Podcast: Foreign Exchange Research with Nick Roussanov (Wes)

By Wesley Gray, PhD|August 28th, 2017|Podcasts and Video|

Here is a link to our podcast on Behind the [...]

Podcast: Compound Your Face off (Wes)

By Wesley Gray, PhD|August 28th, 2017|Podcasts and Video|

Here is a link to our podcast on Invest Like [...]

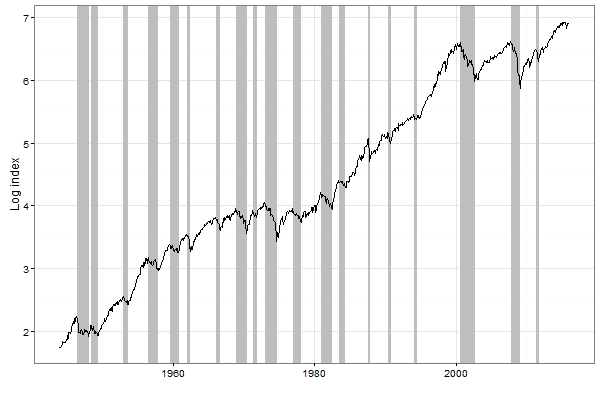

Trend-Following: Testing the Profitability of Trading Rules (Part 6)

By Valeriy Zakamulin|August 25th, 2017|Trend Following, Trend-Following Course, Introduction Course, Investor Education|

The difficulty in testing the profitability of trend-following rules stems [...]

March for the Fallen Weekly Training Series: Nutrion

By Wesley Gray, PhD|August 25th, 2017|Training Section, MFTF Training Series, Business Updates|

Team: This post is part five in the training series [...]

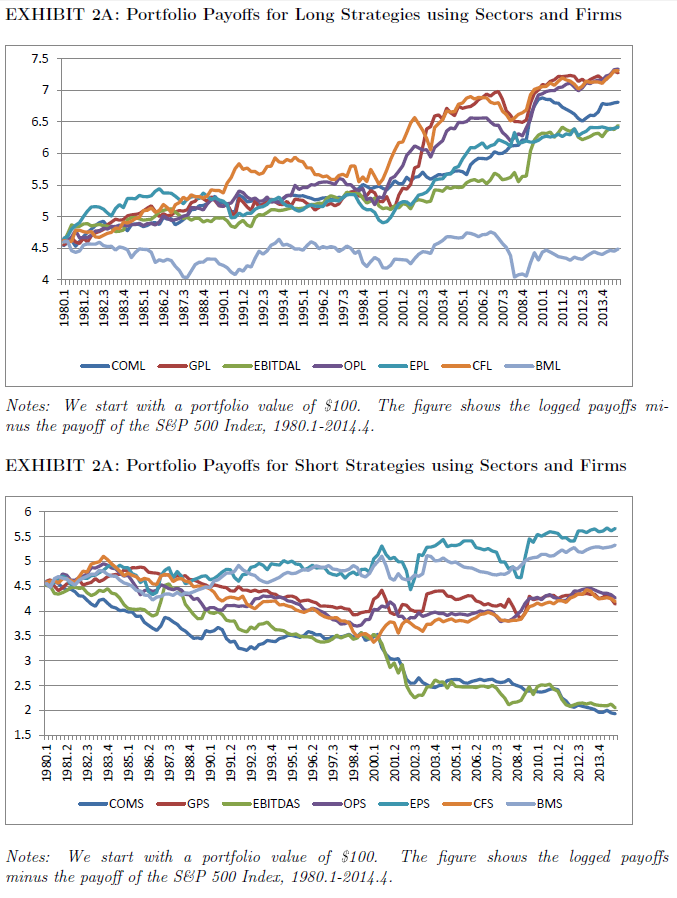

Portfolio Allocations using Enterprise Multiples (and others)

By Jack Vogel, PhD|August 22nd, 2017|Factor Investing, Value Investing Research|

A common question asked in the factor investing field is the following -- "how much of the model's performance is driven by sector allocations, and how much is driven by security selection?" Our answer is to simply buy Value stocks or Momentum stocks, regardless of sector constraints. Why? Well a nice anecdote (but not data) is that investing in "cheap" technology stocks was not a great idea in the internet bubble crash.

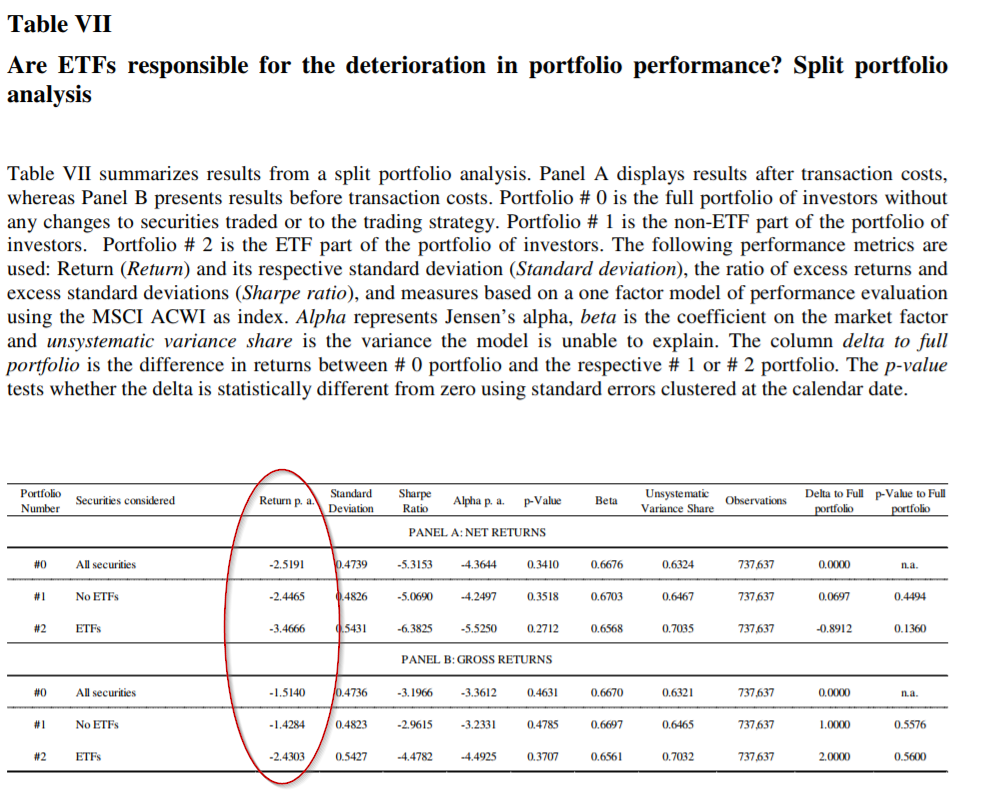

Academic Research Insight: Abusing ETFs

By Wesley Gray, PhD|August 21st, 2017|Basilico and Johnsen, Academic Research Insight|

Title: ABUSING ETFs Authors: UTPAL BHATTACHARYA, BENJAMIN LOOS, STEFFEN MEYER, [...]

MARCH FOR THE FALLEN WEEKLY TRAINING SERIES: UNIFORM/GEAR

By Wesley Gray, PhD|August 19th, 2017|Training Section, MFTF Training Series, Business Updates|

Team: This post is part four in the training series [...]

Trend-Following with Valeriy Zakamulin: Performance Measurement and Outperformance Tests (Part 5)

By Valeriy Zakamulin|August 18th, 2017|Trend Following, Trend-Following Course, Introduction Course, Investor Education|

We consider an investor and a financial market that consists [...]

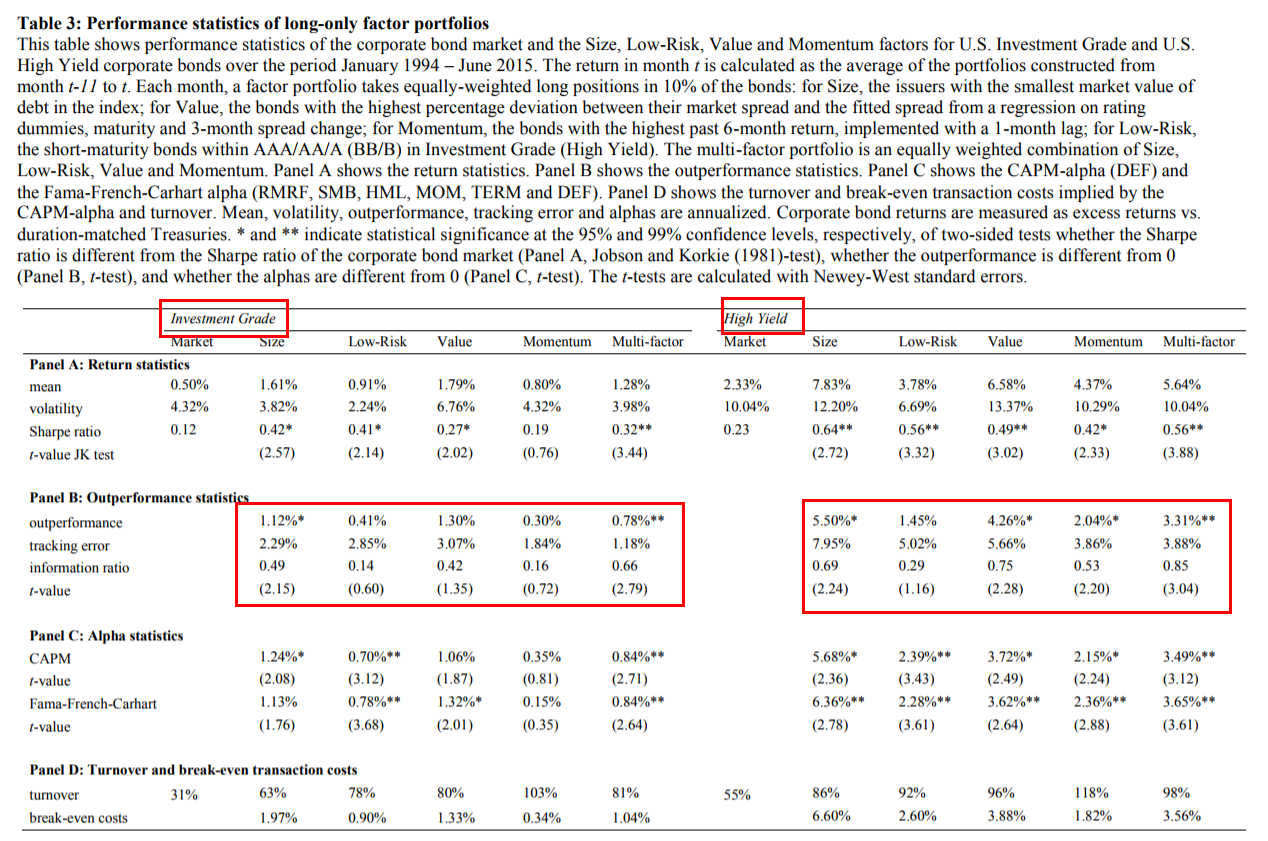

Academic Research Insight: Can Bond Portfolios Be “Factorized”?

By Tommi Johnsen, PhD|August 14th, 2017|Factor Investing, Research Insights, Basilico and Johnsen|

Title: Factor Investing in the Bond Market Authors: Patrick Houweling [...]

MARCH FOR THE FALLEN WEEKLY TRAINING SERIES: FOOTWEAR & FOOT CARE

By Wesley Gray, PhD|August 13th, 2017|Training Section, MFTF Training Series|

Team: This post is part three in the training series [...]