Executive Summary

- Many investors face the complex decision of whether to transition from a diversified ETF to direct indexing. When is this switch a poor investment choice? My findings suggest that many investors are better off avoiding it.

- Direct indexing remains attractive even with a decent amount of embedded capital gains, up to approximately 40% of initial investment, for investors in the highest marginal income tax bracket.

- However, for lower-tax investors with a marginal income tax rate of 22%, ETFs often prove more advantageous: when embedded capital gains exceed 10%, a consumption-focused investor is better off staying in an ETF.

- While the other benefits and costs of direct indexing are difficult to quantify, my results indicate that it is far from a universal solution. Investors with high embedded gains and lower tax rates should approach direct indexing cautiously.

Introduction

When should you move from a diversified ETF to direct indexing?

For many of today’s investors, the answer may be less straightforward than you think.(1)

This piece discusses the costs and benefits of direct indexing versus a diversified low-cost ETF and demonstrates that, in many realistic scenarios, someone currently holding those ETFs should hesitate before transitioning to direct indexing.

Intrigued? Read on.

Cost / Benefit Analysis

Benefits of Direct Indexing vs. ETFs

The benefits of direct indexing relative to ETFs are:

- Tax Alpha: Individual positions may be used in a tax loss harvesting strategy to realize losses, potentially offsetting capital gains or income outside the equity sleeve.

To quantify the dollar value of the tax alpha, the tax assumptions – which map back to fundamentals like the client’s adjusted gross income and state of residence – are key here. Many pieces in the literature assume, generously, that the tax losses harvested are used to offset pre-existing short-term capital gains or ordinary income (in reality, the latter is restricted to $3,000 per year), and do so at high marginal income tax rates.

Importantly, as a long-only direct indexing portfolio appreciates in value, the potential for tax loss harvesting fades toward zero. In particular, I assume that the maximum cumulative net capital loss realized, as a percent of initial investment, is 30% over ten years, which accords with Israelov and Lu (2022) and Liberman et al. (2023).

I assume the tax savings occur equally at the end of the direct indexing portfolio’s first three years and are immediately re-invested into the benchmark ETF with no management fees. This reflects the findings in the papers cited above that the tax loss harvesting benefits tend to be weighted toward the beginning of the portfolio’s life. Arguably, the assumption that the proceeds are invested in an ETF may understate the benefit of direct indexing if there is continued opportunity for additional tax alpha. For simplicity, I have excluded this factor from my calculations. However, given its potential impact, it is unlikely to alter the overall results significantly. - Strategic Alpha: Potential for higher-than-market returns by integrating alpha strategies such as equity factors. This is fairly rare in today’s direct indexing offerings, especially at the management costs that I assume: most providers track a passive index, so I assume there is no expected strategic alpha relative to the passive benchmark for the rest of the piece.

- Customization: Ability to customize a portfolio by restricting or overweighting names due to considerations such as ESG, convictions, or existing positions. One benefit of direct indexing is that it may help to build a diversified portfolio around pre-existing concentrated exposures; these situations are highly idiosyncratic and not addressed here. Setting the concentration use case aside, the value of portfolio customization is hard to quantify in dollars, since these are typically values-driven views that do not have expected alpha.

Costs of Direct Indexing vs. ETFs

The costs of direct indexing relative to ETFs are:

- Upfront Transition Cost: Transition costs are the capital gains taxes that result from liquidating one strategy to invest in another. In this piece, I assume that the investor is already holding a diversified US market ETF, so one cost of direct indexing is liquidating the ETF holdings to generate cash to invest in direct indexing.

This piece does not contemplate any gradual transition strategies. Since the market generally trends upward over time, delaying the transition to direct indexing will likely increase the overall transition cost, assuming the tax rate remains unchanged.

I assume the transition costs are deducted from the portfolio value upfront. Much like tax deferral in reverse, paying these costs early in a portfolio’s life means forgoing potential gains that the portfolio could have earned had those dollars been invested instead. - Management Fees: Many popular US equity ETFs have low expense ratios in the low single digits (~3 basis points). In contrast, direct indexing typically comes with much higher management fees, often in the 35-40 basis point range.

I assume that fees are paid annually and are deducted from the portfolio’s value. Like transition costs, these fees have a cumulative opportunity cost of lost returns. - Tracking Error: The direct indexing portfolio will perform differently from the benchmark. Even without customization and strategic alpha, the use of tax loss harvesting will mean that the direct indexing holdings will differ from the underlying benchmark holdings due to wash sale constraints, driving differences in performance.

Comparing tracking error to tax alpha is akin to comparing apples and oranges. Tracking error is a form of risk and changes the distribution of potential portfolio performance relative to a benchmark, while tax alpha effectively increases the expected net return of the investment. For the rest of this piece, I will assume that the investor is comfortable with the tracking error of direct indexing. I do not attempt to assign dollar costs to the investor associated with the tracking error.

Quantifying the Trade-Offs

Methodology

I assume a $100k portfolio value today with varying levels of embedded capital gains. Existing positions are assumed to be at least a year old and subject to long-term capital gains taxes. For instance, consider a long-term ETF investor with 70% embedded capital gains. His $100k portfolio value today has a cost basis of $30k, and the remaining $70k would be subject to long-term capital gains tax if liquidated.

I assume the US equity market grows at 6% annually. The direct indexing is managed at a 30 basis point fee for ten years following the transition. For simplicity, I assume the ETF has a zero expense ratio.

When comparing portfolio end values, I examine both pre- and post-tax values. The pre-tax values (also called “statement values”) reflect a portfolio that is inherited with a step-up in cost basis at the end of the ten years. The post-tax values reflect a portfolio that is liquidated in its entirety – owing taxes on all embedded capital gains – in service of the investor’s consumption.

I assume two hypothetical investors. The higher tax investor is in the highest federal tax bracket, including a 3.8% NIIT; I do not include state or local taxes, which may increase the overall tax rate. The higher tax investor is often assumed in the literature, making the most robust case for direct indexing a helpful data point. Still, it is worth noting that taxpayers in the highest tax bracket are hardly a representative part of the population, only amounting to about 1% of all taxpayers. To assess direct indexing under a more common circumstance, I analyze a lower tax investor, which maps to a married filing jointly couple with taxable income between $89,451 and $190,750.

| Higher tax investor | Lower tax investor | |

| Capital gains tax rate | 23.8% | 15.0% |

| Marginal income tax rate | 40.8% | 22.0% |

Results: Higher-Tax Investor with Low Embedded Gains

Suppose our investor has held a low-cost diversified US equity ETF (such as VTI) for one year, meaning that his embedded capital gains are relatively low (~20%) in the context of long-term investing. What is the cost-benefit of moving to direct indexing for this investor?

First, the investor has to pay transition costs:

| Stay in ETF | Transition to DI | |

| Initial investment | $80,000 | |

| Embedded capital gains | $20,000 | x 23.8% = $4,760 in taxes |

| Today’s value | $100,000 | $95,240 after transition |

I then examine the final portfolio statement values in ten years, assuming annualized returns of 6%. The difference between the portfolio values is the total pre-tax cost of the transition to direct indexing.

| Stay in ETF | Transition to DI | |

| Value in 10 years | $179,085 | $165,512 |

| Total management fee | $3,933 | |

| Opportunity cost (forgone returns due to transition & fee cost) | $9,640 | |

| Total cost | $13,573 |

For the benefits, I compute the maximum net capital losses realized based on the 30% assumption from the literature cited earlier. This depends on the initial amount invested in direct indexing, which depends on the embedded capital gains in the ETF position.

| Initial direct indexing investment | $95,240 |

| Maximum net capital losses (30% of initial) | $28,572 |

| Marginal income tax rate (higher-tax assumption) | 40.80% |

| Tax savings | $11,657 |

As discussed earlier, I assume the tax savings occur over the first 3 years of direct indexing and are reinvested immediately in the ETF. For instance, at the end of year 1, I assume that the investor saves $3,886 (⅓ * $11,657), which compounds over nine years at the assumed 6% growth rate. Thus, the tax alpha from year one alone would be $6,565. Repeating over the first 3 years, I convert the tax savings to tax alpha, as shown below. The tax savings are the same each year; what differs is the length of time invested (9, 8, and 7 years, respectively).

| Tax alpha, year 1 | $6,565 |

| Tax alpha, year 2 | $6,193 |

| Tax alpha, year 3 | $5,843 |

| Total tax alpha | $18,601 |

Finally, we examine two final values: statement value, which assumes a step-up in cost basis, and post-tax value, which assumes the entire portfolio is liquidated to support the investor’s consumption. The ETF case is easy: the initial $100k portfolio, with an initial $20k in embedded capital gains, grew to $179,085. The embedded capital gains of the final portfolio is $99,085, resulting in a post-tax value of $155,503 ($179,085 – 23.8% * $99,085).

The direct indexing case is less straightforward. Each dollar harvested lowers the cost basis associated with the initial investment. That is, the embedded capital gains related to the initial investment are its final value minus the initial investment in direct indexing net of the net capital losses harvested, i.e., $98,844 ($165,512 – [$95,240 – $28,572]). In other words, the initial investment in direct indexing is $95,240, but the cost basis on the portfolio is decreased to $66,668 since 30% of it is harvested for net capital losses. To determine the total portfolio value, we combine the post-tax value of the initial investment with the additional value generated from reinvesting the tax savings, which has a cost basis based on the original amount saved.

| Stay in ETF | Transition to DI | |

| Statement value from initial investment | $179,085 | $165,512 |

| Embedded capital gains from initial investment | $99,085 | $98,844 |

| Statement value from reinvesting tax savings | $18,601 | |

| Embedded capital gains of reinvesting tax savings | $6,944 | |

| Pre-tax end value | $179,085 | $184,113 |

| Post-tax end value | $155,503 | $158,936 |

So there we have it: for the inheritance-focused (step up in cost basis) investor, over ten years, direct indexing nets our client an extra $5,028 from his initial $100k holdings relative to the Stay-in-ETF benchmark. For the consumption-focused (post-tax) investor, direct indexing nets the client an additional $3,433 relative to the benchmark.

It’s not shabby, but this is nearly the best-case scenario: a higher-tax investor with low embedded gains. The following section will investigate what happens when that same investor has high embedded gains.

Results: Higher-Tax Investor with High Embedded Gains

Suppose that our hypothetical investor purchased his ETF holdings roughly ten years ago, amounting to ~70% embedded capital gains. I run the same exercise as above:

| Stay in ETF | Transition to DI | |

| Initial investment | $30,000 | |

| Embedded capital gains | $70,000 | x 23.8% = $16,660 in taxes |

| Today’s value | $100,000 | $83,340 after transition |

Off the bat, this investor already owes nearly an additional $12,000 in upfront capital gains taxes relative to our previous example. As shown below, those additional upfront taxes have an increased opportunity cost on the portfolio.

| Stay in ETF | Transition to DI | |

| Value in 10 years | $179,085 | $144,832 |

| Total management fee | $3,441 | |

| Opportunity cost (forgone returns due to transition & fee cost) | $30,812 | |

| Total cost | $34,253 |

The “Stay in ETF” scenario has the same value in 10 years as in the previous example. However, in this example, the end value of the initially invested direct indexing portfolio is just under $145k, while our last example had over $20k additional end value.

The benefits are also reduced due to the lower initial investment in direct indexing. Maximum net capital losses fall proportionately, and the potential tax savings are over $1,000 less than in our previous example.

| Initial direct indexing investment | $83,340 |

| Maximum net capital losses (30% of initial) | $25,002 |

| Marginal income tax rate (higher-tax assumption) | 40.80% |

| Tax savings | $10,201 |

Then, we compute the aggregate tax alpha:

| Tax alpha, year 1 | $5,745 |

| Tax alpha, year 2 | $5,420 |

| Tax alpha, year 3 | $5,113 |

| Total tax alpha | $16,277 |

Again, we can examine pre- and post-tax values:

| Stay in ETF | Transition to DI | |

| Statement value from initial investment | $179,085 | $144,832 |

| Embedded capital gains from initial investment | $149,085 | $86,494 |

| Statement value from reinvesting tax savings | $16,277 | |

| Embedded capital gains of reinvesting tax savings | $6,076 | |

| Pre-tax end value | $179,085 | $161,109 |

| Post-tax end value | $143,603 | $139,077 |

By moving to direct indexing, the investor forgoes $17,976 pre-tax and $4,526 post-tax. With higher embedded capital gains, the investor pays a higher cost (higher taxes due to transition, leading to higher opportunity costs of the portfolio) while getting a lower benefit (lower net capital losses to harvest). This investor is better off staying in his ETF position!

Results: Lower-Tax Investor with Low Embedded Gains

Now, consider the lower-tax investor, with a capital gains tax rate of 15.0% and a marginal income tax rate of 22.0%. As with our first exercise, let’s consider an embedded capital gain of 20%.

We run through the same calculations:

| Stay in ETF | Transition to DI | |

| Initial investment | $80,000 | |

| Embedded capital gains | $20,000 | x 15.0% = $3,000 in taxes |

| Today’s value | $100,000 | $97,000 after transition |

With low embedded capital gains and a relatively low tax rate, the investor can reinvest 97% of his ETF’s portfolio value into direct indexing.

| Stay in ETF | Transition to DI | |

| Value in 10 years | $179,085 | $168,571 |

| Total management fee | $4,006 | |

| Opportunity cost (forgone returns due to transition & fee cost) | $6,509 | |

| Total cost | $10,514 |

Compared to the higher-tax investor, the benefits of direct indexing are lower due to the lower marginal income tax.

| Initial direct indexing investment | $97,000 |

| Maximum net capital losses (30% of initial) | $29,100 |

| Marginal income tax rate (higher-tax assumption) | 22.0% |

| Tax savings | $6,402 |

The tax alpha is reduced as a result:

| Tax alpha, year 1 | $3,605 |

| Tax alpha, year 2 | $3,401 |

| Tax alpha, year 3 | $3,209 |

| Total tax alpha | $10,215 |

Now we arrive at pre- and post-tax values:

| Stay in ETF | Transition to DI | |

| Statement value from initial investment | $179,085 | $168,571 |

| Embedded capital gains from initial investment | $99,085 | $100,671 |

| Statement value from reinvesting tax savings | $10,215 | |

| Embedded capital gains of reinvesting tax savings | $3,813 | |

| Pre-tax end value | $179,085 | $178,786 |

| Post-tax end value | $164,222 | $163,113 |

The net pre-tax cost of moving to direct indexing is $299, and the net post-tax cost is $1,109. Even with low embedded capital gains and a low capital gains tax rate, the investor’s relatively low marginal income tax rates make transitioning to direct indexing disadvantageous. The results suggest that this lower-tax investor is best off staying in his pre-existing diversified ETFs.

Putting It All Together

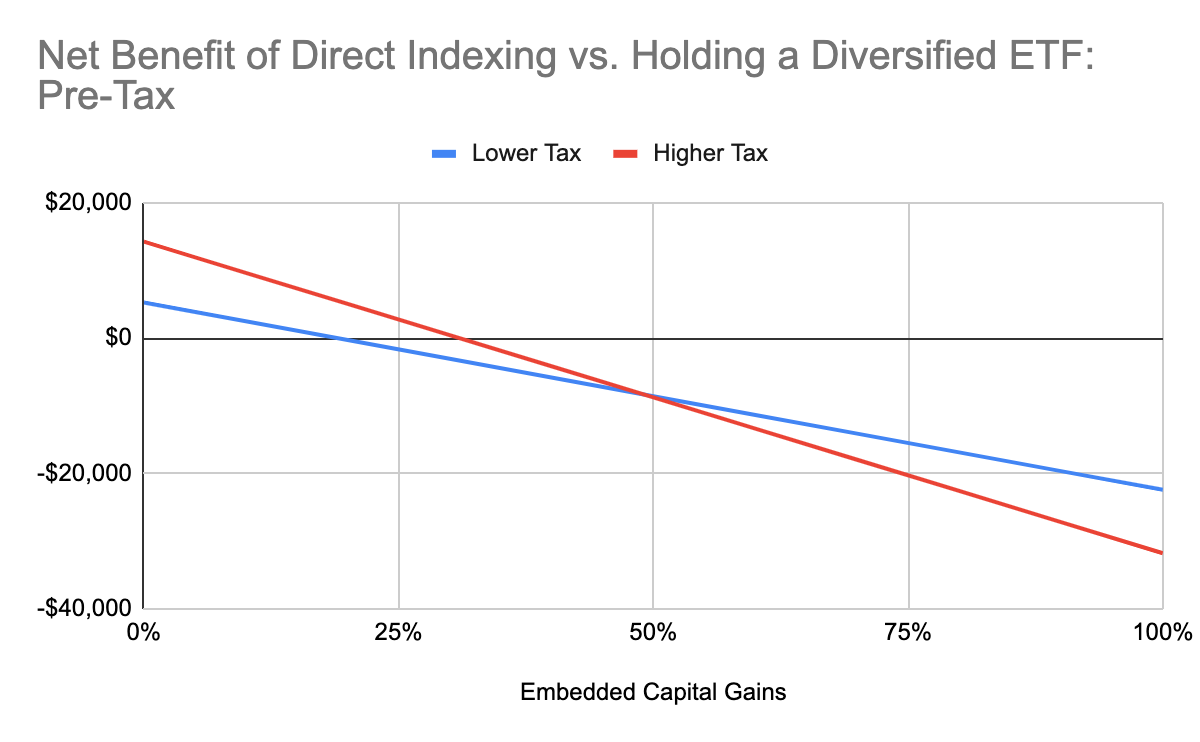

The figure below shows the net benefit of moving to direct indexing across different levels of embedded capital gains on a pre-tax basis.

The two tax profiles have different capital gains tax rates (15.0% and 23.8%, respectively), which drives the difference in the slopes of the trade-off. For the pre-tax (inheritance-focused) case:

- For investors starting from cash – that is, with 0% embedded capital gains – the benefit of direct indexing is material for both investors.

- Direct indexing becomes uneconomic over ~20% embedded capital gains for investors in the lower tax situation.

- Direct indexing becomes uneconomic over ~30% embedded capital gains for investors in the higher tax situation.

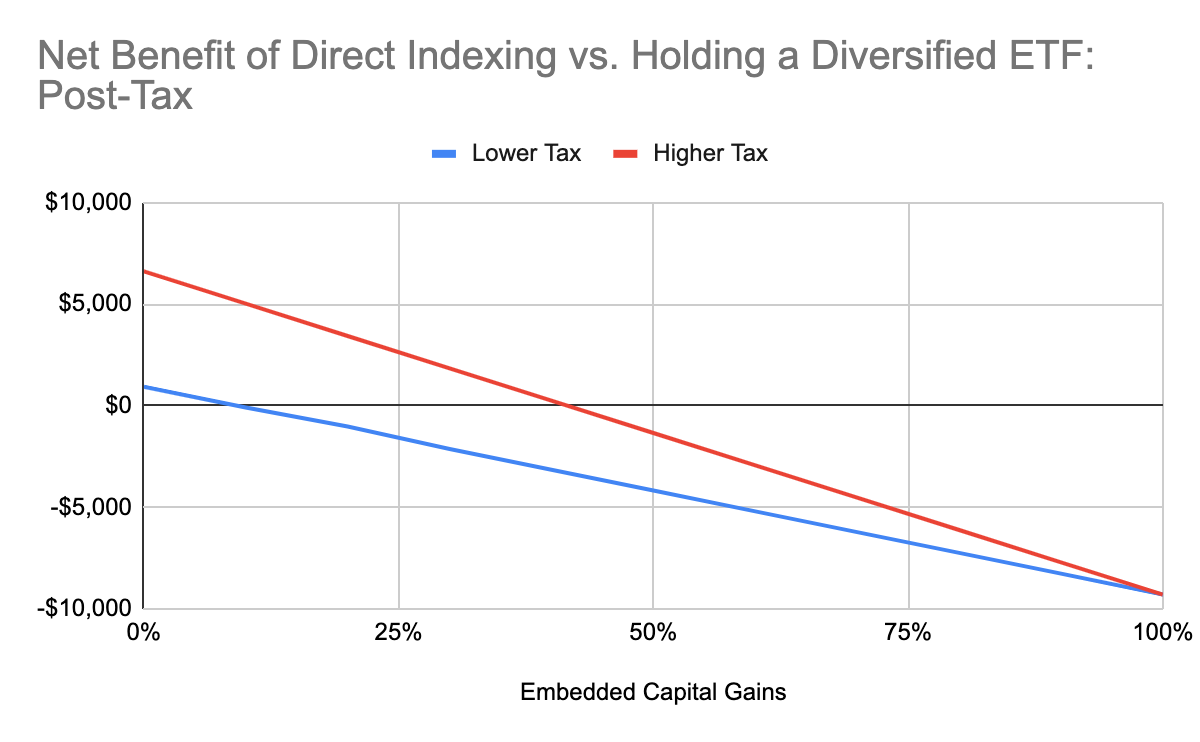

For those investors liquidating the portfolio and considering post-tax end values, the results look different:

- For a lower-tax investor, the benefits of direct indexing are fairly small throughout and become negative when embedded capital gains exceed about 10% of the initial investment.

- The higher tax investor may find it economical to transition to direct indexing when he has up to 40% of embedded capital gains. This is a higher threshold than the pre-tax case, as the assumption of liquidation taxes on the ETF means it remains less attractive at higher levels of embedded capital gains.

Given strong equity performance in recent years, these results indicate that investors who have held ETFs for longer than ~3 years should be especially cautious of transitioning to direct indexing. The results also suggest that it is hard to make a case for direct indexing for a lower-tax investor who plans to spend out of his portfolio. The potential net benefits are negligible even for low initial embedded capital gains. The investor may choose to avoid the known upfront tax costs of transition when there is uncertainty in future tax benefits, alongside hard-to-quantify costs like tracking error.

Of course, other variables matter. For instance, the case against direct indexing would worsen if the investor’s horizon is longer than the assumed ten years. The direct indexing management fees would presumably continue, while much of the literature shows that the opportunity to harvest losses tapers off. Similarly, the case against direct indexing would worsen if the management fee were higher or if the investor’s marginal income tax rate were lower.

Regardless of underlying assumptions, this post demonstrates that direct indexing’s benefits cannot be viewed in isolation. The costs of transitioning an existing portfolio are material and can easily exceed the quantifiable benefits of direct indexing.

Conclusion

In this piece, I have shown that investors holding ETFs should be wary about transitioning to direct indexing.

Of course, disclaimers abound: direct indexing has non-tax benefits (e.g., enabling conviction or exclusions); some investors have concentration risk rather than well-diversified ETFs; and all of this is dependent on tax and fee assumptions (and this shouldn’t rule out consideration of long-short tax-aware strategies).

But, at a high level, it is worth doing the math to ensure that direct indexing is sensible, even for those investors who purchased ETFs relatively recently and especially for investors in lower-tax circumstances. Direct indexing is not a one-size-fits-all solution and should be evaluated carefully based on existing positions, individual tax circumstances, investment horizons, and fee structures.

–

Citations:

Liberman, Joseph and Krasner, Stanley and Sosner, Nathan and Maia de Freitas, Pedro Paulo, Beyond Direct Indexing: Dynamic Direct Long-Short Investing (May 3, 2023). The Journal of Beta Investment Strategies, Direct Indexing Special Issue 2023, 14 (3): 10-41; DOI: 10.3905/jbis.2023.1.045, Available at SSRN: https://ssrn.com/abstract=4437402 or http://dx.doi.org/10.2139/ssrn.4437402

Israelov, Roni and Lu, Jason, Optimized Tax Loss Harvesting: A Simple Algorithm and Framework (July 11, 2022). Available at SSRN: https://ssrn.com/abstract=4152425 or http://dx.doi.org/10.2139/ssrn.4152425

Disclaimer: The content of this post is not investment or tax advice and does not constitute an offer or solicitation to offer or recommend any investment product. The views expressed are entirely the author’s own.

About the author: Stephanie Lo has worked in finance and consulting, with a recent focus on tax-aware, unified managed household applied research and related technology. Stephanie has a PhD in economics from Harvard, with 500+ academic citations of her research, including a piece in the Journal of Finance. She can be reached at [email protected].

References[+]

| ↑1 | See another cost/benefit analysis of TLH systems here. |

|---|

About the Author: Stephanie Lo

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.