This paper examines several key questions related to the integration of artificial intelligence (AI) and human expertise in stock analysis.

From Man vs. Machine to Man + Machine: The Art and AI of Stock Analyses

- Sean Cao, Wei Jiang, Junbo Wang, and Baozhong Yang

- Journal of Financial Economics, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The research questions are as follows:

- How does AI perform compared to human analysts in predicting stock returns?

- Under what circumstances do human analysts retain their advantage over AI?

- What is the impact of combining human analysts with AI (the “Man + Machine” approach) on stock prediction accuracy?

- What are the implications of these findings for the broader application of AI in skilled professions and decision-making processes?

What are the Academic Insights?

By studying firm-level, industry-level, and macroeconomic variables, as well as textual information from

firms’ disclosures, news, and social media (updated to right before the time of an analyst forecast), the authors find:

- AI outperforms human analysts in predicting stock returns, based on a model developed using machine learning techniques. In fact, the AI analyst model surpasses human analysts in 54.5% of stock return predictions during the sample period from 2001 to 2018.AI’s advantage is largely attributed to its ability to process vast amounts of information efficiently. Machine learning models excel in managing high-dimensional and unstructured data, which can be a significant advantage when dealing with large datasets. Moreover, when comparing AI predictions to “debiased” analyst forecasts (forecasts adjusted for known biases), the AI still outperforms in 54.5% of cases.

- Human analysts retain their advantage over AI in several specific circumstances, primarily where human expertise and institutional knowledge play a critical role. For example, human analysts perform better for smaller and less liquid firms. Also they perform better in the presence of intangibles and in industries or companies experiencing rapid changes or high competitive dynamics. Also in cases when firms are facing higher distress risk or undergoing significant financial stress.

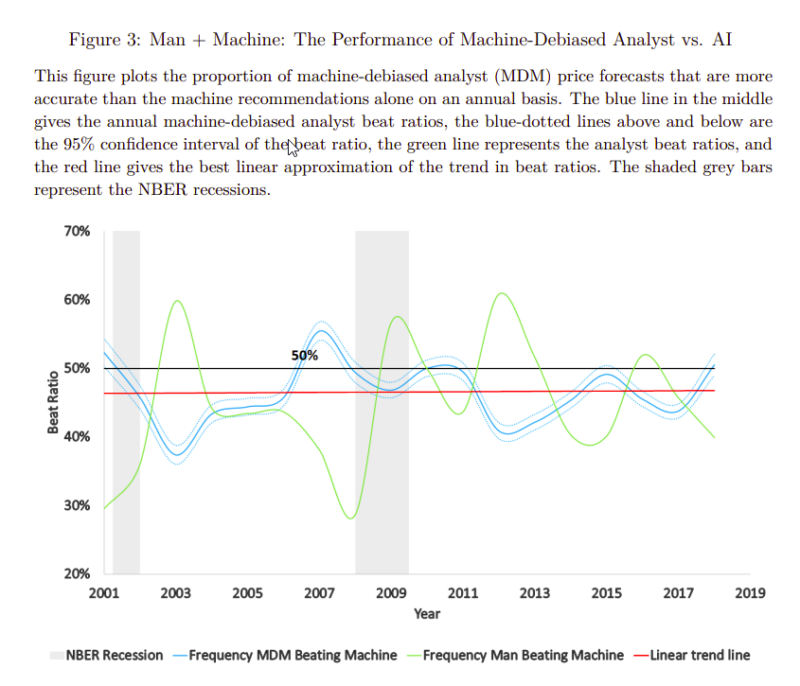

- The impact is significant and beneficial. The “Man + Machine” model outperforms 54.8% of the forecasts made by the AI-only model. One of the notable benefits of the “Man + Machine” approach is its ability to reduce extreme errors. The combined model avoids approximately 90% of the extreme errors made by human analysts and 40% of those made by AI alone. The “Man + Machine” model leverages the complementary strengths of both humans and AI. While AI excels in processing large volumes of data and identifying patterns, human analysts contribute nuanced understanding and contextual insights. This synergy creates a more robust and reliable forecasting tool.

- Combining AI with human expertise can significantly enhance decision-making processes, reduce errors, and offer operational and strategic benefits. The approach underscores the continued importance of human judgment and expertise while leveraging AI’s strengths, paving the way for more effective and robust applications of AI across various skilled professions.

Why does this study matter?

This study is important because it provides a model for enhancing decision-making in finance and potentially other fields. It highlights how integrating the strengths of both AI and human analysts can lead to better outcomes than relying on either alone.The study offers a detailed understanding of how AI and human analysts complement each other. AI excels in processing large volumes of data and identifying patterns, while humans provide contextual understanding, intuition, and nuanced insights. Recognizing these synergies helps in designing systems where both AI and human inputs are maximized.

The Most Important Chart from the Paper:

Abstract

An AI analyst trained to digest corporate disclosures, industry trends, and macroeconomic indicators surpasses most analysts in stock return predictions. Nevertheless, humans

win “Man vs. Machine” when institutional knowledge is crucial, e.g., involving intangible

assets and financial distress. AI wins when information is transparent but voluminous. Humans provide significant incremental value in “Man + Machine,” which also substantially

reduces extreme errors. Analysts catch up with machines after “alternative data” become

available if their employers build AI capabilities. Documented synergies between humans

and machines inform how humans can leverage their advantage for better adaptation to the

growing AI prowess.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.