Given the significant growth of investment in private markets, there have been increasing demands for greater transparency in the operation and structure of private market funds. This paper aims to address questions such as whether fees are set uniformly within most funds, and if not, by how much do they vary.

Fee Variation in Private Equity

- Juliane Begenau and Emil N. Siriwardane

- Journal of Finance, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

By studying the fund-level cash flow data from Eurekahedge, the authors ask the following questions:

- Are fees set uniformly within most private market funds, and if not, by how much do they vary?

- What factors determine variation in fee policies across general partners (GPs) and funds?

- Which limited partners (LPs) pay lower fees?

What are the Academic Insights?

By analyzing quarterly data from Prequin with these characteristics: 9,830 investor-fund level observations, covering 218 unique pension funds (LPs), 856 unique fund managers (GPs), and 2,400 funds, the authors find by asset class, 4,465 of observations are investments in Private Equity funds, 1,956 are in Venture Capital, 1,888 are in Real Estate, 1,215 are in Private Debt, and 306 are in Infrastructure. In total, the core sample covers $543 billion of commitments and $438 billion of contributions.

The authors find:

- NO – Fees are not set uniformly within most private market funds. There is significant variation, with fees ranging from as low as 0.5% to as high as 2.5%. This indicates a wide disparity in the fee structure across different funds.

- The factors that can determine fee dispersions are: fund characteristics; investor demand (which is influenced by factors such as GP past performance, undersubscription of funds, and GP experience in the strategy); the choice of law firm employed by each fund (as law firms assist in drafting LPAs and side letters, influencing fee negotiation and implementation); placement agent usage (due to the cost-sharing arrangement where LPs bear a portion of placement agent fees); asset class (with venture capital funds being less likely to use multiple fee structures compared to other asset classes like private equity, infrastructure, private debt, or real estate. Venture capital funds tend to have lower within-fund dispersion in both management fees and carry)

- LPs with larger commitments relative to the total fund size tend to pay lower fees because LPs with significant financial backing may negotiate better fee terms, possibly due to their ability to attract more capital to the fund, LPs with more experience and sophistication in private markets are also likely to pay lower fees. These LPs may have a better understanding of the market dynamics and may be more skilled in negotiating favorable terms with general partners (GPs); LPs who have a stronger relationship with specific GPs may receive better fee terms. This could be due to trust built over time or a track record of successful collaboration, leading to preferential treatment in fee negotiations, LPs who have been early investors in private equity may also benefit from lower fees. Their early involvement in the asset class may give them leverage in negotiating favorable terms. Characteristics related to pension governance, such as board size and composition, may also influence fee levels. For example, LPs with boards that are more focused on fee considerations may be more successful in negotiating lower fees.

Why does this study matter?

Private equity (PE) is a significant asset class with complex dynamics, and understanding the factors that influence fee structures and performance outcomes is crucial for investors, fund managers, and policymakers. This paper provides valuable insights into how limited partners (LPs) negotiate fee terms and how these terms impact their investment outcomes.

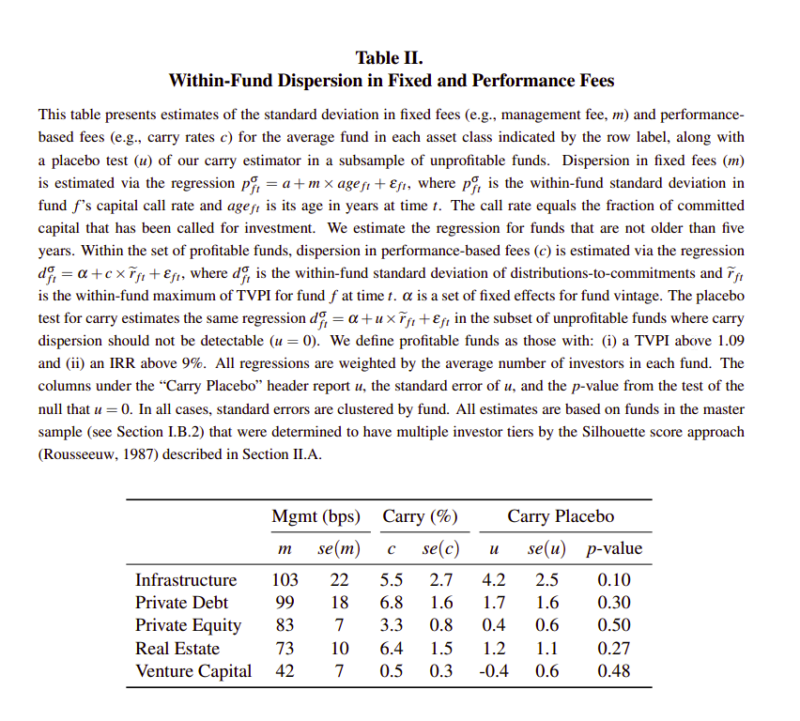

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We study how investment fees vary within private equity funds. Net-of-fee return clustering suggests that most funds have two tiers of fees, and we decompose differences across tiers into both management- and performance-based fees. Managers of venture capital funds and those in high demand are less likely to use multiple fee schedules. Some investors consistently pay lower fees relative to others within their funds. Investor size, experience, and past performance explain some but not all of this effect, suggesting that unobserved traits like negotiation skill or bargaining power materially impact the fees that investors pay to access private markets.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.