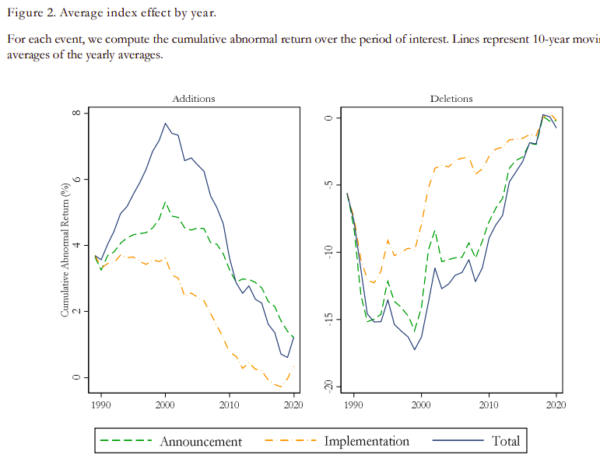

This paper investigates the puzzling decline in the price impact of S&P 500 index additions and deletions over the past four decades, despite the rapid growth of passive investing. It explores potential explanations, including changes in market liquidity and efficiency, shifts in the composition of index changes, the role of migrations from related indices, and the predictability of index changes. The study further extends its analysis to other major indices, providing a broader understanding of how markets adapt to index-driven demand shocks.

The Disappearing Index Effect

- Greenwood and Sammon

- Journal of Finance, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The efficient markets hypothesis has long been challenged by evidence that stock prices respond to investor demand unrelated to fundamentals, particularly around events like index changes. Early studies documented significant price impacts when stocks were added to or removed from the S&P 500, with returns driven by demand shocks from index-tracking funds. However, despite the dramatic growth of passive investing and indexation over the past few decades, the price impact of such changes has declined, raising important questions about market dynamics. This paper explores four key questions::

- Why has the price impact of S&P 500 index changes declined over time despite the growth in passive investing?

- To what extent has increased market liquidity and efficiency contributed to the disappearance of the index effect? How have migrations from related indices, like the S&P MidCap, influenced the net demand shocks associated with index changes?

- How have migrations from related indices, like the S&P MidCap, influenced the net demand shocks associated with index changes?

- Is the decline in the index effect observed for the S&P 500 also present in other major indices, and what explains any differences?

What are the Academic Insights?

By running a horse race of the various frameworks and proxies used to generate long-term E(R) forecasts, the authors find:

- The decline reflects increased market efficiency and liquidity, as well as structural changes that allow professional investors to better absorb demand shocks, even as passive investing has grown. The structural changes include: 1) Increased personnel and computing resources at Wall Street trading desks and large passive investors focused on index trading; 2) Higher concentration of trading volume during index rebalancing events, which facilitates liquidity provision; 3) Active institutional investors now play a larger role in absorbing demand shocks, minimizing price impacts despite significant buying or selling by index trackers.

- Market liquidity and efficiency have significantly increased due to lower trading costs, enhanced institutional capacity for liquidity provision, and concentrated trading volumes around index events.

- Migrations now represent over 70% of additions, with simultaneous buying and selling by index trackers reducing net demand shocks and contributing to smaller price impacts.

- Similar declines are observed in other indices, such as the Russell and Nasdaq 100, though the magnitude and significance vary, likely due to differences in index composition and liquidity conditions.

Why does this study matter?

This study matters because it provides insights into how financial markets adapt to growing passive investment trends, influencing our understanding of market efficiency and price dynamics. By explaining the disappearance of the index effect, it highlights the evolving role of institutional liquidity provision and market infrastructure in stabilizing price pressures. Additionally, the findings have implications for investment strategies, the design of indices, and policy discussions about the impact of passive investing on market behavior.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

The abnormal return associated with a stock being added to the S&P 500 has fallen from an average of 7.4% in the 1990s to 0.3% over the past decade. This has occurred despite a significant increase in the share of stock market assets linked to the index. A similar pattern has occurred for index deletions, with large negative abnormal returns during the 1990s, but only 0.1% between 2010 and 2020. We investigate the drivers of this surprising phenomenon and discuss implications for market efficiency. Finally, we document a similar decline in the index effect among other families of indices.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.