Endowments have distinctive characteristics: they are truly long-term investors and they don’t have to pay taxes. One of the first-ever articles on endowment investing goes back to the mid-’50s with Carpenter (1956) and in 1974, Tobin defined endowments as “investment funds that aim to meet the needs of their beneficiaries over multiple generations and to adhere to the principle of intergenerational equity.” Despite their popularity and the ease of access to university-based endowments, there is little in the academic literature about the history of endowment investing, and how endowments invest. In this article, the authors aim at filling this gap.

75 Years of Investing for Future Generations

- Chambers, Dimson and Kaffe

- Financial Analyst Journal, 2020

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

To explore how endowments invest, the authors ask the following:

- Has the asset allocation of endowments changed through the years?

- Are endowments countercyclical investors, taking advantage of their long term horizon

What are the Academic Insights about how Endowments Invest?

By hand-collecting data (asset allocation and returns) on 12 US university endowments, the authors find:

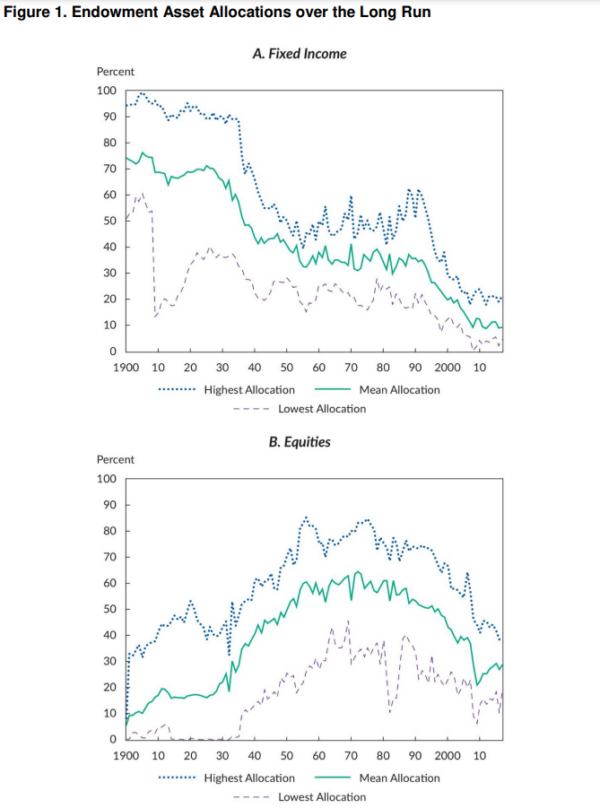

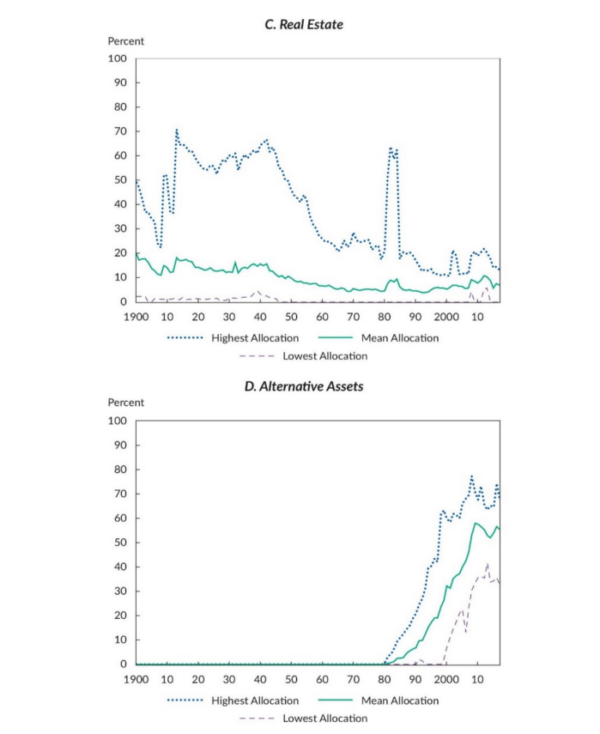

- There were two major shifts in their asset allocation: the first from bonds to stocks in the 1930s and 1940s and the second from stocks to alternative assets beginning in the 1980s. In both eras, the Ivy League schools led the way in these asset allocation moves.

- YES – the 12 endowments typically decrease their active risky allocations, whereas after the onset of the crisis the endowments increase these allocations as risky-asset prices fall.

Why does it matter?

The paper focuses on a rather narrow sample of 12 University-based endowments, but it does provide insight into the investment decisions that truly long-term, tax-free investors can make. As it turns out most utilize their duration advantage by being countercyclical and increasing their exposure to risk assets after crises.

The Most Important Chart from the Paper:

Abstract

University endowments invest for future generations, so their strategy should reflect their long horizon. We researched whether they really do behave like long-term investors. We examined the behavior of US endowments since 1945 and drew comparisons with earlier periods. Using a long-run dataset on 12 major universities, we examined their preferences for risky assets and documented their big strategic moves into equities and, later, into alternatives. We then analyzed how they invest at the time of crises and the extent to which they exploit their long-horizon advantage. We found that, on average, endowments invested countercyclically at crisis times, particularly by increasing their allocations to risky assets after a crisis.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.