The literature on financial planning is varied and widely distributed across different outlets, both academic and practitioner. In this academic article, the authors pull together an analysis of the types of thematic structures found most often in financial planning studies as well as the theories most often referenced.

A Bibliometric Review of Journal of Financial Counseling

and Planning

- Kirti Goyal and Satish Kumar

- Journal of Financial Counseling and Planning

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

- Describe the intellectual thematic structure found in high-quality planning journals.

What are the Academic Insights?

Since 1990, The Journal of Financial Counseling and Planning (JFCP) has emerged as a prominent publication outlet for research in financial counseling and planning. The authors conducted a bibliometric review, providing a retrospective of this journal and thoughtfully suggested future research paths. Clustering was used to perform a thematic analysis of the network of articles. Overall, 494 out of the 523, about 95%, articles that were published between 1990 and 2022 in the JFCP, were found to be linked together, and eight significant clusters emerged.

- The first and largest cluster dealt with credit card behavior, with 123 articles and 2,173 citations. A substantial theme for FP. Most of the articles in this cluster were concerned with the saving motives of consumers and their use of credit card debt. The top-cited article was Lown and Ju (1992). They analyzed a credit use and financial satisfaction model of behavior. They found the strongest effect was the consumer’s perception of debt commitments and the levels of worry and happiness concerning the commitment.

- The second cluster was focused on the importance of financial literacy on financial behavior. It contained 70 articles accompanied by 515 citations. The most cited article was by Henager and Cude (2016) who argue that objective and subjective financial literacy measures were positively related with financial behavior. For older age groups, objective financial knowledge was stronger than it was for younger age groups. This relationship reversed itself for younger age groups, where subjective literacy was more important.

- The third cluster was concerned with financial risk tolerance and contained 70 articles with 1,623 citations. The top article was by Bajtelsmit and Bernasek (1996). The authors reviewed the existing literature on risk tolerance with respect to gender differences in a variety of fields, including economics, sociology, education and gender studies.

- With 59 articles and 2,167 citations, the fourth cluster focused on financial education and financial behavior. Mandell and Klein (2009) was the most cited article which examined how high school students were affected by a personal financial management course. Unfortunately, the results were disappointing: there was no impact on literacy!

- Financial distress and financial self-efficacy characterized the fifth cluster with 58 articles and 985 citations. The article with the most citations within the cluster was by Archuleta et al. (2013), where the potential causes of financial anxiety were analyzed. College students who had taken a financial education course, had copious amounts of student loans, experienced significant financial stress, and had high financial self-efficacy were more likely to seek out professional financial help.

- Cluster six, with 55 articles and 1,725 citations, was concentrated on financial well-being. The most cited article was by Prawitz et al. (2006) which also developed the InCharge Financial Distress/Financial Well-Being Scale. The Scale attempts to measure a construct that represents an individual’s position on a continuum of overwhelming distress to no financial distress all the way to the highest level of financial well-being.

- Cluster seven, with 54 articles and 461 citations, was focused on financial help-seeking behavior and financial education in the workplace. In general, the study convincingly argued and demonstrated that financial education in the workplace is successful as it improved the financial wellness of employees.

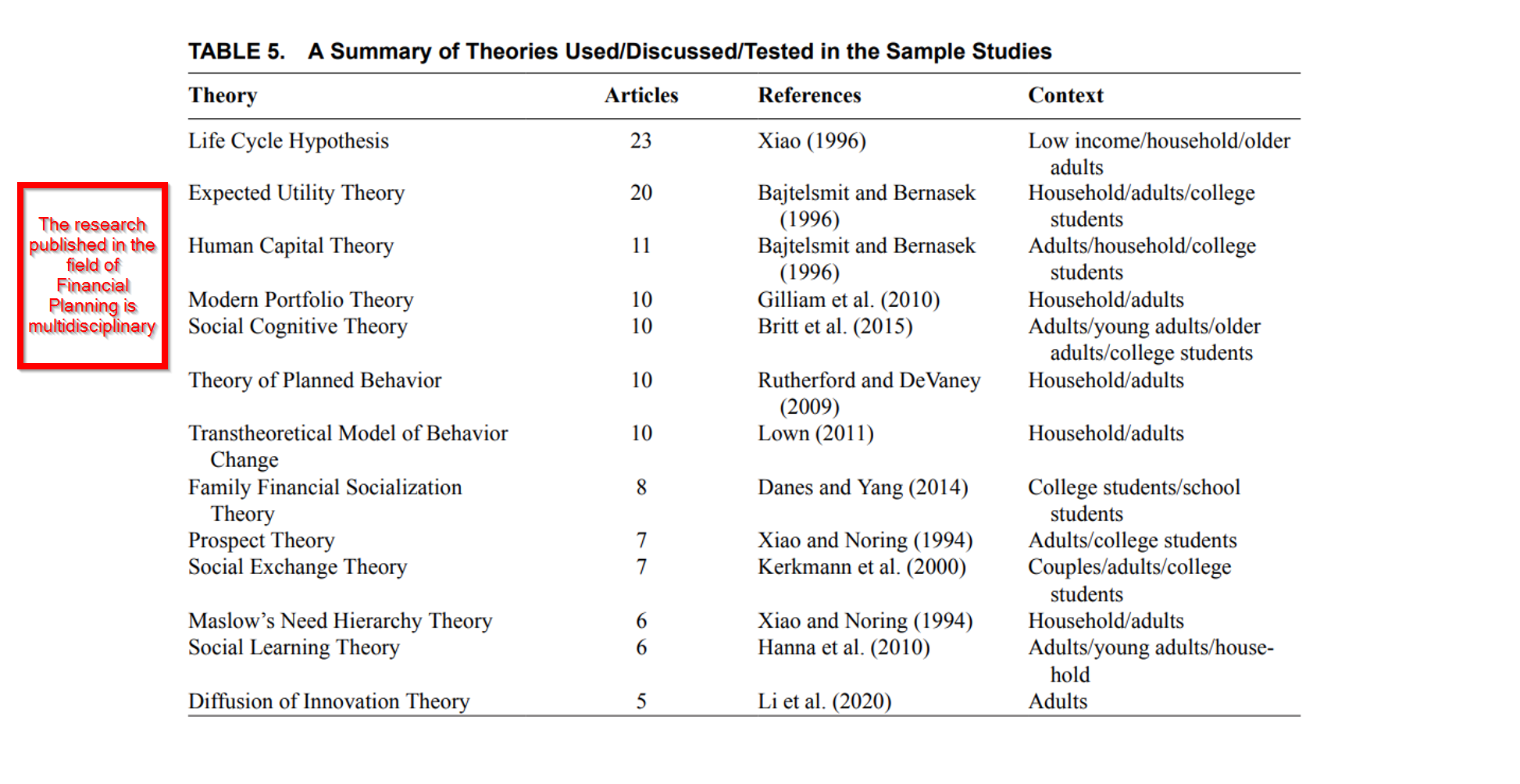

- In addition to the research surveyed, the authors identified and quantified the underlying theoretical foundations of studies reviewed in the JFCP. That information is summarized in Table 5 below.

Why does it matter?

The research presented in this article has strengthened the knowledge and awareness of the literature that currently exists in academic publications on financial planning, especially in recent years. Obvious gaps have been filled in, however the authors advise that future research should provide more in-depth analysis in the planning domain.

I would tend to agree. Readers, please DM me your thoughts, comments, and new contributions and ideas at @TommiJohnsen on X. Are there areas of research missing?

The most important chart from the paper

Abstract

In 1990, the Journal of Financial Counseling and Planning (JFCP) was established. The journal publishes academic research on consumer financial decision-making, financial education, counseling, and planning. This article reviews the journal’s contents published during the period 1990–2022. It analyzes JFCP’s publication trends, citation statistics, significant themes, authors’ collaborations, keywords, and contributions to the literature of consumer finance. Most studies employed Life Cycle Hypothesis and Expected Utility Theory. JFCP publishes mostly US-based quantitative empirical studies. JFCP’s eight knowledge themes are credit card behavior; financial literacy and financial behavior; financial risk tolerance; financial education, and financial behavior; financial distress and financial self-efficacy; financial well-being; workplace financial education and financial help-seeking behavior, and JFCP’s retrospection. Among JFCP’s articles, the most used keywords selected by authors are “survey of consumer finances” and “financial literacy.” This study also describes the author, country, and concept networks.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.