Among the earliest challenges to the efficient markets hypothesis was the observation that stock prices react to investor demand unrelated to fundamentals. One example is the abnormal returns to additions and deletions to the S&P 500 Index. Robin Greenwood and Marco Sammon, authors of the September 2024 study “The Disappearing Index Effect,” examined the price impact of changes to the S&P 500 Index over the period 1980-2020. The following is a summary of their key findings:

- For additions, the average period between the announcement and the effective date was 4.8 days; for deletions it was 5.8 days.

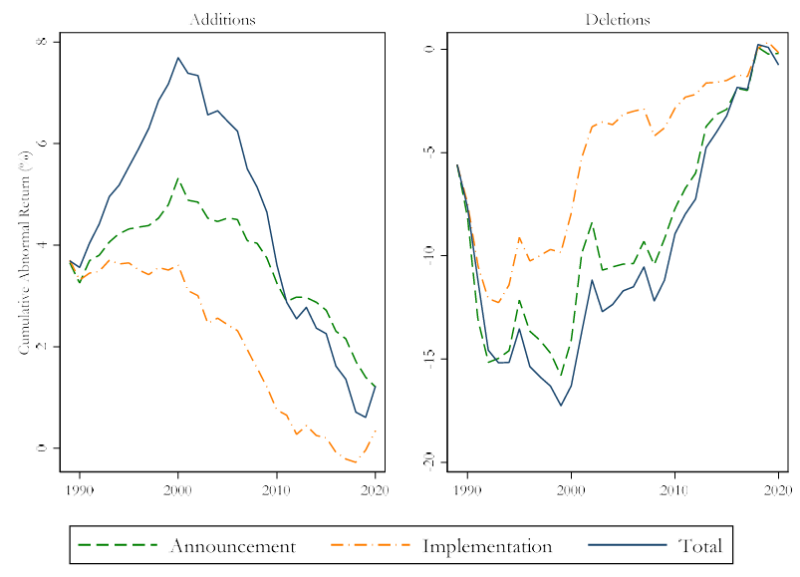

- The impact from additions grew from an average total return of 3.4% in the 1980s to 7.4% in the 1990s. The increase was consistent with an increase in the amount of funds dedicated to replicating index funds.

- Despite the increase in indexing assets, the average price impact decreased in the 2000s to 5.2%, and then fell further to below 1.0% in the most recent decade—statistically indistinguishable from zero. One explanation is that changes are now more predictable.

- A similar pattern has occurred with index deletions. The average effect of being removed from the S&P 500 was -4.6% in the 1980s, -16.1% in the 1990s, -12.4% from 2000-2009, and a statistically indistinguishable from zero -0.6% from 2010-2020.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

- Similar results were found for the Russell 1000 and 2000, as well as the Nasdaq 100 and other S&P mid- and small-cap indices—addition and deletion returns have declined over the past decade.

Why has the index effect seemingly disappeared? Greenwood and Sammon considered several explanations and found three that contributed to the disappearing effect:

- An increasing percentage of index additions and deletions were migrations from the S&P MidCap index. When these stocks are added to the S&P 500 index, they simultaneously leave the S&P MidCap—forced buying by S&P 500 tracking funds was simultaneously matched with forced selling from S&P MidCap-tracking funds, leading to a smaller net demand shock. From the 1990s to the present day, migrations went from about 50% of additions to over 70%. The trend toward more migrations was even stronger among S&P 500 index deletions. The differences in returns for migrations reflects the increasing importance of the S&P MidCap index over time. In the mid-1990s, migration and non-migration additions had average returns of 10.2% and 6.7%, respectively. By the 2010s, however, direct additions had returns of 5.4%, while migrations had returns of 1.8%. This divergence coincided with the rise of MidCap-focused funds.

- Front running—in the three months leading up to the announcement have become somewhat stronger.

- An increase in liquidity provisions. “Over the past 15 years, Wall Street trading desks have increased personnel and computing resources devoted to index trading….Large passive investors also employ large teams to study and improve liquidity around rebalancing.” In addition, “the distribution of trading volume has become more concentrated around index change events, facilitating liquidity provision.” And, despite the large size of the demand shock experienced by additions and deletions, much of it appears to be accommodated by other institutions.

Their findings led Greenwood and Sammon to conclude:

“In the 1980s, index changes were unanticipated, index funds were small, and there was mispricing in the market. As index funds grew larger, the mispricing deepened and turned into an opportunity. As a result, the market adjusted to take advantage of this opportunity, in part by better anticipating inclusions, but mostly by creating arrangements where other institutions stood ready to sell to indexers upon inclusions. This worked to eliminate the anomaly on average, despite demand shocks that continued to grow in magnitude over the 2000s and 2010s.”

The only question is why it took so long for the disappearance to occur.

Investor Takeaway

Greenwood and Sammon’s findings of a disappearing index effect provides further support for the findings of McLean and Pontiff, Does Academic Research Destroy Stock Return Predictability? 2016. Once anomalies are well recognized by the market they decline and may even disappear, though limits to arbitrage can allow them to persist. Their findings also provide support for Andrew Lo’s The Adaptive Markets Hypothesis (2004). The bottom line is that markets are becoming more efficient, raising the hurdles for active managers to generate alpha.

Larry Swedroe is the author of 18 books on investing. His latest is Enrich Your Future.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.