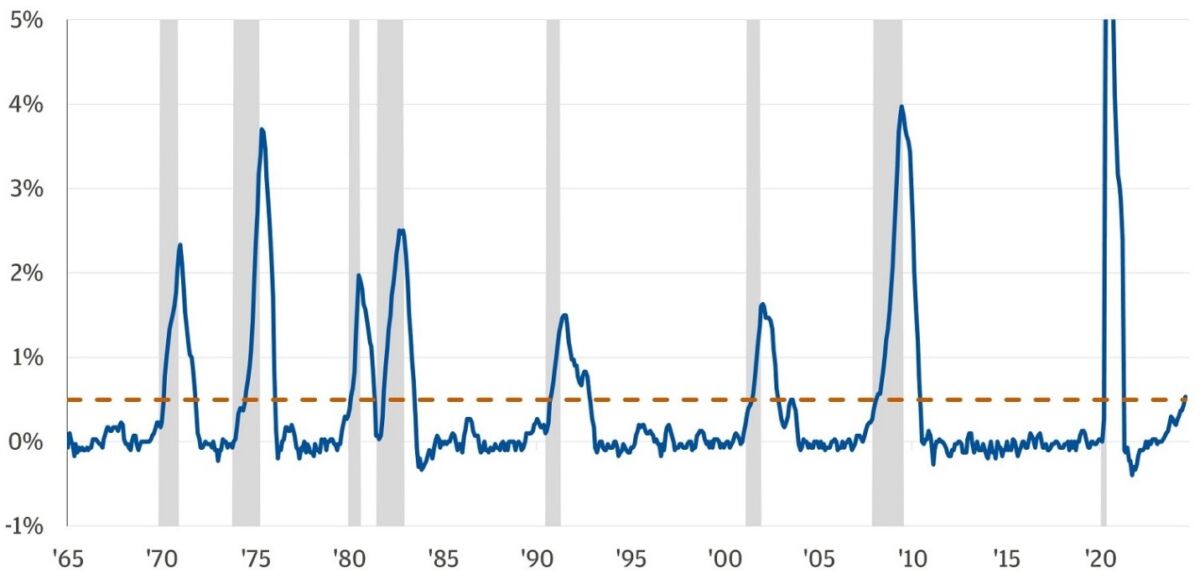

A weaker-than-expected July jobs report, with the unemployment rate increasing to 4.3%, officially triggered the Sahm Rule, causing investors to worry that the Federal Reserve may be behind the curve in cutting interest rates to prevent a recession. (The August report showed an increase in payroll employment of 142,000, with the unemployment rate at 4.2%). Named after Claudia Sahm, a macroeconomist who worked at the Federal Reserve and the White House Council of Economic Advisers, the Sahm rule states that the early stages of a recession are signaled when the three-month moving average of the U.S. unemployment rate is half a percentage point or more above the lowest three-month moving average unemployment rate over the previous 12 months. It is a frequently quoted indicator of an impending, or existing, recession as it has observed without fail that the initial phase of a recession has started when the three-month moving average of the U.S. unemployment rate is at least half a percentage point higher than the 12-month low.

With the exception of the COVID-19 induced recession, during U.S. recessions from 1947 to 2008, the unemployment rate increased gradually before picking up substantially. Thus, the purpose of the Sahm Rule is to establish a threshold at which policymakers should start to respond to a downturn.

Percent Difference to 12-month Low in Unemployment Rate, 3-month Moving Average

Why This Time Might Be Different

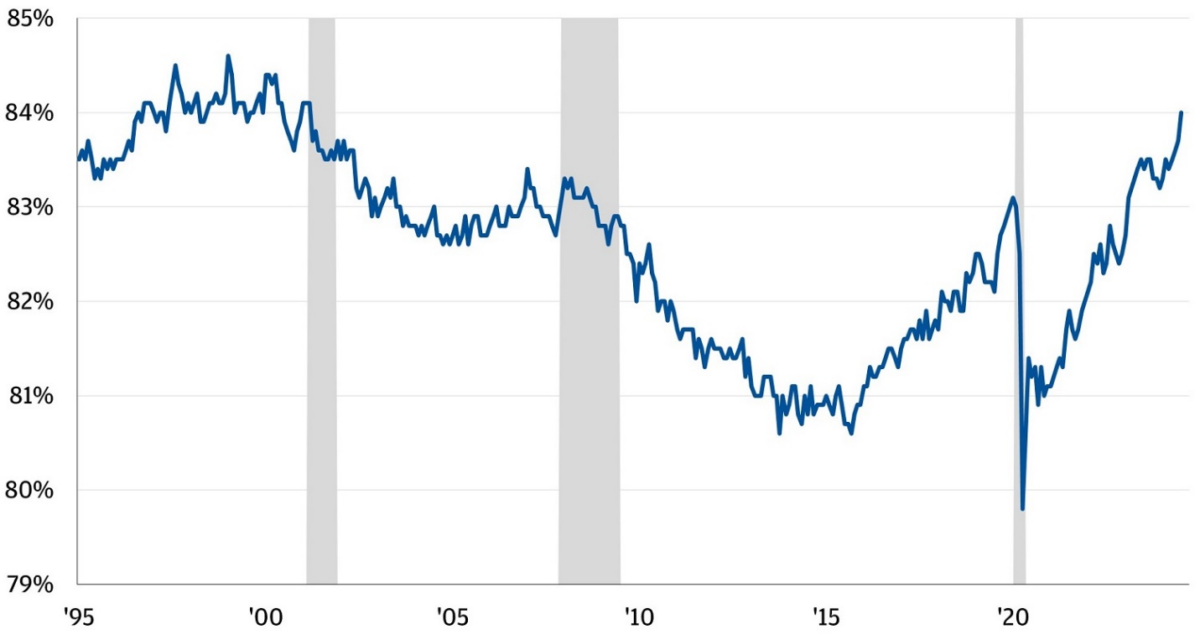

The Sahm Rule is meant to signal a weakening of the labor market. However, while the July jobs report did show a slowdown in the growth of the labor market, it was the slowing in the growth of the labor force, not layoffs, that drove the rate higher.

The civilian population used to calculate the unemployment rate increased by 206,000. With a labor force participation rate of 62.7%, 129,000 jobs were needed to keep the unemployment rate unchanged. In July, the economy added 114,000 jobs, but the labor force increased by 420,000. Thus, the unemployment rate rose due to the increase in workers who haven’t found jobs—not because of increased layoffs.

Prime Age Labor Force Participation Rate (%)

While the slowdown in job growth indicates a slowing economy, the Sahm Rule may be overstating recent economic weakness in the labor market. That is a stark difference from past recessions.

Empirical Evidence

Thanks to Thomas Ash and Jerry Nickelsburg, authors of the study “Works like a Sahm: Recession Indicators and the Sahm Rule,” published in the September 2024 issue of Economic Letters, we can examine the empirical evidence on the Sahm Rule’s ability to predict recessions. They conducted three tests to evaluate the Sahm Rule using the 10 historical U.S. recessions since 1950, “covering its use as a predictor, indicator, or extrapolative tool.” They found that the Sahm rule does not predict recessions nor does it indicate if a recession has occurred in the previous three months with much confidence (especially relative to other more specialized measures, such as financial stability indicators or approaches using composite indices). They added:

“The Sahm rule becomes indicative of a recession around month 4, after the recession has been underway for some time. We note that this would be earlier than the typical NBER designation, however far later than some other leading indicators.”

Bottom line: “The Sahm Rule is no substitute for a more detailed analysis using a range of economic indicators.”

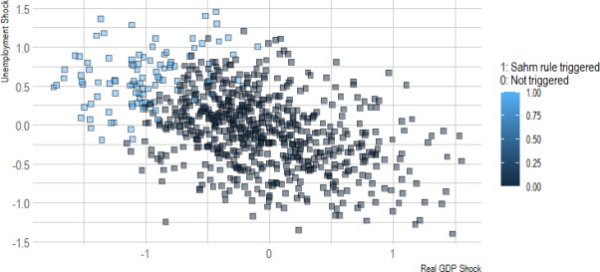

Because a drawback of the simple empirical approach is that it is based on just 10 observations, they complemented this with an analysis using vector autoregressive (VAR) models which are used for multivariate time series the structure of which is that each variable is a linear function of past lags of itself and past lags of the other variables. The VAR analysis allowed them to test the Sahm rule with a much larger (1000 simulations), though artificial, dataset. “Such an approach calibrates a VAR model to the US economy of the past 40 years and offers a laboratory to understand the performance of the Sahm rule.”

Using Monte-Carlo simulations they found that in the majority of cases that featured an “NBER recession”, the Sahm rule was not satisfied.

“Out of the 1000 simulations, 754 result in NBER recessions (note that there is a slight tendency towards recession in the simulations as we retain the financial crisis; removing the financial crisis in estimation does not affect conclusions). The chart then plots, of these 754 recession simulations, which satisfy the Sahm rule (blue squares), and which do not (grey squares).”

The chart shows that most simulations do not satisfy the Sahm rule—out of 754 recessions only 104 triggered the Sahm rule. This conclusion is robust to a range of assumption changes. In addition, due to the extra recession data provided by the simulations, they observed “that this is more likely to occur where the shock that generates the recession does not feature a strong unemployment component initially.”

They added:

“Since the Sahm rule focuses on unemployment, it is most successful at indicating a recession when the source of the shock is more unemployment focused (upper-left quadrant of the chart).” Their findings led them to conclude: “Overall, our simulations demonstrate that caution should be used when interpreting an unsatisfied Sahm rule as indicating no recession, and provides an explanation of economic conditions where this may be especially perilous.”

Investor Takeaway

Keeping in mind that the July increase in the unemployment rate which triggered the Sahm rule was not caused by a rise in the number of unemployed, but by an increase in the size of the labor force. The bottom line is that the because the Sahm rule focuses solely on the unemployment rate, caution is warranted before assuming it is signaling a recession.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest Enrich Your Future.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.