Listening In On Investors’ Thoughts And Conversations

- Hailiang Chen and Byoung-Hyoun Hwang

- Journal of Financial Economics, forthcoming

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

One of the most established tenets in social psychology science states, “When considering what content to share in their social interactions, people primarily contemplate what impressions their sharing could create among receivers and whether those impressions are consistent with who they are or desire to be. ( mainly they want to be liked and seen as competent).” It is defined in scientific terms as “self presentation,” or “impression management.”

The authors hypothesize that impression management consideration can also significantly determine investors’ conversations. This, in turn, can cause investors to inadvertently propagate noise with wide-ranging implications for the quality of investors’ investment decisions and asset prices.

They ask the following research questions:

- Which are the links between impression management and investors’ sharing behavior from the Seeking Alpha blog?

- Which are the links between impression management and investors’ sharing behavior during the experiments?

- Do impression management considerations lead to the transmission of less informative content?

- Are receivers of information aware that certain article characteristics lead to more frequent sharing, but also come with lower investment value?

What are the Academic Insights?

By examining investors’ consumption and sharing of quantitative (opinions linked to numbers are often viewed as more thoughtful) versus qualitative content, and by studying an aggregated server log data from Seeking Alpha as well as experiments with 840 actual investors, the authors find:

- While Seeking Alpha users read more articles that contain relatively few numbers, it is the articles that are heavily couched in numbers that generate the greater number of shares and, thus, become a predominant part of investors’ conversations

- In tests with the actual investors, and when impression management considerations are strengthened, investors more frequently choose to share the quantitative article, but not the qualitative article

- YES- When gauging which articles are more accurate, it is the qualitative Seeking Alpha articles that more accurately predict returns — NOT the quantitative ones.

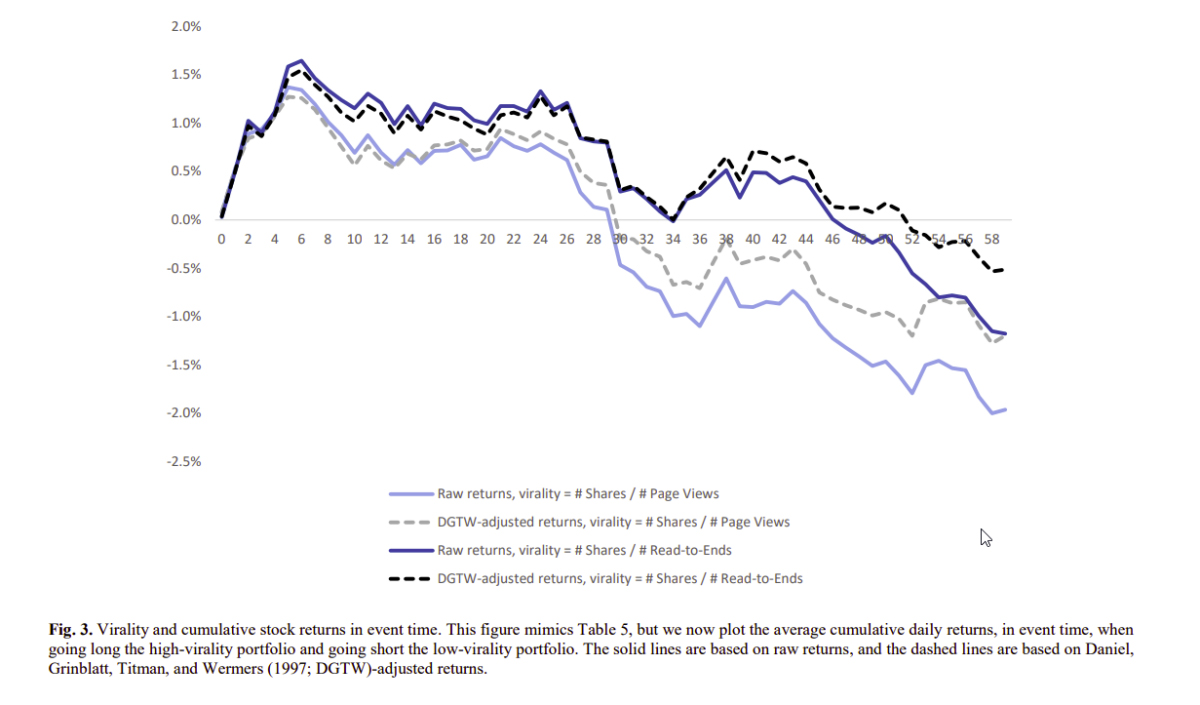

- NO- stocks that are mentioned more frequently in investors’ conversations become overpriced and, subsequently, earn abnormally low returns. These results were confirmed by two additional robustness tests ( with Twitter data as well as survey evidence).

Why does it matter?

Given the evidence that investors derive much of their information through social interactions, it is important to determine whether information acquired from social interactions leads to better or worse investment decisions and what factors cause information acquired from social interactions to mislead. The authors find that the stories that investors most frequently consume can be strikingly different from those that they most frequently share. Additionally, the content that investors consume is more accurate than the content that investors share. This happens because stories best suited for impression management are not always the most value relevant and stories that are the most value relevant are not always well suited for impression management. If listeners do not sufficiently account for this possibility, they end up putting too much weight on certain stories. This, in turn, can trigger excess buying activity and generate both temporary mispricing and poor investment performances.

Overall, financial advice and investment ideas transmitted through social interactions can lead to poor investment performances.

The Most Important Chart from the Paper:

Abstract

A large literature in neuroscience and social psychology shows that humans are wired to be meticulous about how they are perceived by others. In this paper, we propose that impression management considerations can also end up guiding the content that investors transmit via word of mouth and inadvertently lead to the propagation of noise. We analyze server log data from one of the largest

investment-related websites in the United States. Consistent with our proposition, we find that investors more frequently share articles that are more suitable for impression management despite such articles less accurately predicting returns. Additional analyses suggest that high levels of sharing can lead to overpricing.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.