What are the new avenues and topics for future research? This article lays out a systematic literature review to begin to answer those questions and suggest future expansions of each stream.

Robo-advisors: A systematic literature review

- Giovanni Cardillo and Helen Chiappini

- Finance Research Letters

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

- What are the major research streams on robo-advisors?

- What will future research streams on robo-advisors likely take?

What are the Academic Insights?

- Four groups of research on robo-advisors were identified:

- Attempts to classify robo-advisors: The analysis of attempts to classify reveals how flexible robo-advisors have become in financial practice. They may represent several business lines at once or a single business, either with humans or on an automated platform. Robo-advisors are not necessarily associated with financial institutions. Those that are, may be integrated at various levels and may generate additional fee revenue. Robo-advisors also represent active as well as passive managers with varying levels of intensity. On the passive side, robo-advisors assist in asset allocation, risk management, portfolio management including rebalancing. For active strategies, they are used to identify investments using artificial intelligence models and assist in managing changes in assets for individual clients. Three business models have been referred to in the literature. The D2C model utilizes online platforms that are completely automated with typical portfolio construction algorithms. The B2B model provides only digital support to a human advisor. The third is a hybrid of B2B +D2C models, where personal contact is paired with automated portfolio recommendations.

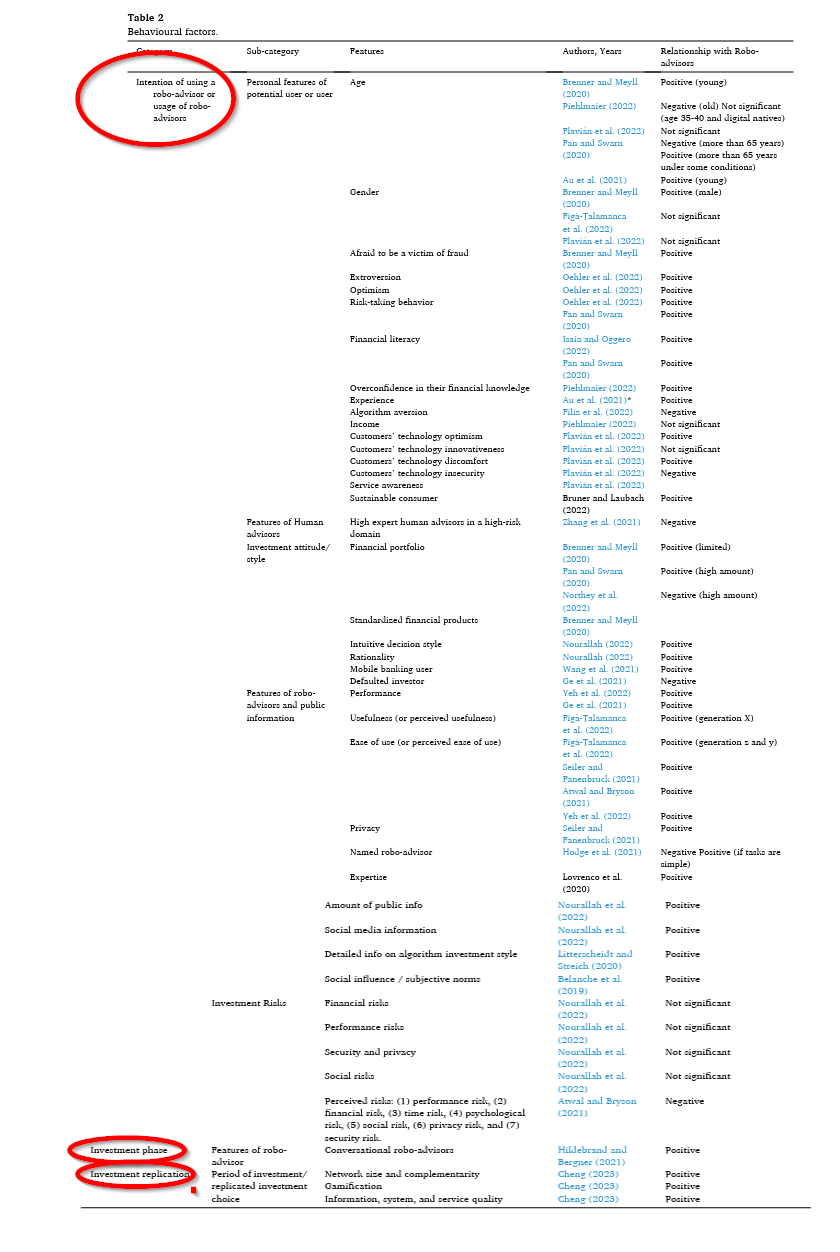

- Behavior, attitudes and traits: Descriptives related to the usage of robo-advisors are comprehensively covered in the research literature. Personality characteristics positively associated with usage include attitude toward risk, extroversion and optimism, fear of fraud, financial literacy and overconfidence, technological optimism, innovative attitude, and some level of discomfort (a surprise!). Traits negatively related include insecurity regarding technology and aversion to math modelling. Gender and level of income seem not to influence the use of robo-advisors. Characteristics of the specific robo-advisor also affect the likelihood of client usage. Ease of use is key for various generations, Gen X especially. Information sources about the advisor also matter. For example, clear and comprehensive descriptions of the math modelling and coverage by social media or personal acquaintances. For more details see Table 2 below.

- Performance: Robo-advisors do not outperform market indexes under static or dynamic conditions, with or without automated rebalances, or with a buy-and-hold strategy. Against human advisors, the results are similar although there may be advantages with targeted clienteles and degree of diversification. Robo-advisors are particularly helpful to clients with poorly diversified portfolios, low income and with low education levels.

- Algorithms and models are primarily based on Modern Portfolio Theory, with adjustments to include spending goals, risk tolerance and changing targets.

- The authors suggest furture research on robo-advisorwill likely expand the four categories as follows:

Why does it matter?

There are several beneficiaries for this literature review:

For researchers and scholars: a new set of research topics and a comprehensive review of topics that have been covered in the literature. For asset managers, banks, and other financial institutions interested in initiating robo-advisory operations or expanding current operations: studies on customer preferences, performance of robo-advisors relative to benchmarks, solutions based on AI, potential impact on employees. For regulators and supervisors: knowledge and insights on the impact robo-advisors may have on the business models for banks and on efficiency.

The most important chart from the paper

Abstract

Using a systematic literature review, our study analyzes articles on robo-advisors between 2017 and 2022. Our review identifies four relevant research streams: early classification of robo-advisors, behavioral topics, performance, and algorithm modelization. Finally, we propose relevant research questions for each stream, providing scholars with new research angles. Our considerations are also valuable for asset managers, banks, and other financial companies since adopting robo-advisors affects their business models through clients’ preferences and cost structure.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.