When investors have a concentrated stock position that has performed well, they eventually face the same tough question: Should they continue to hold the position (and the outsized exposure it brings to their portfolio) or diversify – and face significant capital gains taxes?

Though many investors and their advisors think that selling the stock and reinvesting the proceeds into a diversified portfolio is the straightforward answer, it can also be suboptimal. Thankfully, the wealth management industry has various solutions to optimize a concentrated portfolio while reducing tax drag. However, one solution that’s existed for almost a century still remains relatively obscure – the Exchange Fund.

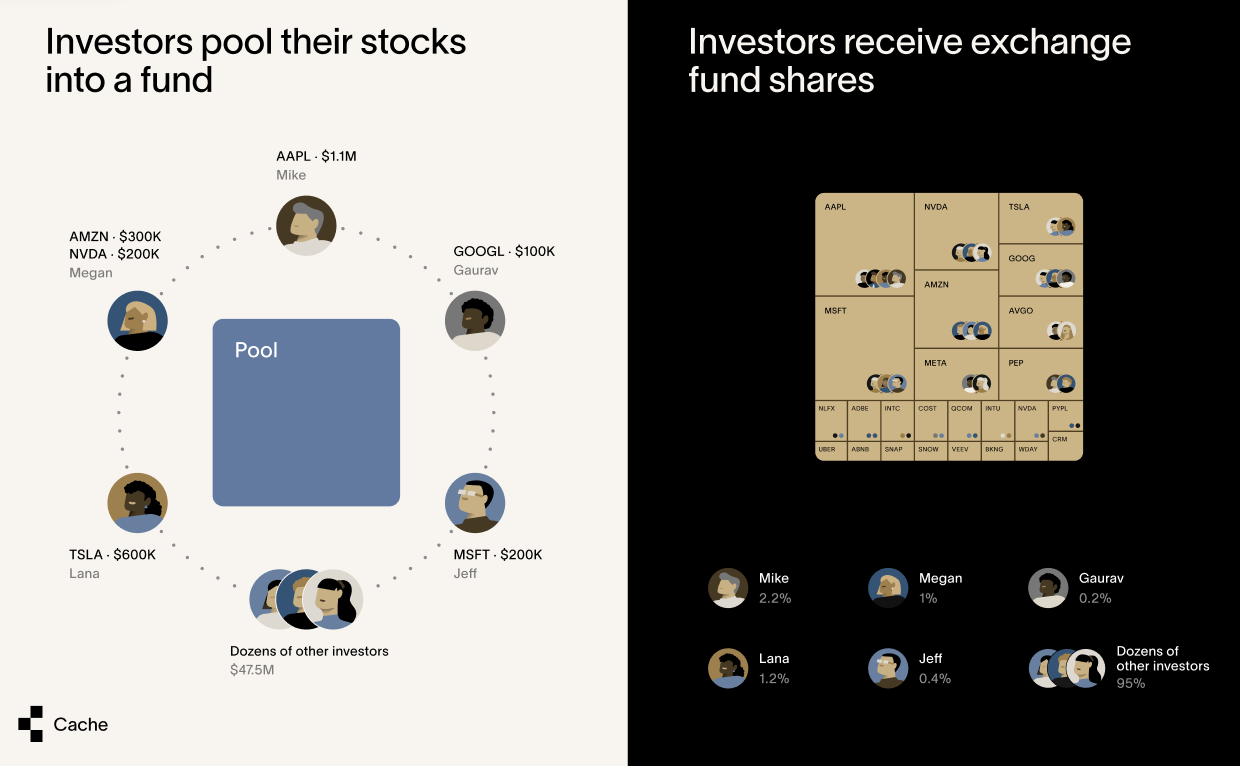

Exchange funds are an investment vehicle that takes in stocks from multiple investors and pools them into a single fund, giving each investor a pro-rata share of the fund. Each investor contributes a stock their portfolio is concentrated in, and by carefully assembling a set of investors, exchange funds help participants diversify. Since contributions to a properly structured exchange fund are not considered a taxable event, investors can diversify their portfolios without incurring a huge tax bill.

Under the current tax code, the participant can withdraw a diversified basket of stocks after a seven-year curing period. No capital gains taxes are due until participants eventually decide to sell those stocks.

However, before discussing exchange funds more in-depth, let’s examine the problem with portfolio concentration.

The Case for Diversification

Antti Petajisto’s 2023 review of 97 years’ worth of stock market data for the Brooklyn Investment Group analyzed the long-term performance of single stocks. During this research period, single stocks tended to underperform the market – especially when they had recently been high performers. The research found:

- The median ten-year return on individual U.S. stocks relative to the broad equity market was –7.9%, underperforming by 0.82% per year.

- Stocks among the top 20% of performers over a given five-year period saw median ten-year market-adjusted return fall to -17.8%. That’s -1.94% per year versus the market.

- The median ten-year market-adjusted return of recent winners was negative 93% of the time between the end of WWII and 2023.

Petajosto concluded: “The case for diversifying concentrated positions in individual stocks, particularly in recent market winners, is even stronger than most investors realize.”

History and Evolution of Exchange Funds

Even though many have not heard of exchange funds, these investment vehicles have been around for almost a century. Eaton Vance pioneered the modern-day version in the late 1990s and is currently the market leader.

In addition to Eaton Vance, several other investment banks have created their own exchange funds. Goldman Sachs is the only sizable competitor to Eaton Vance currently in the exchange fund marketplace. Since an exchange fund is often constructed with contributed securities only, a broad distribution network is required to ensure sufficient diversification.

Being an independent asset manager helped Eaton Vance build the broadest distribution network in the exchange fund business, with sub-placement agents from across the industry of financial institutions. Eaton Vance was acquired by Morgan Stanley in 2021.

Drawbacks and Opportunities

One limitation of the legacy exchange fund providers is the narrow scope of their potential investor pool, namely Qualified Purchasers with at least $5mm of investable assets. These restrictions are not triggered by anything other than the legacy providers’ unilateral decision to restrict access – and not due to regulatory or tax code considerations.

By offering exchange funds to Accredited Investors where the net worth threshold is just $1mm, the pool of potential exchange fund investors could increase twenty-fold.

Another limitation of exchange funds currently being offered is that they focus on approximating the performance of broadly diversified indices, such as the S&P 500 or the Russell 3000. While this broad diversification is very good for investors, the ability to source contributed securities across all economic sectors can be challenging.

The opportunity set of potentially contributed securities that are highly appreciated has largely centered around prior and current areas of strong growth. Today, that is in the Technology sector, but historically, other sectors, such as Consumer Discretionary and Healthcare, have grown significantly. Some sectors, such as Telecommunications and Electric Utilities, have not typically shown great appreciation over time; thus, sourcing those stocks is more challenging. That leaves “holes” in the exchange fund portfolio, or those stocks must be purchased with cash to plug the gaps versus the relevant benchmark index.

For example, for every contribution an exchange fund receives for a highly appreciated stock (such as Apple or Microsoft), there need to be contributions of securities that may not have appreciated as rapidly (such as AT&T or Ford) – otherwise, the fund won’t reach its diversification objectives. Therefore, sourcing a broad index can limit the overall opportunity for investors with a concentrated stock position.

A more narrowly focused, growth-oriented index, such as the Nasdaq-100 or Russell 1000 Growth, could be a more fertile area for sourcing highly appreciated stocks for an exchange fund.

Diversification reduces concentration risk, but it does not eliminate investment risk completely. Losing principal when you participate in an exchange fund is still possible.

The New Cache Exchange Fund

Enter Cache and its innovative approach to offering exchange funds. You might think of them as Exchange Funds 2.0.

The Cache Exchange Fund is intended to broaden the market for exchange funds by making them available to Accredited Investors and Qualified Purchasers. This would benefit many investors and make this option accessible to them for the first time.

Cache Exchange Funds also seek to broaden the opportunities for investors by, ironically enough, narrowing the index for which they seek to approximate the characteristics and performance. The initial Cache Exchange Funds are using the Nasdaq-100 as their benchmark. By doing so, there is much more capacity for highly appreciated stocks (such as Apple, Microsoft, Amazon, etc.) and other growth-oriented securities that make up a significant portion of the Nasdaq-100.

This should allow more investors to contribute their shares to the portfolio in proportionally larger sizes than competing exchange funds because of the higher weightings that growth stocks have in the index compared to the S&P 500 or Russell 3000.

While the mechanics of exchange funds can take a little time to understand, their utility is straightforward: diversify your concentrated stock positions tax-efficiently. Many more investors can now consider an exchange fund as an investment option. While investors should, of course, consider their unique situation as part of all investment analysis, there is now a strong alternative for solving investment considerations related to stock concentration. Advisors can learn more on the Cache website.

—-

The statements and opinions expressed are those of the individual and not necessarily those of Cache Advisors LLC or Cache Securities LLC (“Cache”). Material presented herein is gathered from sources that we believe to be reliable. We do not guarantee the accuracy of the information it contains. This article may not be a complete discussion of all material facts and is not intended as the primary basis for your investment decisions. All content is for general informational purposes only and does not take into account your individual circumstances, financial situation, or your specific needs, nor does it present a personalized recommendation to you. It is not intended to provide legal, accounting, tax or investment advice. Investing involves risk, including the loss of principal.

Investment advisory services are offered through Cache Advisors LLC, an investment advisor registered with the U.S. Securities and Exchange Commission (“SEC”). Brokerage services are offered through Cache Securities LLC, an SEC registered broker dealer, Member FINRA and Member SIPC.

About the Author: Mike Allison

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.