The financial research literature has found that the performance of assets (and factors) can vary substantially across regimes (for example, see here and here)—factor premiums can be regime dependent. Unfortunately, the real-time identification of the current economic regime is one of the biggest challenges in finance. Amara Mulliner, Campbell Harvey, Chao Xia, and Ed Fang, authors of the March 2025 study “Regimes,” offered a new perspective on identifying economic regimes and leveraging that information for potentially improved investment outcomes. This approach resonates with a growing interest in finding “analogous market moments” – periods in history that echo current conditions. Let’s dive into the key takeaways and explore this connection.

What the Researchers Explored

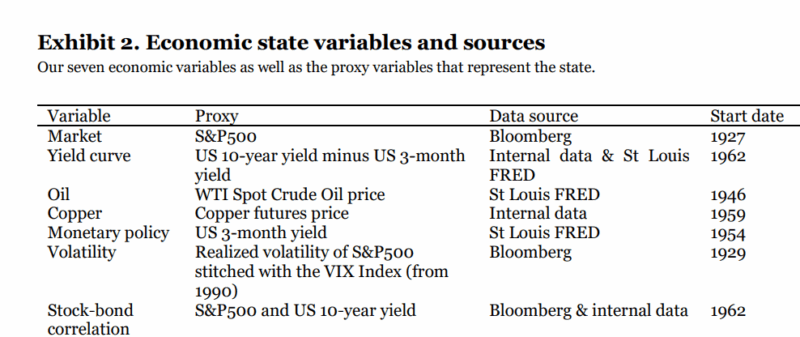

Mulliner, Harvey, Xia, and Fang introduced a novel, systematic method for identifying the prevailing economic regime. Unlike conventional approaches that predefine a set of possible regimes, they used seven well-known economic state variables (equally weighted) to objectively determine periods in history that closely mirror current conditions. They noted that the correlations were generally low (the highest was between copper and oil at just 0.33) indicating that the seven economic variables chosen contained independent information, providing diversification.

Their key concept was to identify “regimes” based on the similarity of economic indicators. Of interest is that they also explored the concept of “anti-regimes,” periods that were the most dissimilar to the present day, to determine if they contained predictive signals.

Key Findings: Outperformance Through Regime Awareness

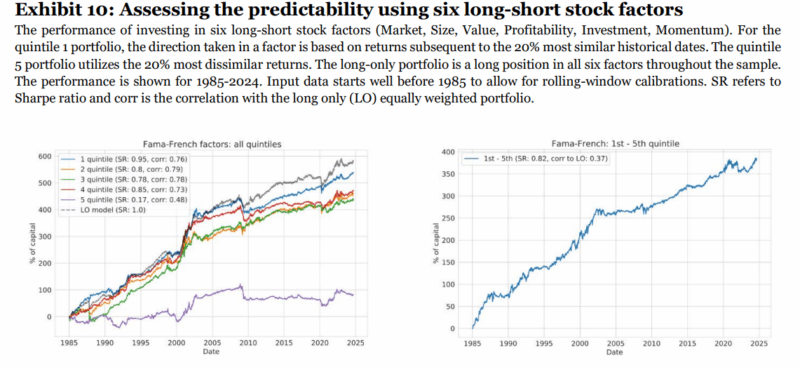

The researchers tested their methodology on six common long-short equity factors (market, size, value, profitability, investment, and momentum) over the period of 1985-2024. By identifying periods with similar economic conditions, the model assessed the subsequent performance of an asset. If the historical performance was positive, a long position was initiated. If the historical performance was negative, a short position was initiated.

Following is a summary of their key findings:

- There was a positive relation between the returns on their strategy and similarity.

- The least similar historical dates did the worst in terms of performance.

- The alpha generated by the strategy that goes long the most similar and short the least similar was statistically significant, at three standard deviations from zero.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

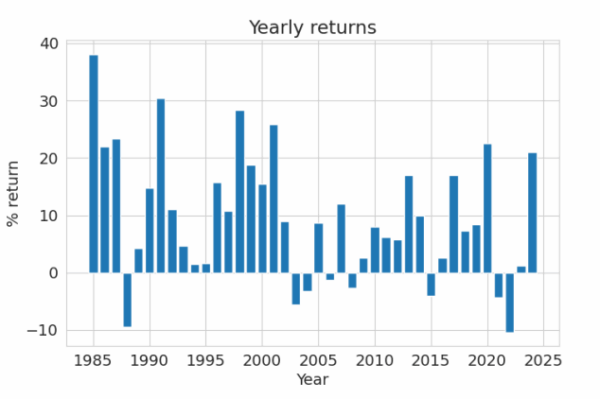

- The strategy was also a consistent performer and exhibited positive skewness. Excess returns were positive in 80% of the years. Furthermore, conditional on outperformance the average return is 13.3%. Conditional on underperformance, the average return was only -5.1%.

Long similarity and short dissimilarity: Yearly returns from regime model implementation at targeting 15% volatility.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Interestingly, the study also uncovered valuable insights from “anti-regimes,” suggesting that periods most unlike the present also had predictive power.

Connecting to “Analogous Market Moments”

This pursuit of economic “regimes” aligns with the concept of “analogous market moments,” as researched by Verdad Capital. Verdad’s approach also leveraged historical economic data to find periods that were like the present day. They created a measure of macroeconomic similarity by incorporating a range of predictive economic signals such as high-yield spreads, inflation, stock-bond correlation, and the yield curve. They then converted this data into a vector and used Euclidean distance to measure how extreme each observation was.

Both approaches operate on the fundamental assumption that we can learn from history and that studying historical market data can provide valuable insights into the future. The key difference lies in the specific methodologies used to define and identify these analogous moments.

Key Takeaways

So, what does this mean for financial advisors and investors? Here are the takeaways:

- Enhanced Factor Timing: This research offers a data-driven approach to factor timing. Instead of relying on static allocations, advisors can potentially adjust factor exposures based on the identified economic regime or analogous market moment.

- Dynamic Portfolio Adjustments: The ability to detect shifts in economic regimes allows for more dynamic portfolio adjustments, potentially mitigating risk and capturing opportunities as the economic landscape evolves.

- Going Beyond Traditional Analysis: This study highlights the value of incorporating macroeconomic data and historical analysis into investment decision-making, moving beyond traditional stock-picking methods.

- A New Tool for Risk Management: Understanding the current economic regime and potential shifts can provide advisors with a valuable tool for managing risk and tailoring portfolios to specific market conditions. The ability to identify similar historical periods could inform risk assessments and scenario planning.

- Leveraging Macroeconomic Similarity: Both the new research paper and the “analogous market moments” concept underscore the power of finding periods of macroeconomic similarity. Whether you use a complex regime detection model or a simpler distance-based approach, the underlying principle remains the same: history can provide valuable guidance.

- Caveats and Further Research: As with any research, it’s important to acknowledge limitations. The study focuses on a specific period and set of factors. Further research is needed to validate the findings across different asset classes and market environments. The model’s sensitivity to the choice of economic state variables also warrants consideration. Different methods for finding “analogous” periods may yield different results.

Summarizing, the new research makes the case for incorporating regime detection into investment strategies. The parallel to Verdad Capital’s “analogous market moments” reinforces the value of this approach. By understanding the current economic environment and its historical context, financial advisors can potentially improve portfolio performance and deliver better outcomes for their clients. Keep an eye on further developments in this area, as it could represent a significant step forward in dynamic asset allocation and risk management.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest Enrich Your Future.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.