This paper focuses on “organization capital,” representing intangible assets in a firm’s key employees that is not captured by classic value measures such as book-to-market. The authors propose a structural model to analyze the impact of organizational capital on asset prices and argue that shareholders perceive firms with high levels of organizational capital to be riskier than those with more physical capital.

Organization Capital and the Cross-Section of Expected Returns

- EISFELDT and PAPANIKOLAOU

- Journal of Finance 2023

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The authors ask the following questions:

- What is Organization Capital?

- How does Organization Capital affect asset prices?

- Is There a difference in risk premia for firms with varying levels of Organization Capital?

- What is the impact of the frontier technology shock on Organization Capital and asset prices?

- How does the model align with empirical data?

What are the Academic Insights?

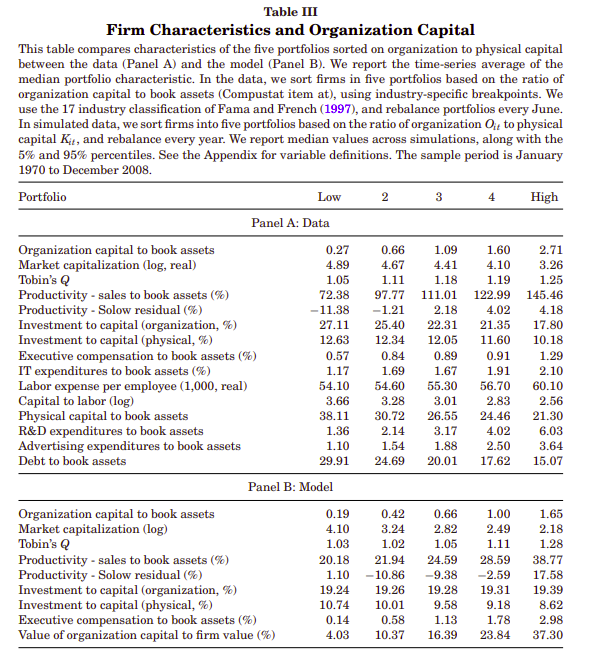

- Organizational capital represents intangible assets embodied in a firm’s key employees. It is distinct from physical capital, such as machinery or real estate, and refers to the knowledge, skills, relationships, and expertise of the individuals within the organization. These individuals are often critical to the firm’s operations and contribute to its productivity, innovation, and competitive advantage. It is calculated as a measure of the stock of organization capital by cumulating firms’ selling, general, and administrative (SG&A) expenses using the perpetual inventory method. We rank firms based on their ratio of organization capital to book assets relative to their industry peers (O/K), since the accounting treatment of SG&A expenses varies across industries.

- Organizational capital affects asset prices by introducing a unique risk associated with the intangible and firm-specific nature of organizational capital. Shareholders demand higher risk premia for investing in firms with significant organization capital, reflecting their concerns about the potential loss of key talent and its impact on the firm’s performance. This differential perception of risk influences asset pricing and the returns on assets related to firms with varying levels of organizational capital.

- YES – there is a difference in risk premia for firms with varying levels of organization capital. Shareholders tend to demand higher risk premia for investing in firms with high levels of organizational capital relative to firms with more physical capital.

- The frontier technology shock refers to a systematic fluctuation in the division of surplus between key talent and shareholders. This shock is considered to be a determinant of the risk inherent in organization capital. In essence, it represents changes in the productivity and efficiency of organization capital technology that affect the cash flows associated with it. It affects the cash flows from organization capital, and by extension, the value of organization capital itself. When this shock is positive, it implies an improvement in the frontier technology, leading to increased productivity and efficiency of organization capital. Conversely, a negative shock suggests a deterioration in the efficiency of organization capital technology.

- In several ways:

- The model aligns with the observed difference in risk premia for firms with varying levels of organizational capital. The model’s calibration reproduces the higher risk premia shareholders demand for investing in firms with high organization capital relative to those with more physical capital. The portfolio construction based on the model’s predictions mirrors the observed returns.

- The model’s calibration reflects the impact of the frontier technology shock on organization capital and asset prices. Considering this systematic shock, the model can explain the dynamics of organization capital and its influence on asset pricing, consistent with empirical observations.

- The paper indicates that the model provides a quantitative replication of the empirical findings, allowing for a better understanding of the relationships between organization capital, firm characteristics, and asset prices. The model helps to quantify the differences in risk premia and expected returns.

- The paper also mentions generalized method of moments (GMM) estimates of the market price of risk associated with the frontier technology shock. These estimates support the model’s alignment with the data by indicating the impact of this shock on risk and returns.

Why does this study matter?

This paper advances our understanding of the changing nature of capital in the modern economy and the implications of organization capital for investment decisions, risk management, asset pricing, and economic policy. It highlights the importance of recognizing intangible assets as a significant component of a firm’s value and risk profile.

The Most Important Chart from the Paper:

Abstract

Organization capital is a production factor that is embodied in the firm’s key talent and has an efficiency that is firm specific. Hence, both shareholders and key talent have a claim to its cash flows. We develop a model in which the outside option of the key talent determines the share of firm cash flows that accrue to shareholders. This outside option varies systematically and renders firms with high organization capital riskier from shareholders’ perspective. We find that firms with more organization capital have average returns that are 4.6% higher than firms with less organization capital.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.