period 2004-2020. For financial services, the news was even more encouraging as the sector stood out with a higher than the median score for female representation.

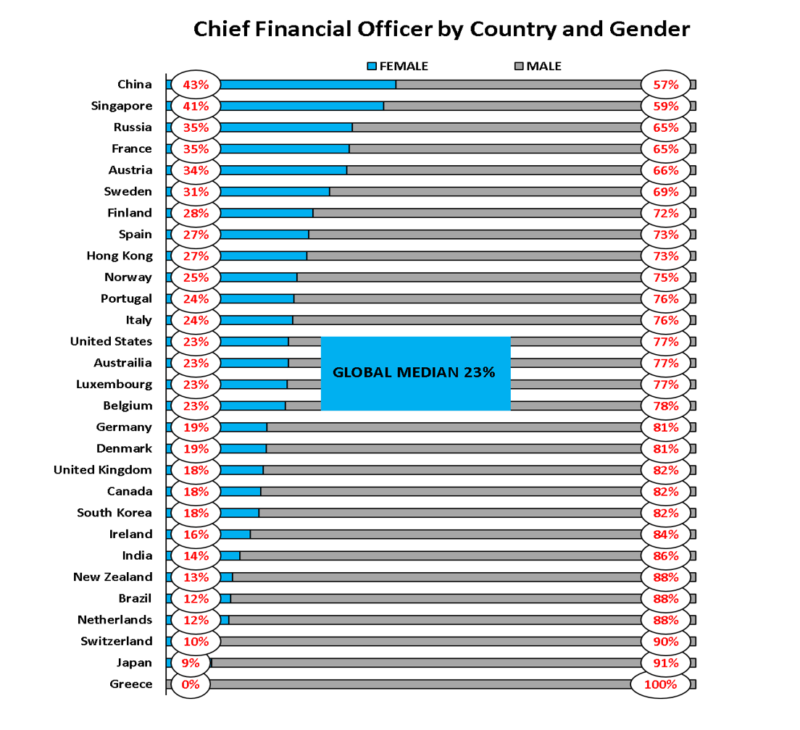

We analyzed 24,796 positions of Chief Financial Officer globally and as shown in graph 1, the country with the highest female CFO representation was China at 43%, while the country with the lowest female representation was Greece at 0%. While the number 1 position goes to China, 9 European countries plus the United States, Hong Kong, Russia, and Singapore scored above the global median.

Graph 1: CFO gender representation ranked from highest to lowest

The Chief Accounting Officer (CAO)

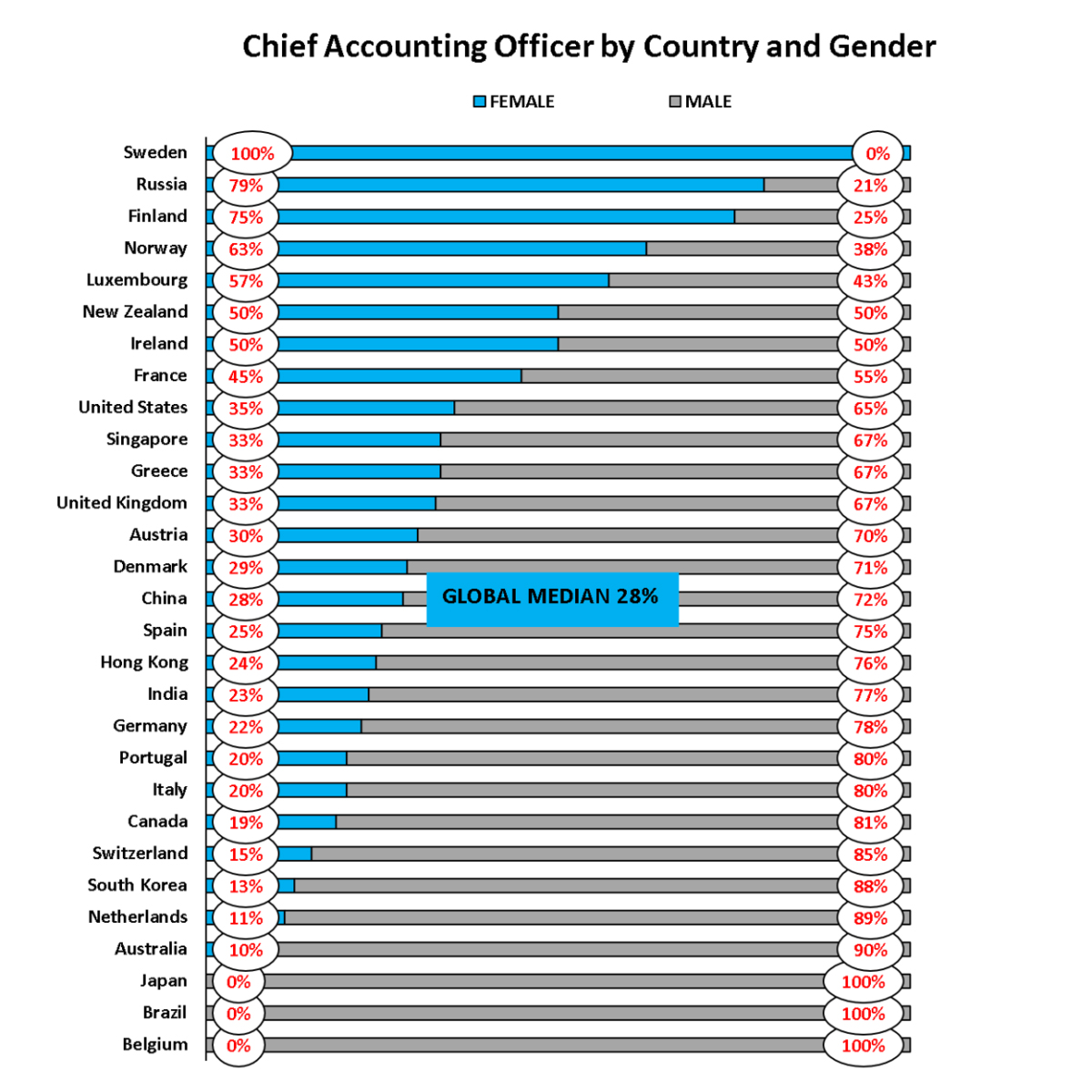

We analyzed 2,480 positions of Chief Accounting Officer in the finance industry. The global median is 28% and surprisingly, Russia at 79%, as shown in graph 2, was the country with the highest female representation. Japan, Brazil, and Belgium reported no women in the CAO position.

One observation stands out: Sweden, Russia, Finland, Norway, and Luxembourg appear to have more female than male CAOs. As with CFOs, two BRICs score at or above the global median (Russia and China) while the other two (Brazil and India) are well below the median. Nine European countries along with the United States again scored well above the median. Results from other published research present varying pictures of the CAO role depending on the sector and size of the firms included in the study.

- According to data reported by Catalyst, about 29% of females hold chief executive positions in accounting across all sectors in the US, whereas Canadians make up almost half.

- Morningstar (2016) reports that women comprise 63% of the accounting profession in the US compared with lawyers at 33% and medical doctors at 37%. In the EU, it’s a different story with women occupying almost two-thirds in legal and accounting positions.

- Generally speaking, it appears that the financial services industry may be equal to or even better positioned compared to other sectors for women CAOs.

Graph 2: CAO gender representation ranked from highest to lowest

What are the Academic Insights?

There is ample evidence that “the higher the corporate ladder, the fewer the women” (Mercer, 2020; McKinsey, 2019). However, for the “accounting” leg of the C-Suite, our findings show that female representation is higher compared to the more general executive leadership positions including Board members, the CEO, and President.

Why does it matter? The academic research suggests that companies with higher levels of women in leadership positions outperform on a number of corporate financial performance metrics.

For example, a compelling argument is made in an article published by Gupta et al., in 2019 and titled “CFO Gender and Financial Statement Irregularities”. The authors document that executive gender has an impact on financial misreporting. The analysis of over 2000 US-based firms produced a negative correlation between female CFOs and financial misreporting. Find a summary of the Gupta et al., 2019 study on our blog: Battle of the Sexes, Who’s Better at Fudging the Numbers? – Academic Insights on Investing.

Similarly, an earlier study (Krishnan and Parsons, 2008) demonstrates that the degree to which reported earnings actually capture economic reality, “the quality of earnings”, is positively associated with gender diversity in senior management.

You can find a pdf version of this scorecard here

References

Catalyst, 2016, Women in Accounting Quick Take.

Crist Kolder Associates, 2020, Volatility Report 2020.

Gupta, V.K., Mortal, S., Chakrabarty, B., Guo, X. and D.B. Turban, 2020, CFO Gender and Financial Statement Irregularities, Academy of Management Journal.

Krishnan, G.V.. and L.M. Parson, 2008, Getting to the Bottom Line: An Exploration of Gender and Earnings Quality, Journal of Business Ethics.

Lutton, L., and E. Davis, 2015, Morningstar Research Report: Fund Managers by Gender.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.