In this article, we examine the research on (dis)ecconomies of scale for active management.

Diseconomies of Scale in Active Management: Robust Evidence

- Lubos Pastor, Robert F. Stambaugh, Lucian A. Taylor, Min Zhu

- Critical Finance Review, 2022

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Pastor, Stambaugh, and Taylor (2015) and Zhu (2018) provide significant evidence of decreasing returns to scale (DRS) at both the fund and industry levels. The authors examine the robustness of their inferences after Adams, Hayunga, and Mansi (2021) critique the above two studies.

What are the Academic Insights?

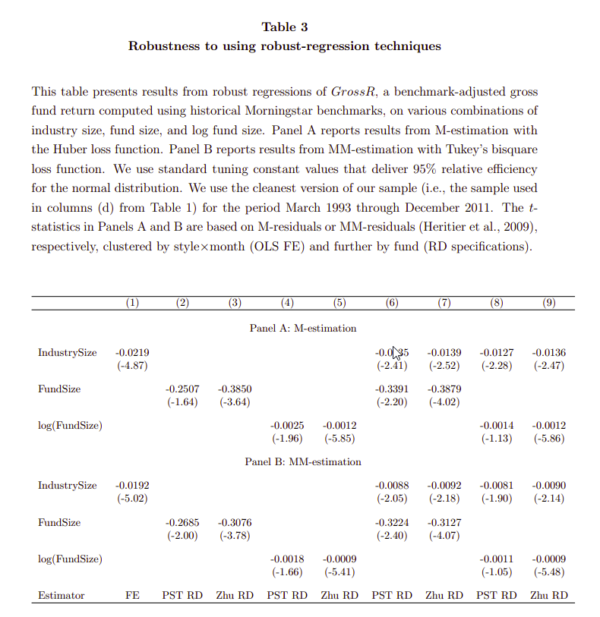

The authors find robust evidence of DRS at fund and industry levels. Their evidence reaffirms the conclusions of PST (2015) and Zhu (2018) but contradicts those of AHM. AHM’s conclusions are based on an asymmetric outlier-removal procedure that is biased and hard to justify ex-ante. In contrast, the author’s conclusions are based on a variety of evidence, including robust regression and two symmetric ways of removing outliers. After applying additional data-cleaning steps to a sample already carefully constructed by matching CRSP and Morningstar sources, they obtained that evidence. Neither those data-cleaning steps nor alternative benchmarks make a difference, dispelling AHM’s data-error narrative for the PST and Zhu results.

Why does it matter?

This study is important to the debate around (dis)economies of scale in the asset management industry.

The Most Important Chart from the Paper:

Abstract

We take a deeper look at the robustness of evidence presented by Pastor, Stambaugh, and Taylor (2015) and Zhu (2018), who find that an actively managed mutual fund’s returns relate negatively to both fund size and the size of the active mutual fund industry. When we apply robust regression methods, we confirm both studies’ inferences about scale diseconomies at the fund and industry levels. Moreover, data errors play no role, as both studies’ results are insensitive to applying various error screens and using alternative return benchmarks. We reject constant returns to scale even after dropping 25% of the most extreme return observations. Finally, we caution that asymmetric removal of influential observations delivers biased conclusions about diseconomies of scale.

.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.