Trend-Following with Valeriy Zakamulin: Anatomy of Trading Rules (Part 4)

By Valeriy Zakamulin|August 13th, 2017|Trend-Following Course, Trend Following, Introduction Course, Guest Posts, Investor Education|

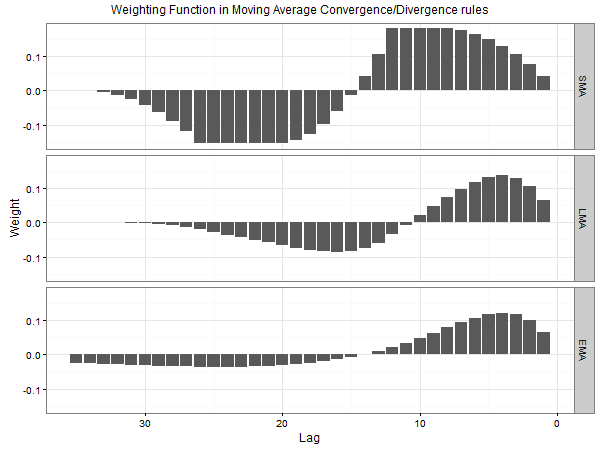

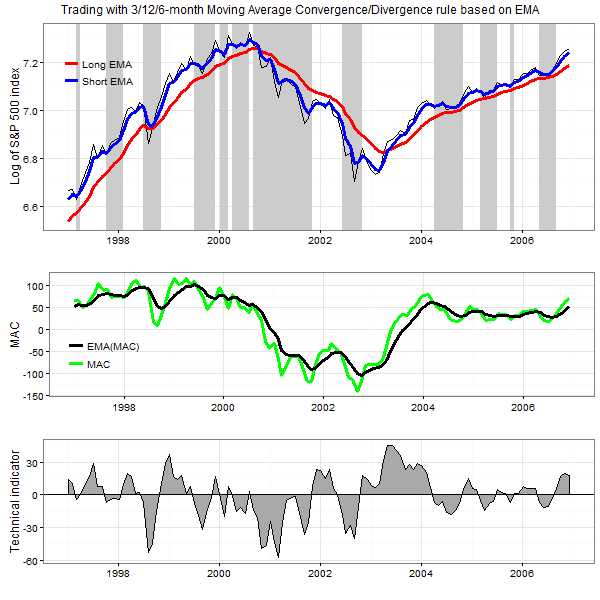

In our context, a technical trading indicator can be considered [...]

TREND-FOLLOWING WITH VALERIY ZAKAMULIN: TECHNICAL TRADING RULES (PART 3)

By Valeriy Zakamulin|August 11th, 2017|Trend Following, Trend-Following Course, Introduction Course|

A trend following strategy is based on switching between a [...]

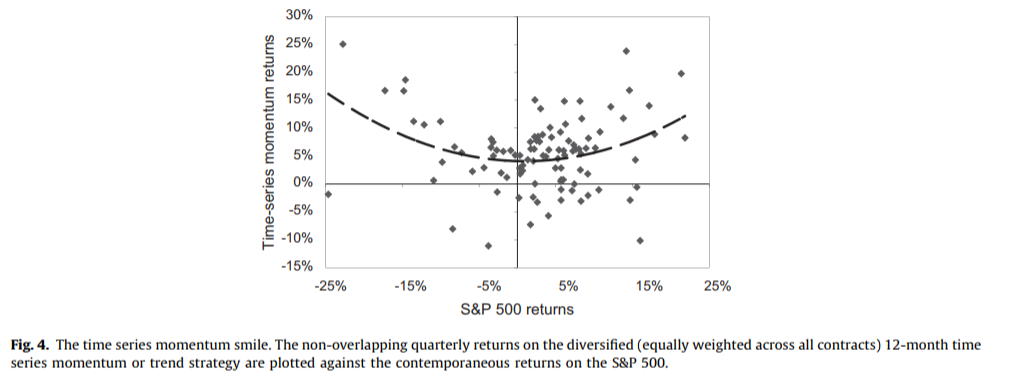

Diversification Benefits of Time Series Momentum

By Larry Swedroe|August 10th, 2017|Larry Swedroe, Research Insights, Trend Following|

Similar to some better-known factors like size and value, time-series momentum is a factor that historically has demonstrated above average excess returns. Time-series momentum, also called trend-momentum or absolute momentum, is measured by a portfolio long assets that have had recent positive returns and short assets that have had recent negative returns. Compare this to the traditional (cross-sectional) momentum factor that considers recent asset performance only relative to other assets. The academic evidence suggests that inclusion of a strategy targeting time-series momentum in a portfolio improves the portfolio’s risk-adjusted returns.

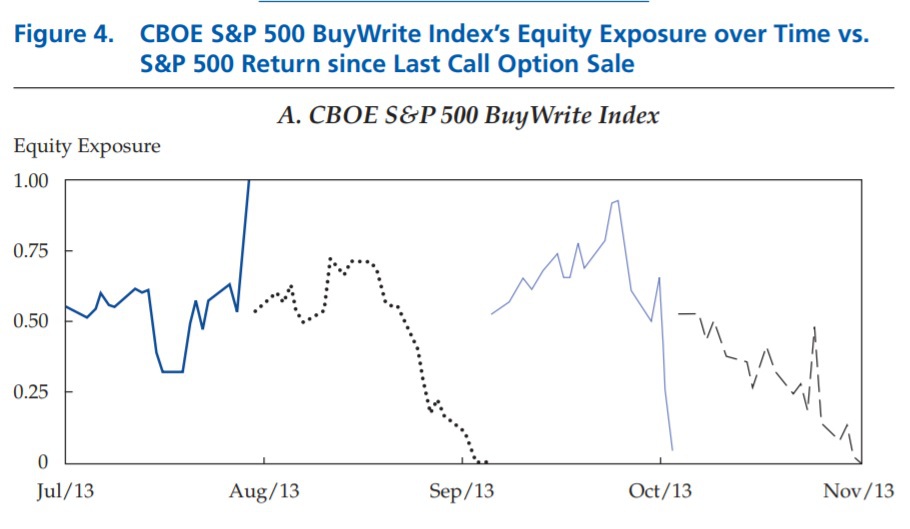

Volatility Premium, Covered Call Selling, and Knowing What You Own

By Andrew Miller|August 8th, 2017|Research Insights, Guest Posts|

The folks at AQR are top-notch researchers and have written [...]

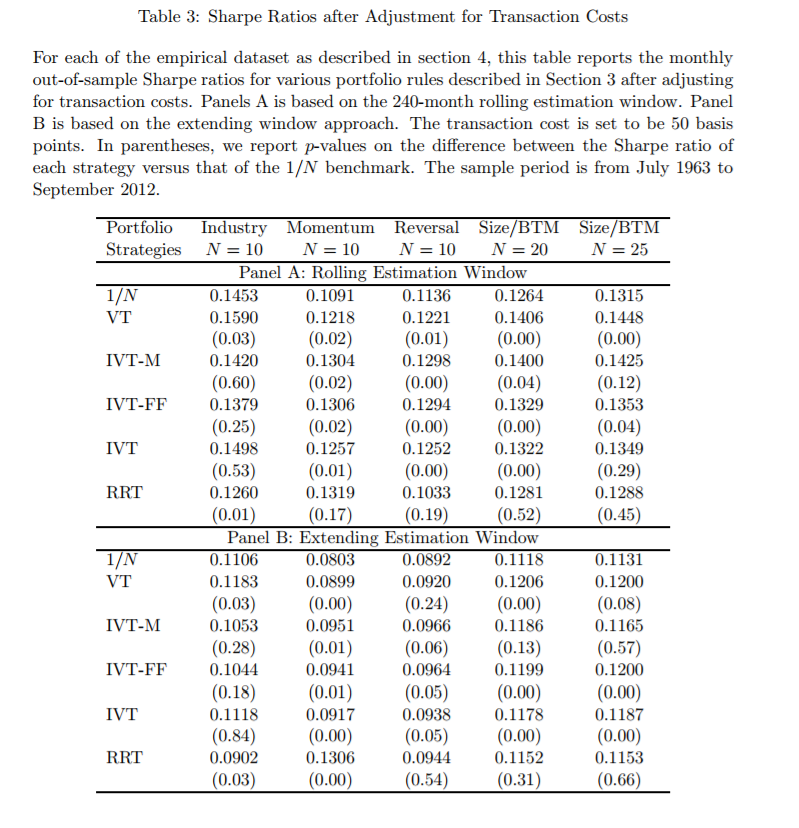

Academic Research Insight: Diagonal Models versus 1/N Diversification

By Wesley Gray, PhD|August 7th, 2017|Academic Research Insight|

Title: MITIGATING ESTIMATION RISK IN ASSET ALLOCATION: DIAGONAL MODELS VERSUS [...]

March for the Fallen Weekly Training Series: Workout Plan

By Wesley Gray, PhD|August 4th, 2017|Training Section, MFTF Training Series|

Team: This post is part two in the training series [...]

Avoiding Traumatic ESOP 1042 Election Distress

By Doug Pugliese|August 1st, 2017|1042 QRP Solutions|

Medical scientists have identified a disorder, known as Traumatic 1042 Election Distress, that can afflict business owners who pursue Section 1042 sales of their company stock to an ESOP. The researchers recently concluded their clinical study, based on observations of hundreds patients over the past 30 years. Their newly published findings identify common stress patterns observed among business owner patients. The disorder is curable if diagnosed early.

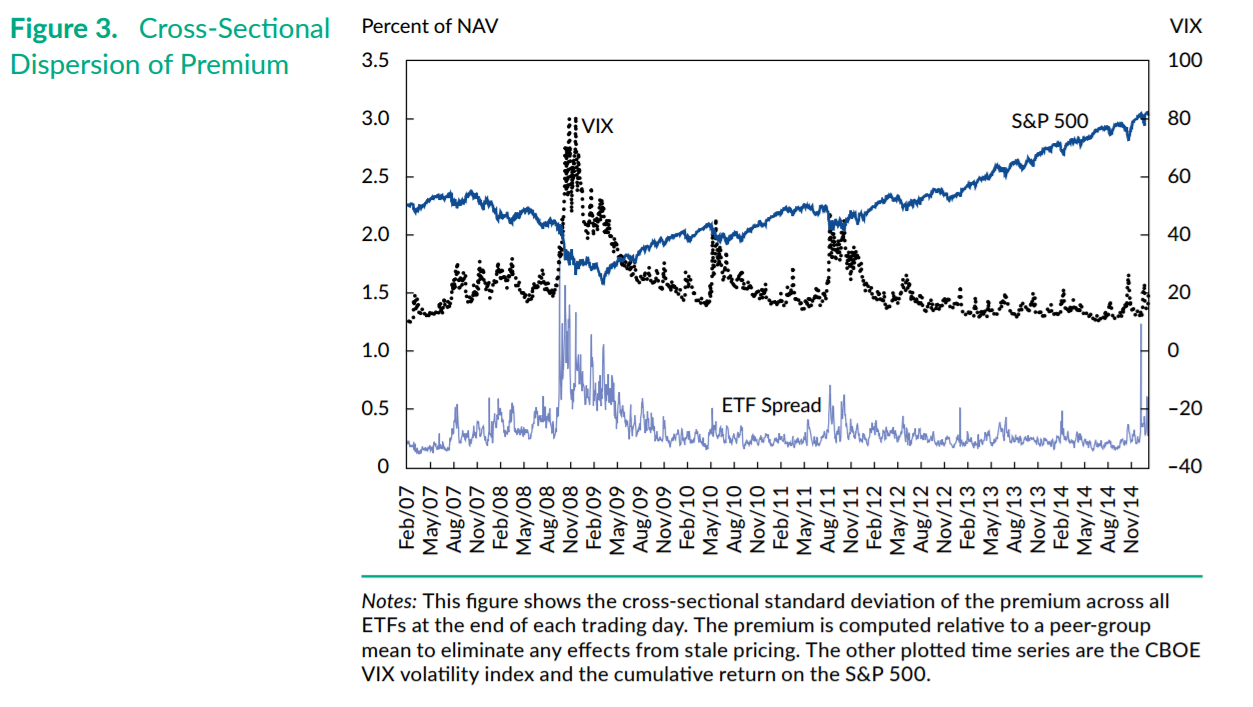

Academic Research Insight: Digging into ETF Trading Spreads

By Wesley Gray, PhD|July 31st, 2017|Basilico and Johnsen, Academic Research Insight|

In this article we discuss what the academic research says [...]

March for the Fallen Weekly Training Series: Training Rules

By Wesley Gray, PhD|July 28th, 2017|Training Section, MFTF Training Series|

This post is part one in the training series for [...]

Kyle Baxter, Our Newest Teammate, is On Deck!

By Wesley Gray, PhD|July 28th, 2017|Business Updates|

We wanted to formally welcome the newest addition to the Alpha [...]