Academic Research Insight: Sin Stocks May Earn a “Boycott” Risk Premium

By Tommi Johnsen, PhD|October 30th, 2017|Research Insights, Basilico and Johnsen, Academic Research Insight|

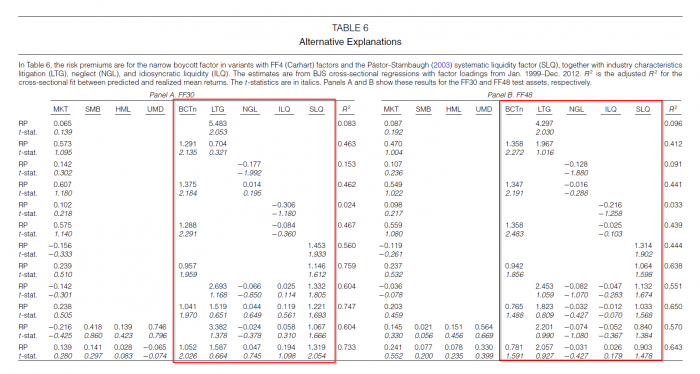

Social Screens and Systematic Boycott Risk H. Arthur Luo and [...]

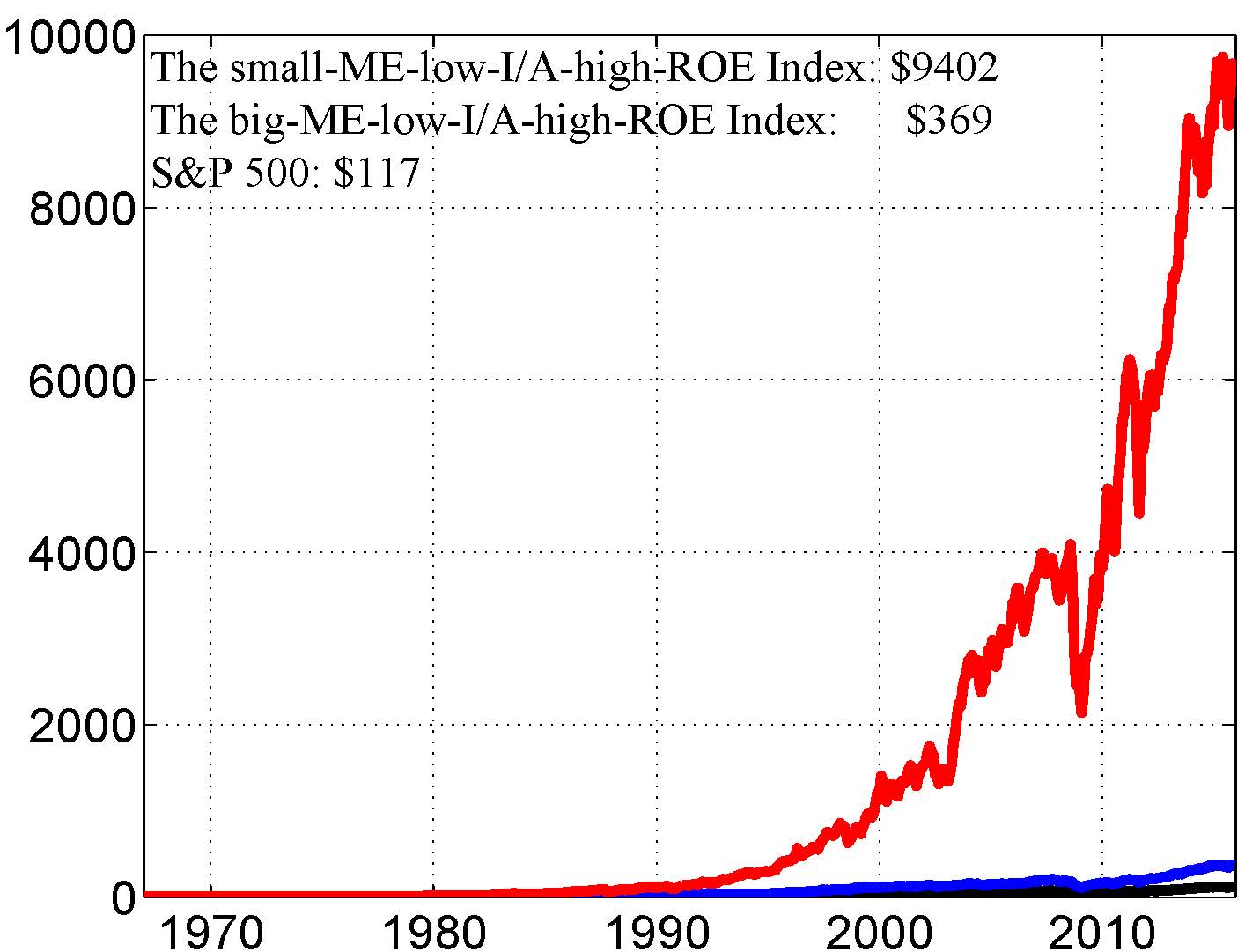

Factor Investing with Factor Expert Lu Zhang

By Wesley Gray, PhD|October 26th, 2017|Research Insights, Factor Investing, Interviews, Value Investing Research, Momentum Investing Research|

Replicating Anomalies is arguably a "must-read" for anyone who thinks [...]

Takeaways from a Non-PHD who Powered Through a 144-page Factor Investing Paper

By Ryan Kirlin|October 25th, 2017|Research Insights, Factor Investing|

Wes recently challenged me with a unique proposition: Hey Ryan, [...]

Avoid Getting “Ameritraded:” Best Execution For Financial Advisors with Small Clients

By Pat Cleary|October 24th, 2017|Investment Advisor Education|

Have you been Ameritraded? Millions of years' worth [...]

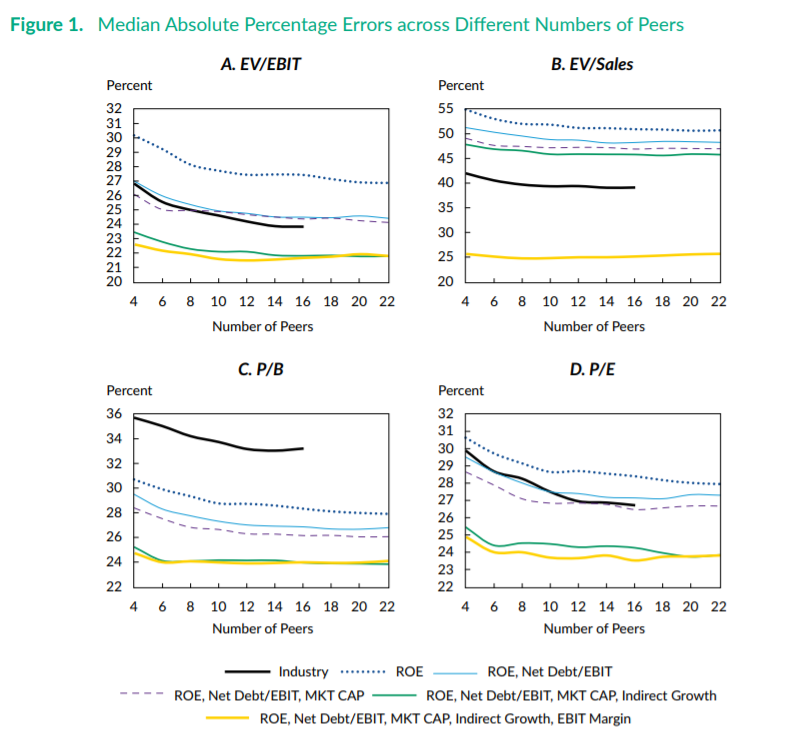

Academic Research Insight: Stick to the Fundamentals and Discover Your Industry Peers

By Wesley Gray, PhD|October 23rd, 2017|Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Value Investing Research|

Stick to the Fundamentals and Discover Your Peers Jean Overgaard [...]

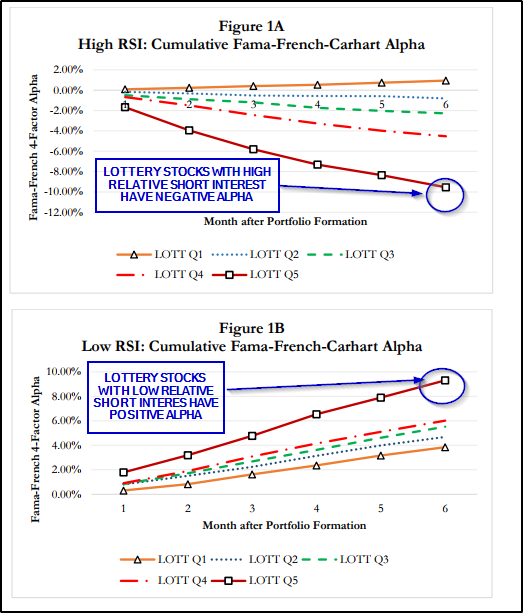

A Potential Winner: Buying Lottery Stocks with Low Short Interest

By Rich Shaner, CFA|October 20th, 2017|Research Insights, Academic Research Insight, Guest Posts|

Short Interest and Lottery Stocks Kelley Bergsma & Jitendra Tayal [...]

Trend-Following: A Deep Dive Into A Unique Risk Premium

By Wesley Gray, PhD|October 18th, 2017|Factor Investing, Research Insights, Trend Following|

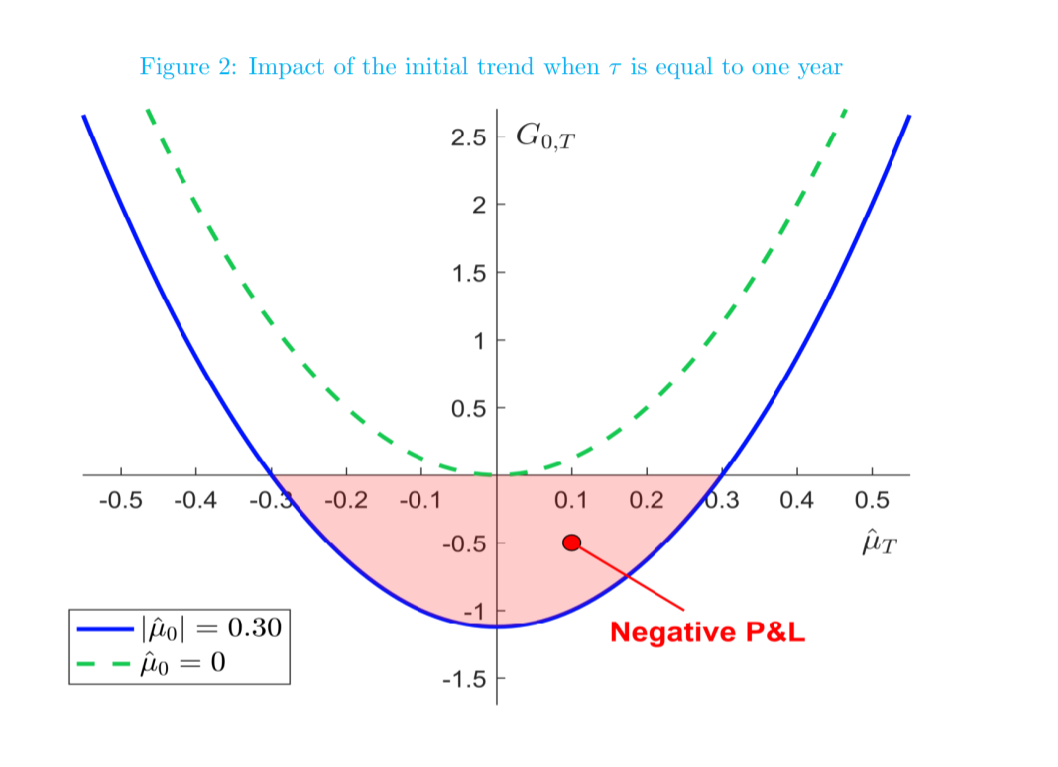

Trend-following strategies have historically been laughed at via the modern [...]

A Fund Flows Theory for Value and Momentum Investing

By Jack Vogel, PhD|October 17th, 2017|Research Insights, Value Investing Research, Momentum Investing Research|

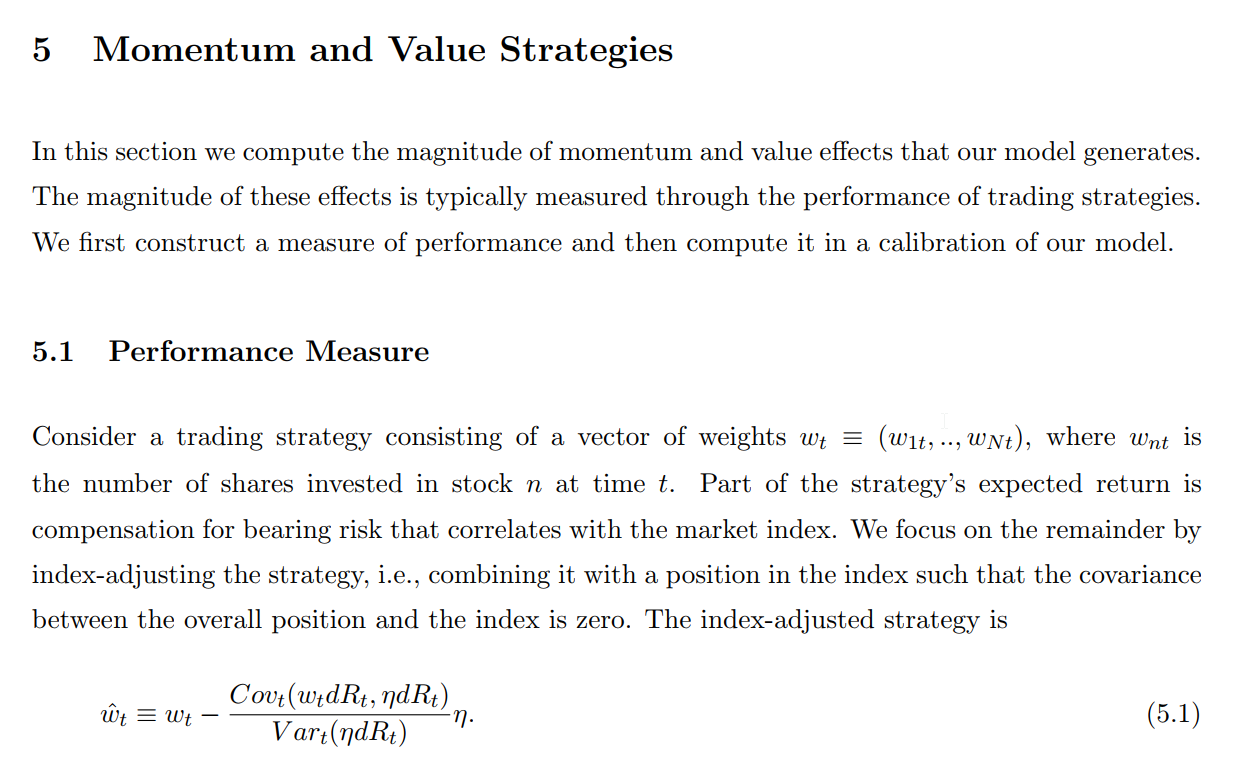

Value and Momentum Investing -- our two favorite factors. We talk about these phenomena on our blog all the time, and have given both rational and behavioral explanations as to why these may occur. However, very few in the finance community are direct investors into Value and Momentum securities -- the individual stocks (or bonds) themselves. Many use ETFs or mutual funds to gain access to these factors. Institutions generally do the same, either investing in hedge funds or managed accounts. This is delegated asset management, whereby one delegates the decision of the security selection onto a third-party manager. A by-product of delegation is that from time to time, the third-party manager must be assessed. While many may claim the process is most important, the performance is always taken into consideration. So what happens to a Value manager who is overweight the wrong industry? While the manager may be following the same process discussed ex-ante, the ex-post assessment may be that the manager needs to be fired due to underperformance.

Academic Research Insight: Sentiment Feedback Strength Trading Strategy

By Wesley Gray, PhD|October 16th, 2017|Research Insights, Basilico and Johnsen, Academic Research Insight|

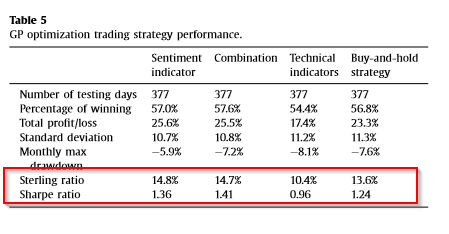

Genetic programming optimization for a sentiment feedback strength based trading [...]

Podcast: Factor Replication with Lu Zhang (Wes)

By Wesley Gray, PhD|October 16th, 2017|Podcasts and Video|

Here is a link to our podcast on Behind the Markets [...]