Benefits of Having a Female CFO

- Julia Klevak, Joshua Livnat and Kate Suslava

- working paper

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

According to the Wall Street Journal, as of Spring 2021, women represent 59.5 percent of college students and graduate at higher rates than men (65% compared to 59%). Additionally, recent statistics find that female accounting graduates outnumber males at the bachelor’s and master’s levels, and 51 percent of new hires in accounting are women. However, females serve in 23% of the CFO jobs.

The authors study the following questions:

- Is there an equal representation of male and female CFOs during calls?

- Are there differences in the language used by company CFOs to communicate with investors?

- Are women evaluated differently during calls?

- Is there an association between the tone of the CFOs during calls and subsequent firm expansion?

What are the Academic Insights?

By studying earnings conference calls, during which the CFO typically presents and discusses the financial results for the previous quarter (Management Discussion, or MD), and then participates in the Questions and Answers (QA) section of the call, the authors find:

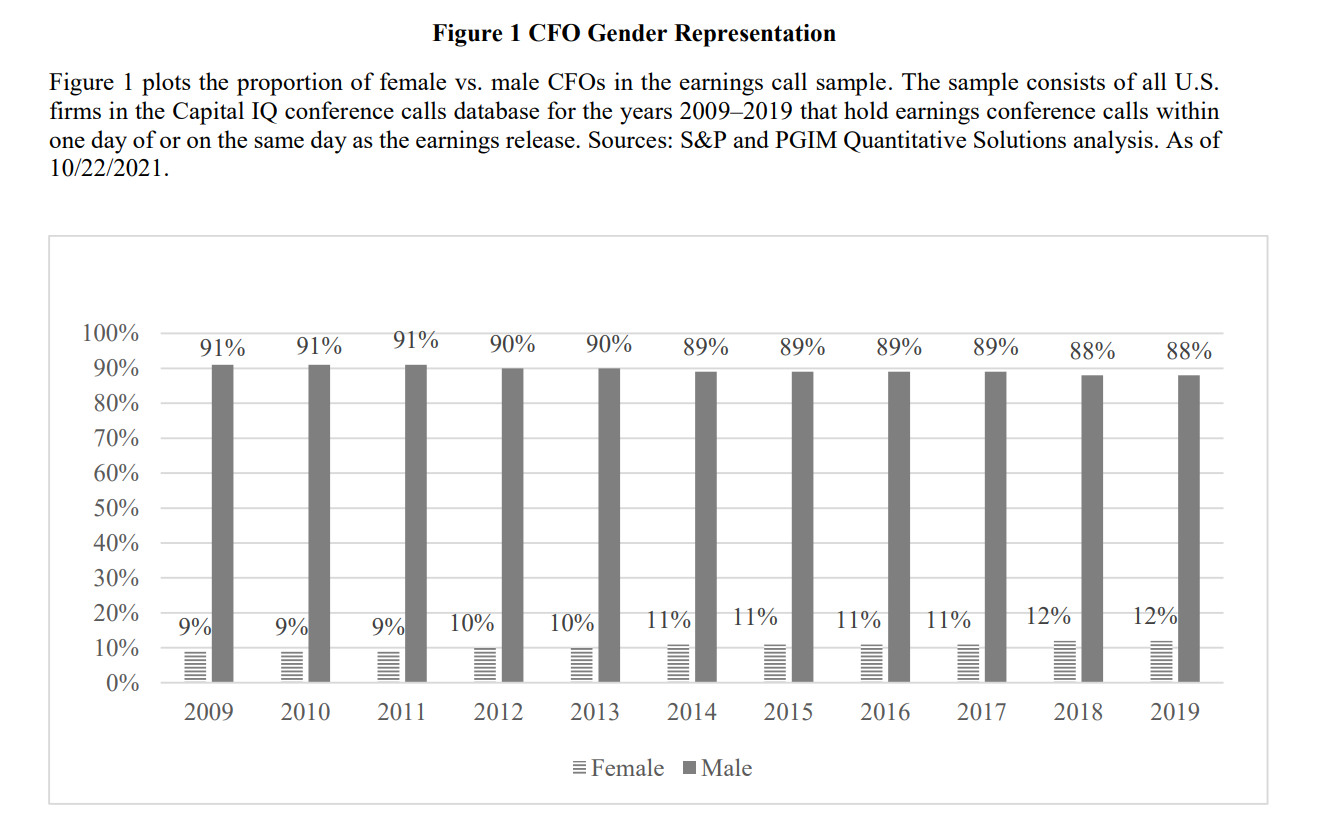

- Female CFOs are present in only 11 percent of the calls and are more likely to participate in the scripted MD part than in the more spontaneous and interactive QA section.

- YES-Female CFOs typically give shorter (measured by the length of presentation), less upbeat (measured by tone/sentiment), and clearer presentations (measured by complexity); they also tend to use less obfuscation (measured by obfuscation using euphemisms and clichés) and more numbers (measured by the proportion of numbers) than male CFOs. These differences are more strongly revealed in the spontaneous QA section of the call and hold both for the full sample of call transcripts and for a sample of pairs of CFOs matched by industry and company size. Overall the findings seem to indicate that female CFOs are more conservative in their investor communication than male CFOs, in accordance with previous studies on gender differences in finance.

- YES-women are evaluated differently from their male counterparts. In fact, at the time of the call, investors react more strongly to the tone of female CFOs than to the tone of their male peers. The tone of female CFOs is more strongly associated with next-quarter earnings surprises, which measure how much actual firm earnings deviate from the analyst forecasts.

- YES- there is some evidence that the positive tone of male/female CFOs is more/less strongly associated with future firm expansion.

Why does it matter?

This paper is the first one to demonstrate the gender differences in language during quarterly earnings calls.

The Most Important Chart from the Paper:

Abstract

We examine gender differences in the language of CFOs who participate in quarterly earnings calls. Female executives are more concise and less optimistic, are clearer, use fewer idioms or clichés, and provide more numbers in their speech. These differences are particularly strong in the more spontaneous Questions and Answers (QA) section of the calls and are reflected in stronger market and analyst reactions. Gender differences seem to be associated with CFO overconfidence.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.