Richard Thaler: Misbehaving His Way to a Nobel Prize!

By Wesley Gray, PhD|November 17th, 2017|Book Reviews|

Unless you live under a rock, you've probably heard that [...]

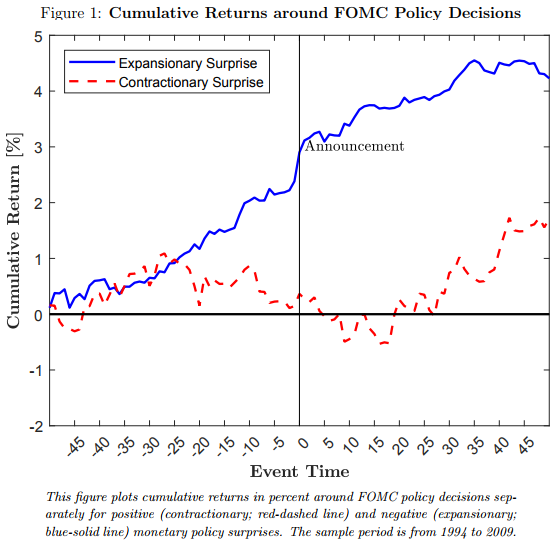

Monetary Momentum

By Jack Vogel, PhD|November 16th, 2017|Research Insights, Academic Research Insight, Momentum Investing Research|

On most mainstream finance websites, a good chunk of the [...]

Academic Research Insight: How to Balance Short and Long term Goals in Asset Allocation

By Wesley Gray, PhD|November 13th, 2017|Basilico and Johnsen, Academic Research Insight|

Strategic Asset Allocation-Combining Science and Judgment to Balance Short Term [...]

Factor Investors Beware: Positive SMB May Not Mean You Own Small-Caps

By Jack Vogel, PhD|November 10th, 2017|Research Insights, Factor Investing, Size Investing Research|

Regression analysis is used all the time to assess how [...]

Welcoming Ryan Kirlin, an ETF Expert, to the Alpha Architect Team

By Wesley Gray, PhD|November 9th, 2017|Business Updates|

We wanted to formally welcome the newest addition to the Alpha [...]

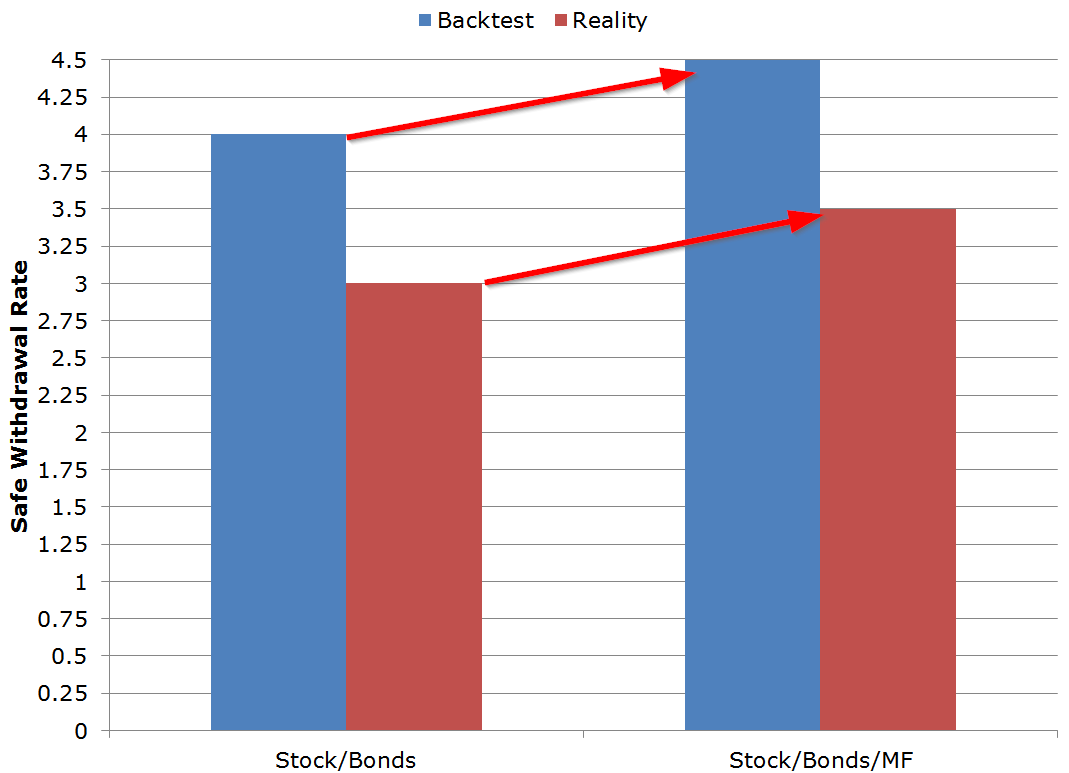

Do Trend-following Managed Futures Increase Safe Withdrawal Rates?

By Wesley Gray, PhD|November 8th, 2017|Research Insights, Trend Following, Managed Futures Research|

Andrew Miller, a regulator contributor to the blog, is passionate [...]

How to Build an Investment Advisor Cybersecurity Program

By Pat Cleary|November 7th, 2017|Cyber Security Programs, Investment Advisor Education|

As a proud alumnus of the Marine Corps (OMB Breach), [...]

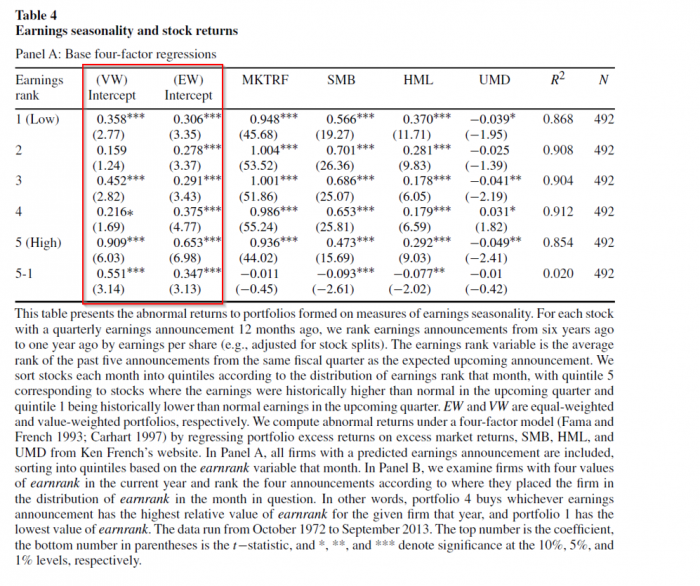

Academic Research Insight: Being Surprised by the Unsurprising: Earnings Seasonality and Stock Returns

By Tommi Johnsen, PhD|November 6th, 2017|Research Insights, Basilico and Johnsen|

Are we misidentifying seasonal patterns as genuine earnings news? Tom [...]

What Will We Talk About at the Evidence-Based Investing Conference This Year?

By Wesley Gray, PhD|November 1st, 2017|Business Updates|

Jack and I will be attending the Evidence-Based Investing Conference [...]

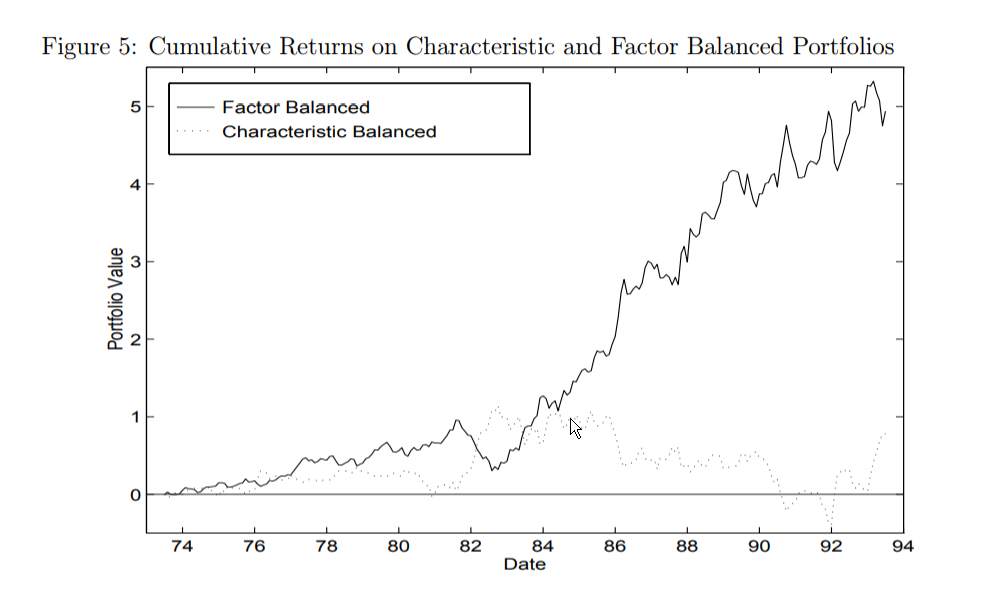

Do Portfolio Factors or Characteristics Drive Expected Returns?

By Jack Vogel, PhD|October 31st, 2017|Factor Investing, Research Insights, Key Research, Value Investing Research|

This article examines a somewhat overlooked, but important, discussion that raged among academic researchers on the source of the value investing premium in the late 1990s and early 2000s—the topic: factors vs characteristics.