DIY Trend-Following Allocations: February 2023

By Ryan Kirlin|February 2nd, 2023|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Partial exposure to domestic equities. Partial exposure to international equities. No exposure to REITs. Partial exposure to commodities. No exposure to intermediate-term bonds.

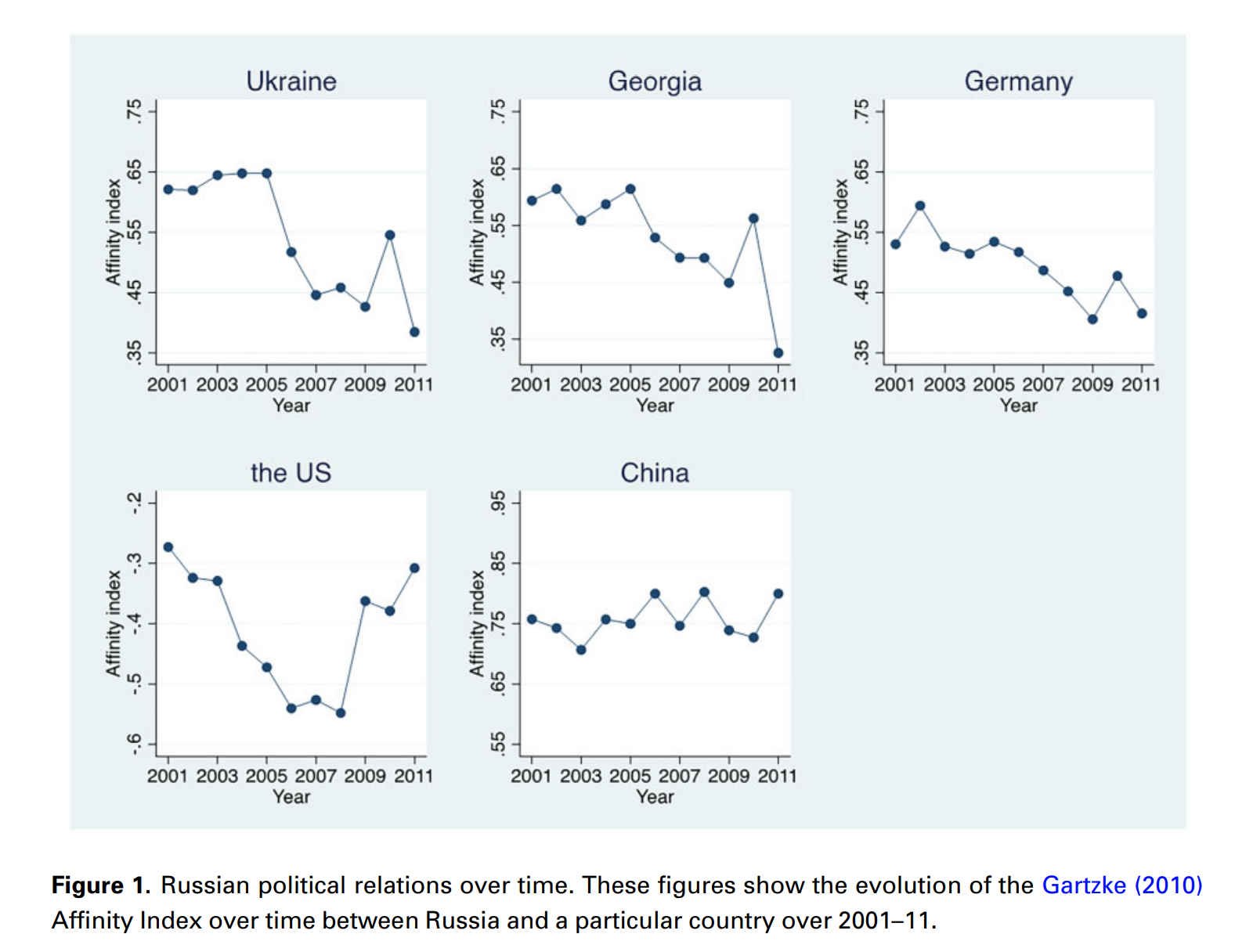

Political Beta

By Tommi Johnsen, PhD|January 30th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, Macroeconomics Research|

This example of research on political beta is an example of applying portfolio theory to problems associated with global politics.

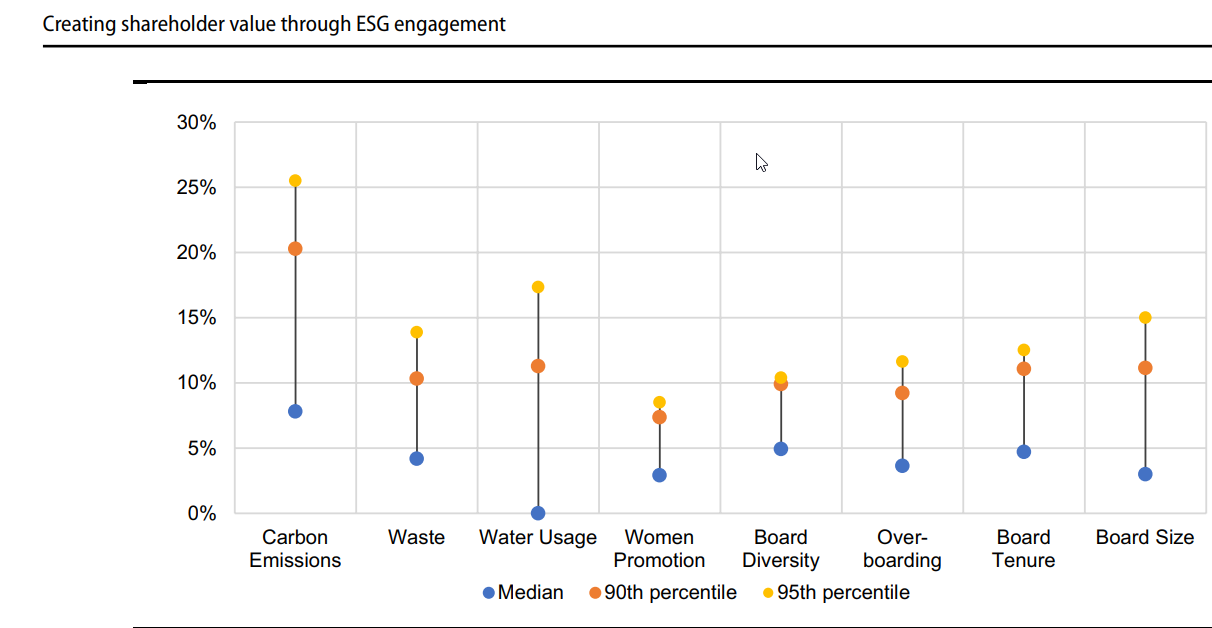

Improving ESG Practices Boosts Valuations

By Larry Swedroe|January 27th, 2023|ESG, Research Insights, Larry Swedroe|

This chart on creating shareholder value through ESG engagement is useful when evaluating if ESG practices boost valuations.

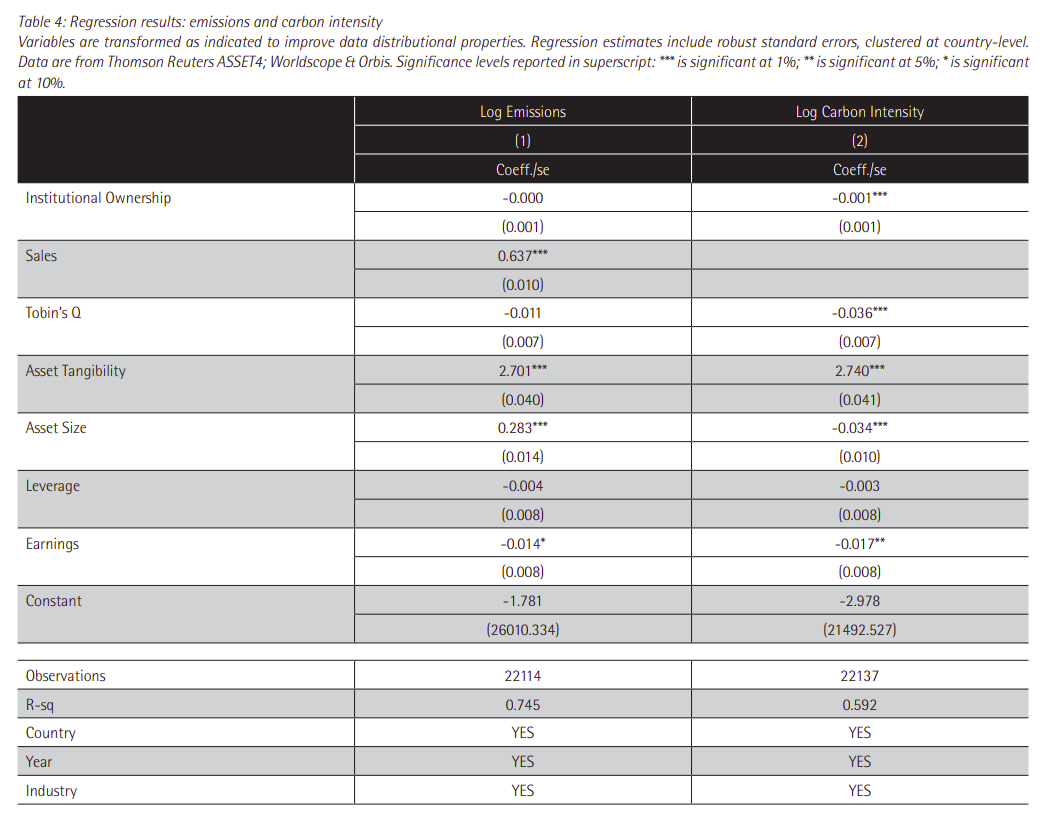

Institutional Investors and Corporate Carbon Footprint

By Elisabetta Basilico, PhD, CFA|January 23rd, 2023|ESG, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight|

This table of emissions and carbon intensity is relevant to the question of institutional investor influence over the carbon footprint.

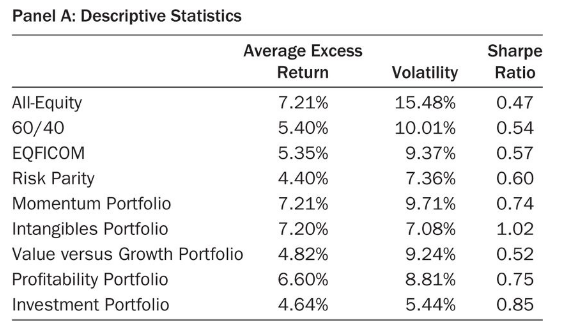

Mitigating Risks with Factor Strategies

By Larry Swedroe|January 20th, 2023|Factor Investing, Larry Swedroe|

The following exhibit, which is useful to the subject of mitigating risks with factor strategies, provides the total return of the four benchmark portfolios and the five anomaly portfolios.

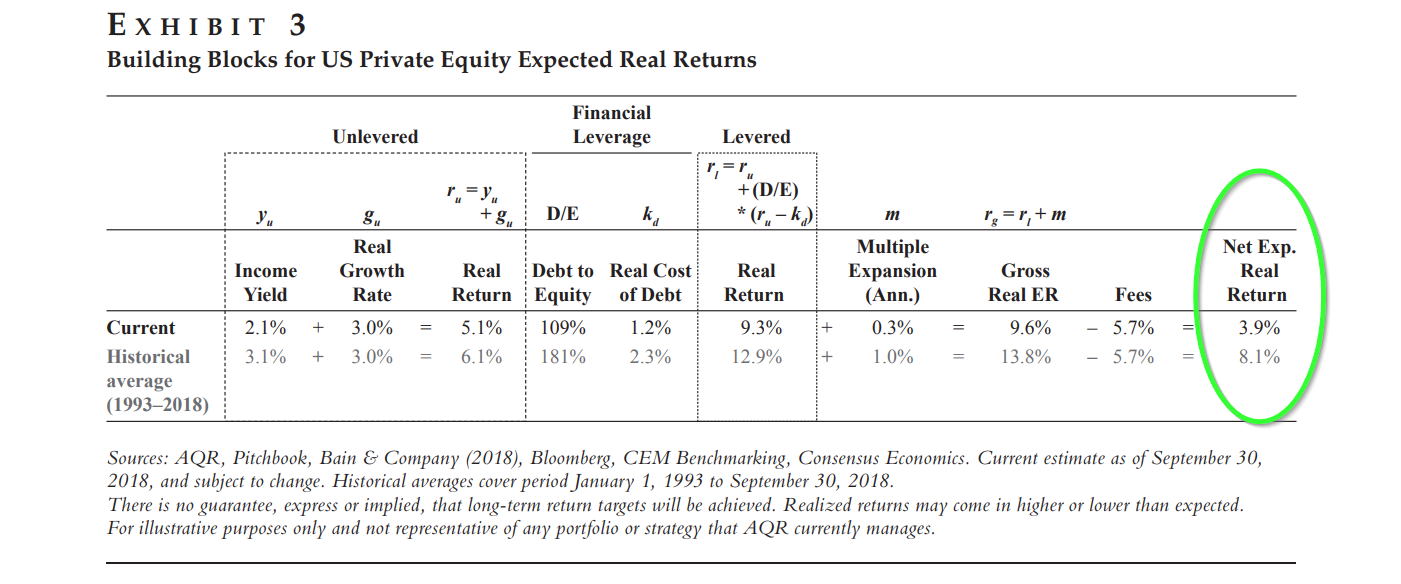

Expected Returns for Private Equity Will Probably Suck

By Tommi Johnsen, PhD|January 17th, 2023|Private Equity, Research Insights, Basilico and Johnsen, Academic Research Insight|

The illiquid nature of the asset class makes the demystifying of private equity returns difficult to achieve under any circumstances, but the framework presented in this article should move the reader closer to the goal.

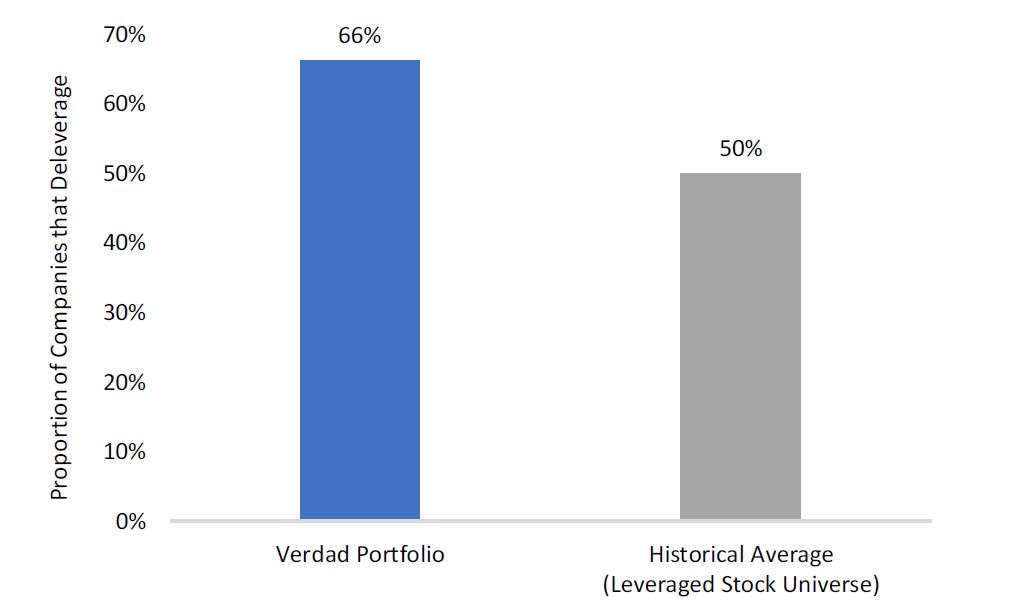

The Value Factor and Deleveraging

By Larry Swedroe|January 13th, 2023|Factor Investing, Larry Swedroe, Research Insights, Value Investing Research|

How do you separate the signal from the noise? To have confidence that a factor premium, or strategy, isn’t just the result of data mining - a lucky/random outcome - we recommended that you should require evidence that the premium has been not only persistent over long periods of time and across economic regimes, but also pervasive across sectors, countries, geographic regions and even asset classes; robust to various definitions (for example, there has been both a value and a momentum premium using many different metrics); survives transactions costs; and has intuitive risk- or behavioral-based explanations for the premium to persist.

Global Factor Performance: January 2023

By Wesley Gray, PhD|January 10th, 2023|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads

Can Investors Save the Planet? Unlikely.

By Elisabetta Basilico, PhD, CFA|January 9th, 2023|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight|

Can the planet earth be saved by investors? Find out what the research says!

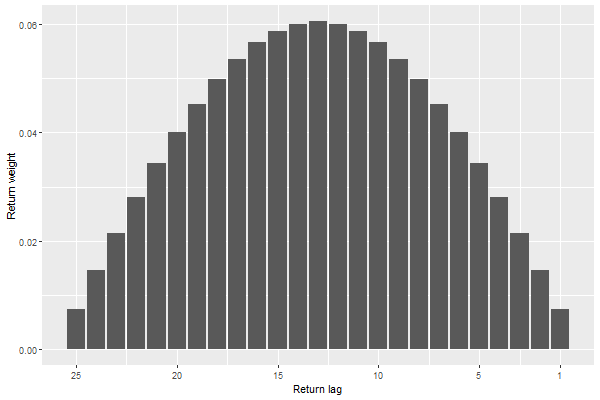

Optimal Trend Following with Transaction Costs

By Valeriy Zakamulin|January 5th, 2023|Research Insights, Trend Following|

In spite of the widespread popularity of trend-following investing, little is still known about optimal trend-following with transaction costs.