Highly illiquid assets trade infrequently making it difficult to know their true market value. To address this issue, funds that invest in illiquid assets create fair valuation estimates at periodic intervals. These valuation estimates determine the share values at which interval and tender offer funds issue and redeem their shares. Because the true value is uncertain, wealth transfers can be created between buy-and-hold investors and those entering and leaving the fund to the extent that the fair valuation estimate is different from the true value. While any wealth transfers are likely to wash out over time for buy-and-hold investors, if these differences are minimal and occur randomly, to the extent there are systematic differences between the fair valuation estimates and their true value, NAV timing investors could potentially create trading strategies which would systematically transfer wealth from buy-and-hold investors to themselves.

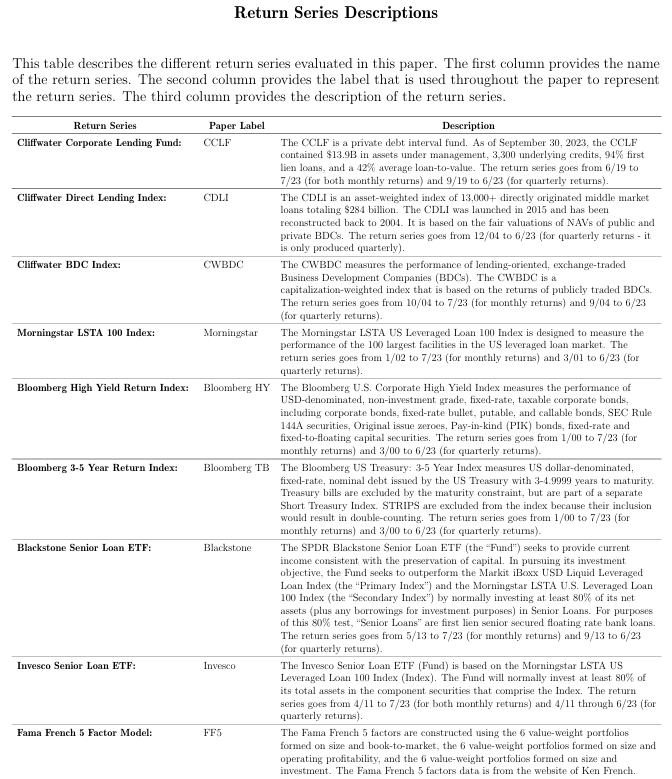

Spencer Couts (Assistant Professor of Real Estate Development at USC) and Andrei Goncalves (Associate Professor of Finance at the Fisher College of Business of The Ohio State University), have done a series of papers (on liquidity transformation risk and illiquid fund returns) addressing two issues: the liquidity transformation service provided by funds that issue and redeem shares that are more liquid than their assets and the serial correlation (and thus predictability) of their returns. In their December 2023 study “Cliffwater Corporate Lending Fund (CCLFX) NAV-timing Analysis,” they evaluated the NAV-timing risk exposure of the fund that derives from “stale pricing”—old pricing that does not reflect all available information. Due to the newness of the fund, their data sample was limited to the roughly four-year period June 2019 through July 2023, a short period that did not include a significant market decline. The table below lists the benchmarks indices and funds that invest in similar assets that they used for their analysis.

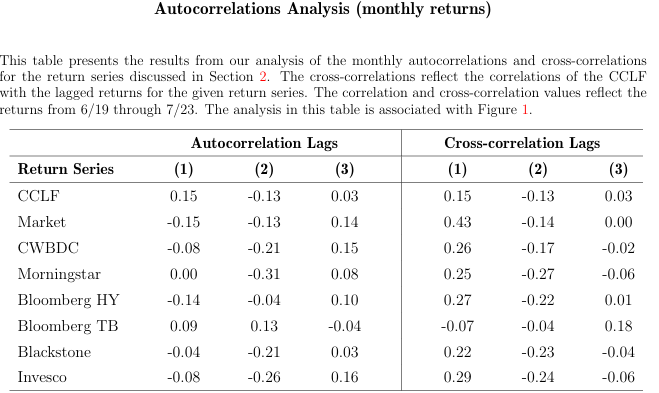

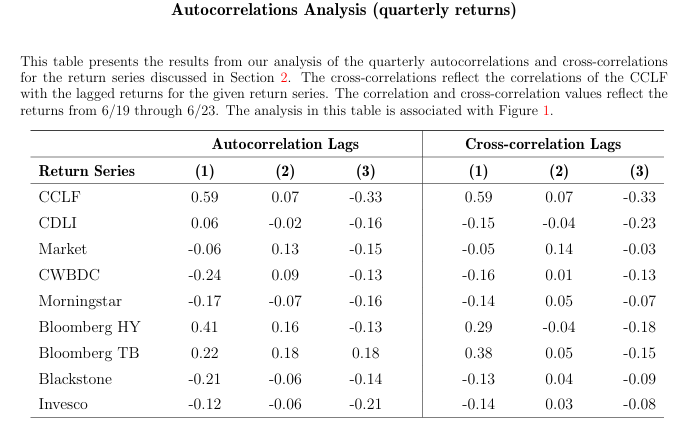

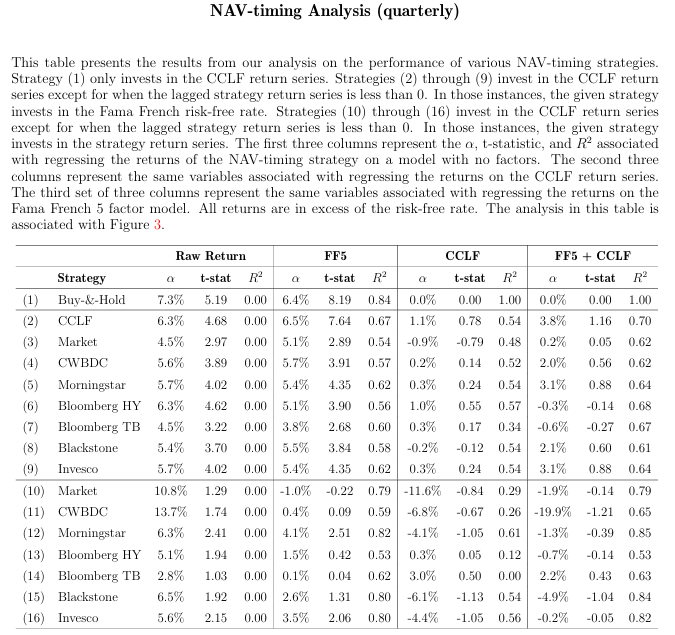

Coots and Goncalves evaluated two metrics—the autocorrelations of the CCLFX returns and the cross-correlations of the CCLF returns with the lagged returns of seven other return series. They also evaluated 15 NAV timing strategies including switching between CCLFX and one-month Treasury bills and switching between other alternate return series.

Before reviewing their findings, it is important to note that while CCLFX is not a mutual fund, it is a non-diversified, closed-end management investment company, registered under the Investment Company Act of 1940, that is structured as an interval fund and regulated by the SEC. As such it has a separate board, compliance officer, auditor, custodian, and independent fund administration. The fund is priced (and available for purchase) daily while redemptions are available on a quarterly basis (with a minimum of 5% per quarter). The daily NAV is determined by the fund using a board approved valuation policy consistent with “fair value” asset pricing (FASB ASC 820 Fair Value Measurement) and approved by the SEC, the fund’s auditor (Cohen & Co, the 4th largest auditor of registered funds and the 13th largest auditor of hedge funds in the U.S.). For non-traded illiquid (Level 3) assets, pricing is determined based upon inputs from the fund’s subadvisors (subadvisors have 3rd party valuation agents who assist them in determining loan prices on a quarterly basis, Cliffwater itself, a leading independent valuation firm (Houlihan Lokey), and S&P Global (IHS Markit).

The following is a summary of the findings of Couts and Goncalves.

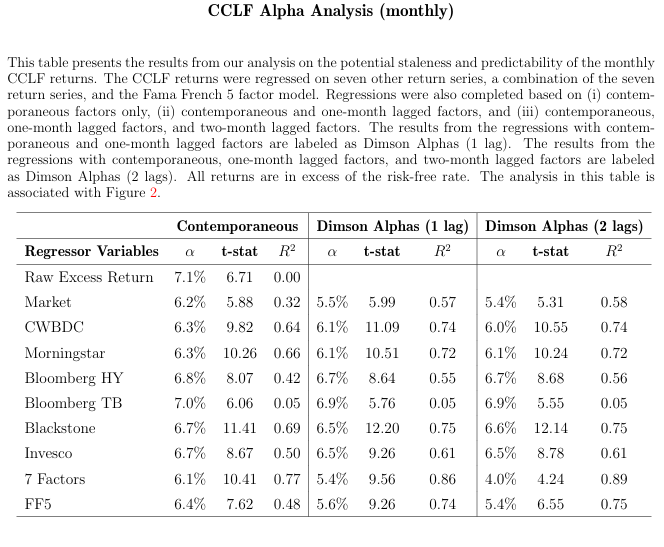

- CCLFX returns are positively correlated with its own lagged returns as well as the lagged returns of other debt-based and market-based return series, leading to a degree of predictability in the CCLFX returns based on lagged CCLFX returns and lagged returns of other factors.

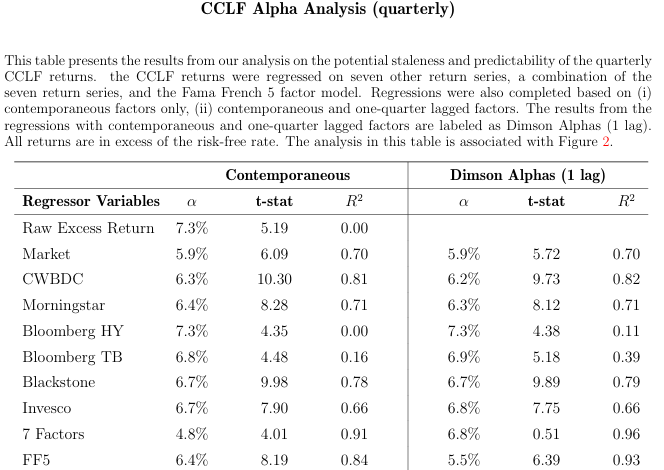

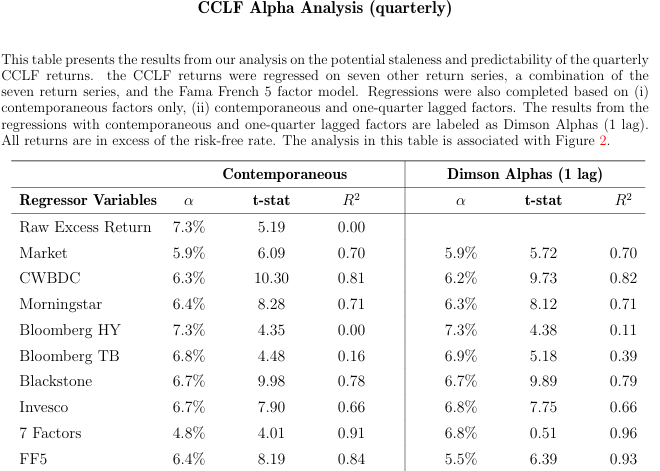

- The cross-correlations became insignificant (or even turned negative) beyond one month and was non-existent in quarterly returns (when redemptions can occur).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

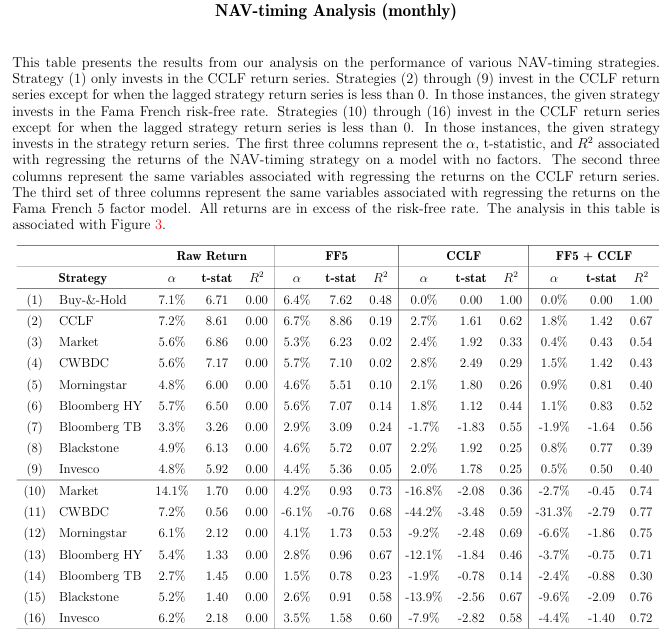

Even without the quarterly redemption restrictions, the cost of not being invested in the CCLFX was greater than any potential wealth transfer benefit associated with trying to implement a NAV-timing strategy—while the timing (switching) strategies generated alphas in the regressions, the returns were less than those of a buy-and-hold CCLFX investor.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

- The quarterly redemption restrictions effectively mitigated the NAV-timing risks created from the stale pricing found in the CCLFX returns. However, even without the quarterly redemption restrictions, the performance of the NAV-timing strategies over the sample period would have been marginal, at best.

- While CCLFX’s monthly and quarterly alphas decreased slightly when one-month lagged and two-month lagged variables were added, the alpha values were still economically and statistically significant—CCLFX returns provided a significant risk-adjusted return suggesting that investing in it would have added value to a typical investor’s portfolio.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Regressions against the Fama-French 5-factor model (beta, size, value, investment, and profitability), showed that CCLFX’s produced economically and statistically significant alphas (with one exception: regressing on the seven returns series with one-month lagged returns).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Their findings led Couts and Goncalves to conclude that while CCLFX’s returns did exhibit a degree of staleness in their monthly returns, the finding that the alpha values did not decrease when lagged factors were added at the quarterly level suggests that the quarterly returns fully incorporate market pricing information without a significant delay. They added that their finding that each of the CCLFX alphas was both economically and statistically significant suggests the CCLF has a positive risk-adjusted return after adjusting for the risk in the public market factors they considered.

Couts and Goncalves cautioned that the sample period was relatively short, and the results did not reflect a significant market decline which could enhance any NAV-timing or stale pricing wealth transfer risks to CCLFX. “Nonetheless, our findings suggest that even after a significant market decline the market pricing information would likely be incorporated at the quarterly level and that the quarterly redemption restrictions would significantly mitigate any NAV-timing or stale pricing wealth transfer risks.” The findings of a lack of any significant autocorrelation beyond one month should not be surprising because Cliffwater does provide daily pricing (to allow for daily purchases), there is virtually no duration risk since all loans are floating rates with either 30- or 90-day resets, and the loan quality is higher (the higher the loan quality, and the lower the duration risk, the lower will be the fund’s volatility, reducing the risk of autocorrelation in returns due to stale pricing).

Investor Takeaways

The empirical research findings demonstrate that stale pricing exists with funds that provide more liquidity than exists for their underlying assets. That creates the risk of wealth transference through NAV timing. This is especially true for private equity and private real estate funds. However, at least in the case of CCLFX, which restricts investments to private credit that is senior, secured, and backed by private equity, the risk of stale pricing is minimal, and doesn’t even exist beyond a month from an economic and statistical significance viewpoint. The takeaway is that the volatility of CCLFX is somewhat understated somewhat when looking at one-month returns. However, when looking at volatility on a quarterly, or longer, basis that is not the case. The bottom line is that CCLFX provides investors with access to the credit premium and the illiquidity premium of private credit without being concerned about the risk of stale pricing. And for investors who don’t need liquidity for at least some portion of their portfolio the illiquidity premium is as close to a free lunch as one can find. Thus, one should eat as much of it as possible!

Full Disclosure: I own shares of CCLFX.

Larry Swedroe is the author or co-author of 18 books on investing. His latest is Enrich Your Future

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.