Because of the strong evidence, momentum continues to receive much attention from researchers. Out of the hundreds of exhibits in the factor zoo, one of just five equity factors that met all the criteria (persistent, pervasive, robust, implementable, and intuitive) Andrew Berkin and I established in our book “Your Complete Guide to Factor-Based Investing” was momentum (both cross-sectional [long-short] and absolute [trend]).

While the original 1993 research on momentum by Narasimhan Jegadeesh and Sheridan Titman focused solely on U.S. common stock returns, momentum (both cross-sectional and trend) has been found pretty much everywhere: in global stocks, government and corporate bonds, commodities, currencies, and stock portfolios, industries, and countries.

Momentum in Options

Steven Heston, Christopher Jones, Mehdi Khorram, Shuaiqi Li, and Haitao Mo contribute to the momentum literature with their study “Option Momentum,“ published in the December 2023 issue of The Journal of Finance. They investigated the performance of option investments across different stocks by computing monthly returns on at-the-money straddles (which combine approximately equal positions in a put and a call with the same maturity and strike price) on individual equities. Their data sample covered options on U.S. stocks over the period January 1996 to June 2019 and contained about 385,000 observations of straddle returns with positive open interest.

On each expiration day, they selected two matching call/put pairs for each stock, where all calls and puts expired in the following month. One was the pair whose call delta was closest to 0.5 (a delta of 0.5 means that the option’s price is expected to change by $0.50 for every $1 change in the underlying asset’s price). The other pair used the same criteria but required that both the put and the call had positive open interest on the day they were selected. In either case, if the call delta was less than 0.25 or greater than 0.75, they discarded the observation. Thus, the sample targeted options were at-the-money and did not include contracts that were deep in-the-money or out-of-the-money. They also computed the VIX (a measure of the stock market’s expectation of volatility based on S&P 500 Index options) return.

Following is a summary of their key findings:

- Straddle returns had negative means (5.3% monthly), large standard deviations (81% monthly), and substantial positive skewness, as indicated by the low median. VIX returns were more negative, with a higher standard deviation and a longer right tail.

- For both straddle and VIX returns, dynamic hedging had relatively modest effects on average returns and resulted in larger reductions in standard deviations.

- Momentum was far stronger in options than in other asset classes.

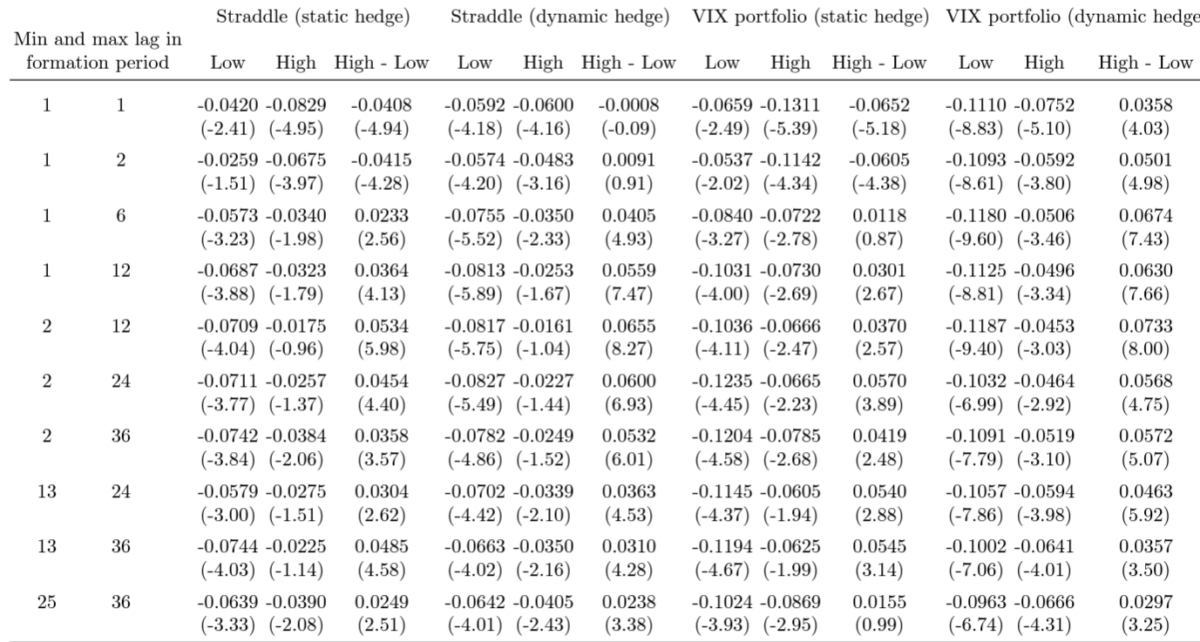

- Options with high historical returns continued to significantly outperform options with low historical returns over horizons ranging from six to 36 months. For example, the 1‑12-month static straddle quintile spread earned 3.64% per month.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

- The momentum strategy based on the past year of returns, with an annualized Sharpe ratio of 1.53, provided strong risk-adjusted returns.

- Momentum returns were positively skewed, with a relatively modest maximum drawdown relative to their mean returns or relative to the drawdowns of alternative option strategies.

- The large average returns documented did not show the type of crash risk that occurs with stock momentum portfolios.

- Momentum was stable over the sample, significant in every five-year subsample and almost all subgroups formed based on firm size, stock or option liquidity, analyst coverage, and credit rating.

- The findings were robust to including out-of-the-money options or delta hedging the returns.

- Option momentum, like stock momentum, exhibited one-month reversals, but unlike stock momentum, option return continuation was not followed by long-run reversal (there was no evidence of overreaction)—likely related to the fact that options, as short-lived assets, cannot accumulate mispricing over time in the same way that stocks can.

- Significant returns remained after factor risk adjustment and after controlling for implied volatility and other characteristics.

- Transaction costs lowered the performance of the momentum and reversal strategies, but both remained profitable under reasonable assumptions if strategies were modified to reduce the effects of those costs.

- Across stocks, trading costs were unrelated to the magnitude of momentum profits.

- The findings for time-series (trend) momentum were similar to those of cross-sectional (long-short) momentum.

- Options also displayed momentum at the industry level.

- Stock and option momentum were distinct findings—their return correlation was slightly negative.

Their findings led Heston, Jones, Khorram, Li, and Mo to conclude that the continuation and reversal patterns they documented were “highly significant, robust and pervasive. Most significantly, option returns display momentum, meaning that firms whose options performed well in the previous 6 to 36 months are likely to see high option returns in the next month as well. Momentum is present whether we measure past performance on a relative basis (‘cross-sectional momentum’) or an absolute basis (‘time-series momentum’). It is profitable in every five-year sub-sample and is far less risky than short straddle positions on the S&P 500 Index or individual stocks. Further, returns to these strategies show no evidence of the momentum crashes that periodically affect stocks, though it is possible that our sample is too short to detect such phenomena.”

Investor Takeaways

There is strong empirical evidence demonstrating that momentum (both cross-sectional and time-series) provides information on the cross-section of returns of many risk assets and has generated alpha relative to existing asset pricing models. Heston, Jones, Khorram, Li, and Mo’s study adds to that body of research by providing another test of pervasiveness, increasing our confidence that the findings of momentum in asset prices are not a result of data mining.

The strong empirical evidence is why firms like Alpha Architect, AQR, Avantis, Bridgeway, and Dimensional, leaders in factor-investing strategies, incorporate momentum into their strategies. For example, based on research demonstrating the persistence of factor momentum, AQR recently added cross-sectional stock market factor momentum to their general managed futures strategy. Individual investors can utilize momentum strategies without incurring additional costs by incorporating momentum into trading decisions. For example, when rebalancing, they can delay purchases of assets with negative momentum and delay sales of assets with positive momentum.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest Enrich Your Future.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third party data and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-23-590

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.