In this article, the authors examine the research on the benefits of international diversification. Some argue that because equity markets generally crash simultaneously, there are no benefits to having equity diversification. The evidence from this paper rejects this hypothesis.

Diversification During Hard Times

- Najah Attig and Oumar Sy

- Financial Analyst Journal, 2023

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

In this article, the authors examine whether there are benefits to international diversification during financial crises and economic shocks. Specifically, they ask the following questions:

- Does economic fluctuation affect the benefits of diversification? Which diversification approach works best during recessions?

- Does international diversification work during crisis periods?

What are the Academic Insights?

The quick answer is that international diversification works during bad times. The authors study a broad set of 70,425 securities from 48 markets (25 DMs and 23 EMs) from January 1995 to December 2021 for a total of 7.7 million monthly observations.

They find:

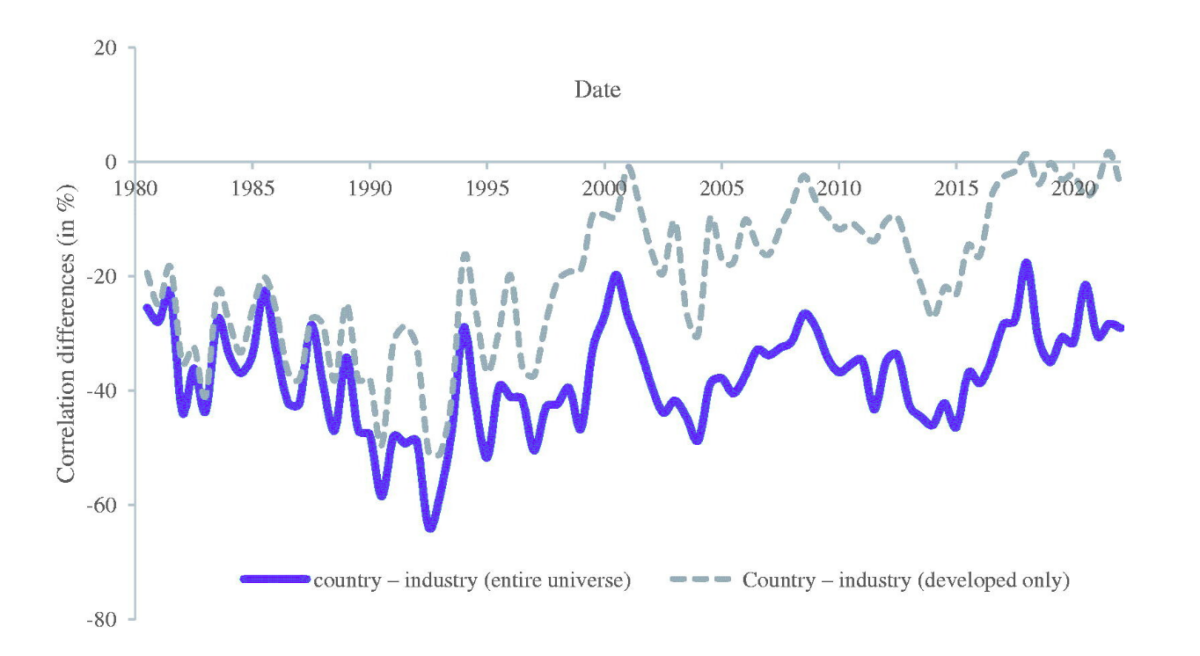

- When looking at the entire universe of stocks, pure country effects are more volatile than pure industry effects. This result implies that international diversification has been superior to industrial diversification for global portfolio managers during the full period under analysis. However, industrial diversification has been the slightly better alternative for managers limited to DMs since 2000.

- For the entire universe and the three subsamples, the country, and industry absolute deviations get a positive and significant coefficient on the recession dummy, indicating that the benefits of international and industrial diversification are countercyclical because they are higher during recessionary periods relative to expansionary periods. This evidence suggests that irrespective of the diversification approach taken, recessions are not a good time to avoid diversifying.

Why does it matter?

Unrestricted global portfolio managers should try to mitigate both geographical and industrial sources of return variations by implementing top-down investment policies that are internationally, regionally, and industrially diversified. Fund managers restricted to EMs should focus primarily on international diversification, as few of EMs’ return variations are due to industry or regional factors. Finally, investors restricted to DMs should be more concerned with industrial diversification because the degree of integration of these markets leaves lesser gains for geographical diversification.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Using a large sample of stocks from 48 developed and emerging markets over 1995 to 2021, we find evidence that suggests that international diversification is the best risk-reduction tool when all markets are considered. However, after the turn of the millennium, industrial diversification is the best alternative for funds limited to developed markets, especially when they are restricted to a region. Importantly, the benefits of diversification persist through hard times, such as the Asian financial crisis, the IT bubble burst, the global financial crisis, and the COVID-19 pandemic, demonstrating their countercyclicality and proving their value when investors need them the most.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.