Late to Recessions: Stocks and the Business Cycle

- Gomez-Cram

- Journal of Finance, 2022

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

There is abundant literature on the relationship between the business cycle and future stock returns. The traditional view is that stocks are rationally priced to immediately reflect investors’ expectations about future economic activity and that expected excess returns on stocks are positive, vary over time, and display counter-cyclical behavior.

The author asks the following question:

- Are stock returns efficient at incorporating fluctuations in the business cycle?

What are the Academic Insights?

By using real-time macroeconomic and financial data to identify business-cycle turning points in real-time, the author finds:

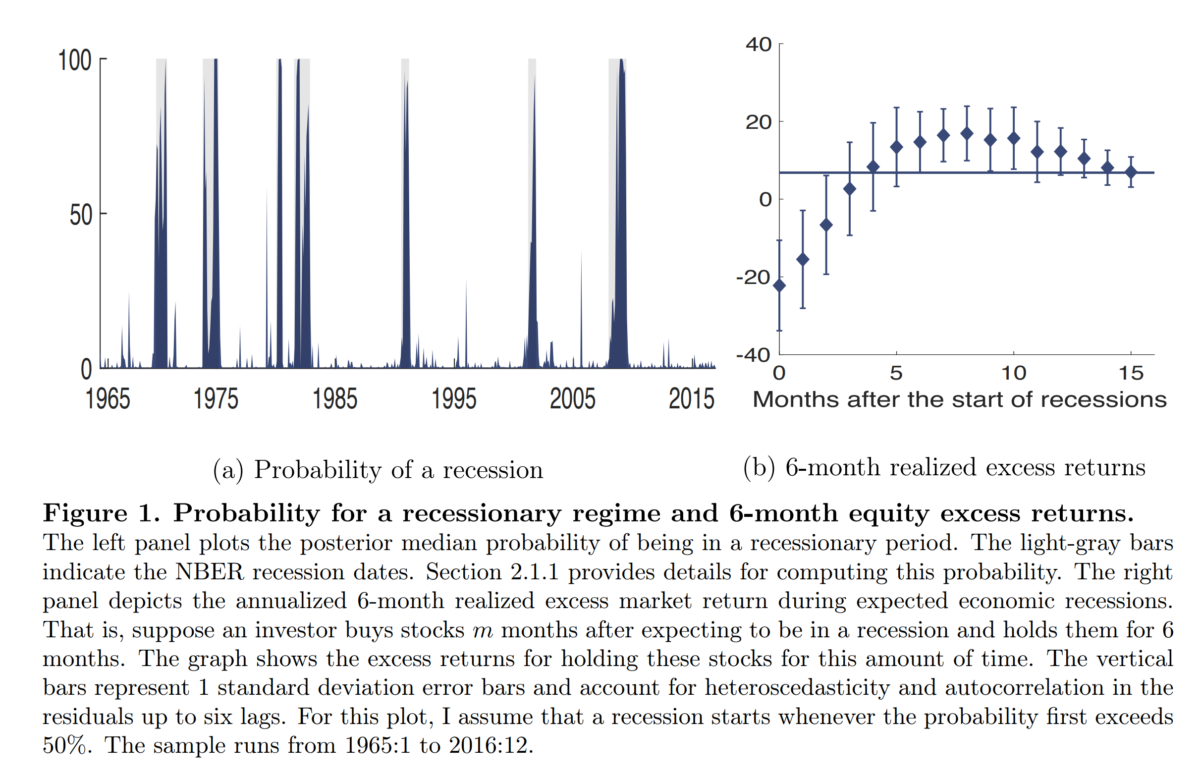

- NO, stock prices are late in reflecting information that signals the onset of recessions. In fact, they are predictably negative for several months following the onset of recessions before rising to persistent higher-than-average levels.

- Returns exhibit substantial momentum in recessions, whereas in expansions they display the mild reversals expected from discount rate changes.

- A trading strategy that exploits the above findings produces significant risk-adjusted returns: for the aggregate market, it earns an annualized alpha of 5.4%, increases Sharpe ratios by 30% over the fully invested buy-and-hold approach, and produces a significant monthly out-of-sample R2 statistic of 1.7%.

Why does it matter?

From a market participant perspective, the pattern of the above findings suggests that investors can profit by selling at the start of recessions and then increasing risk-taking several months later. From a risk-based perspective, the empirical findings present a puzzle because it is hard to explain negative average excess returns within any rational equilibrium model. Deepening the puzzle is the fact that these negative returns arise in bad macroeconomic times, precisely when risk-based theories generally suggest that compensation for risk should be positive and high. The author argues instead that the pattern appears more consistent with the idea that investors are late to act on macroeconomic news that signals the start of recessions.

The Most Important Chart from the Paper:

Abstract

I show that the state of the business cycle is far more informative about expected stock returns than

previously recognized. I identify business-cycle turning points by estimating a state-space model

using real-time macroeconomic and financial data. I find that returns are predictably negative

for the first 4-6 months after the onset of recessions, and only become high thereafter. Moreover,

returns exhibit substantial momentum in recessions, whereas in expansions they display the mild

reversals expected from discount rate changes. A market timing strategy that optimally exploits

these returns’ business-cycle dependence produces a 60% increase in the buy-and-hold Sharpe ratio

and substantially outperforms popular timing strategies in out-of-sample tests. In contrast with

previous literature, the predictability is mostly due to the macro quantities. Using investor forecast

surveys, I show that my findings are consistent with investors’ slow reaction to recessions.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.