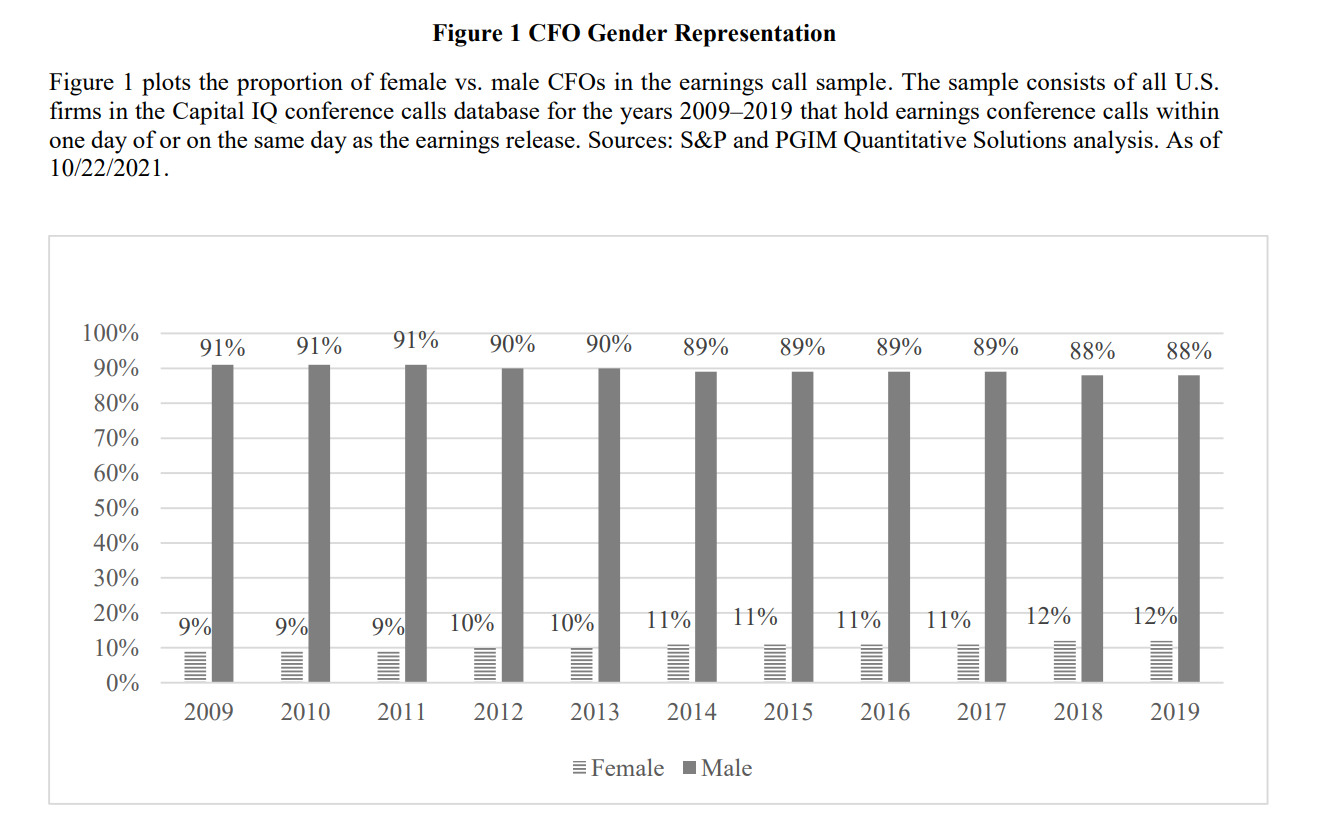

Benefits of Having a Female CFO

By Elisabetta Basilico, PhD, CFA|May 9th, 2022|Research Insights, Women in Finance Know Stuff, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning|

We examine gender differences in the language of CFOs who participate in quarterly earnings calls. Female executives are more concise and less optimistic, are clearer, use fewer idioms or clichés, and provide more numbers in their speech. These differences are particularly strong in the more spontaneous Questions and Answers (QA) section of the calls and are reflected in stronger market and analyst reactions. Gender differences seem to be associated with CFO overconfidence.

Using Momentum to Find Value

By Larry Swedroe|May 5th, 2022|Larry Swedroe, Factor Investing, Research Insights, Trend Following, Academic Research Insight, Value Investing Research, Momentum Investing Research|

Value and momentum are two of the most powerful explanatory factors in finance. Research on both has been published for about 30 years. However, it was not until recently that the two had been studied in combination and across markets. Bijon Pani and Frank Fabozzi contribute to the literature with their study “Finding Value Using Momentum,” published in The Journal of Portfolio Management Quantitative Special Issue 2022, in which they examined whether using six value metrics that have an established academic background combined with the trend in relative valuations provide better risk-adjusted returns than Fama-French’s traditional HML (high minus low book-to-market ratio) factor. The value metrics chosen were book value-to-market value; cash flow-to-price; earnings before interest, taxes, depreciation, and amortization (EBITDA)-to-market value; earnings-to-price; profit margin-to-price; and sales-to-price. Using six different measures provides tests of robustness, minimizing the risk of data mining. However with so many dials to turn there is a risk of achieving positive returns that aren't material or achieving postive results with the potential for overfitting.

DIY Asset Allocation Weights: May 2022

By Ryan Kirlin|May 2nd, 2022|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Big changes this past month: Half exposure to domestic equities. No exposure to international equities. Half exposure to REITs. Full exposure to commodities. No exposure to intermediate-term bonds.

The Future of Factor Investing

By Tommi Johnsen, PhD|May 2nd, 2022|Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight|

In this article, the author discusses current structural research and investment trends that are shaping the future of factor investing. Specifically, the author focuses on three emerging trends: the ongoing evolution of traditional factor models and strategies, recent innovation in data sources and modeling techniques, and the potential disruption from integrating factor strategies into the asset allocation process.

Betting Against Beta: New Insights

By Larry Swedroe|April 28th, 2022|Larry Swedroe, Factor Investing, Research Insights, Academic Research Insight, Value Investing Research, Momentum Investing Research, Low Volatility Investing|

The intuition behind betting against beta is that leverage-constrained investors, instead of applying leverage, obtain an expected return higher than the market’s expected return through overweighting high-beta stocks and underweighting low-beta stocks in their portfolios. Their actions lower future risk-adjusted returns on high-beta stocks and increase future risk-adjusted returns on low-beta stocks. We take a deeper look into this idea.

Did Covid-19 Change how We Shop?

By Elisabetta Basilico, PhD, CFA|April 25th, 2022|Research Insights, Basilico and Johnsen, Academic Research Insight, Macroeconomics Research|

We study e-commerce across 47 economies and 26 industries during the COVID-19 pandemic using aggregated and anonymized transaction-level data from Mastercard, scaled to represent total consumer spending. The share of online transactions in total consumption increased more in economies with higher pre-pandemic e-commerce shares, exacerbating the digital divide across economies. Overall, the latest data suggest that these spikes in online spending shares are dissipating at the aggregate level, though there is variation across industries. In particular, the share of online spending in professional services and recreation has fallen below its pre-pandemic trend, but we observe a longer-lasting shift to digital in retail and restaurants.

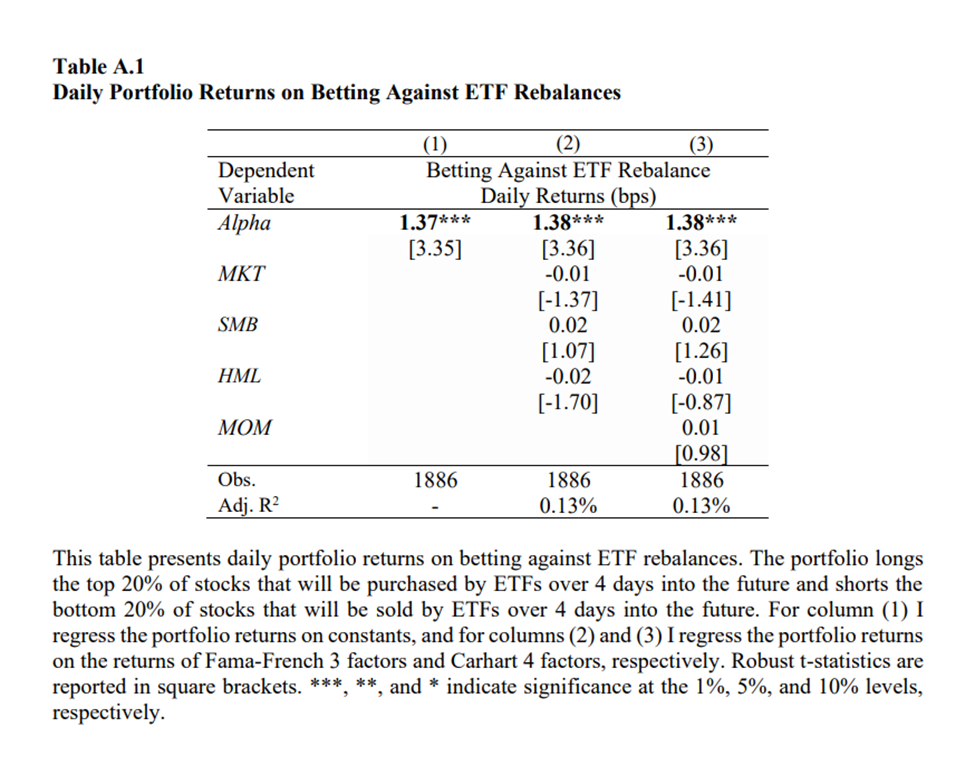

The Implementation Costs of Indexed ETFs

By Larry Swedroe|April 21st, 2022|Research Insights|

A common mistake made by many passive investors is that they view all index funds in the same asset class as “commodities," often considering only the expense ratio when making their investment choices. However, not all index funds are alike, and not all passively managed funds (what I refer to as “systematically structured portfolios”) are index funds.

Can Market Maker Capital Constraints Result in Mispricing of ETFs?

By Tommi Johnsen, PhD|April 18th, 2022|Research Insights, Basilico and Johnsen, Academic Research Insight, ETF Investing|

Capital constraints of financial intermediaries can affect liquidity provision. We investigate whether these constraints spillover and consequently cause contagion in the degree of market efficiency across assets managed by a common intermediary. Specifically, we provide evidence of strong comovement in pricing gaps between ETFs and their constituents for ETFs served by the same lead market maker (LMM). The effects are stronger for ETFs that are more illiquid and volatile, when the underlying constituents of the ETFs are more costly to arbitrage, and for LMMs with more constrained capital. Using extreme disruptions in debt markets during COVID-19 as an experiment, we show that non-fixed income ETFs serviced by LMMs managing a larger fraction of fixed income ETFs experience greater pricing gaps. Overall, our results indicate that intermediaries’ constraints indeed influence comovements in pricing efficiencies.

Bond Investing in Inflationary Times

By Larry Swedroe|April 14th, 2022|Inflation Investing, Larry Swedroe, Research Insights, Academic Research Insight, Fixed Income|

As the chief research officer of Buckingham Strategic Partners, the issue I am being asked to address most often is about fixed income strategies when yields are at historically low levels and inflation risk is heightened due to the unprecedented increase in money creation (through quantitative easing), the extraordinary expansionary fiscal spending around the globe, and the war in Ukraine driving prices higher (especially for food and energy). As always, to answer the question we turn first to the academic evidence on which investments in general provide the best hedges against inflation.

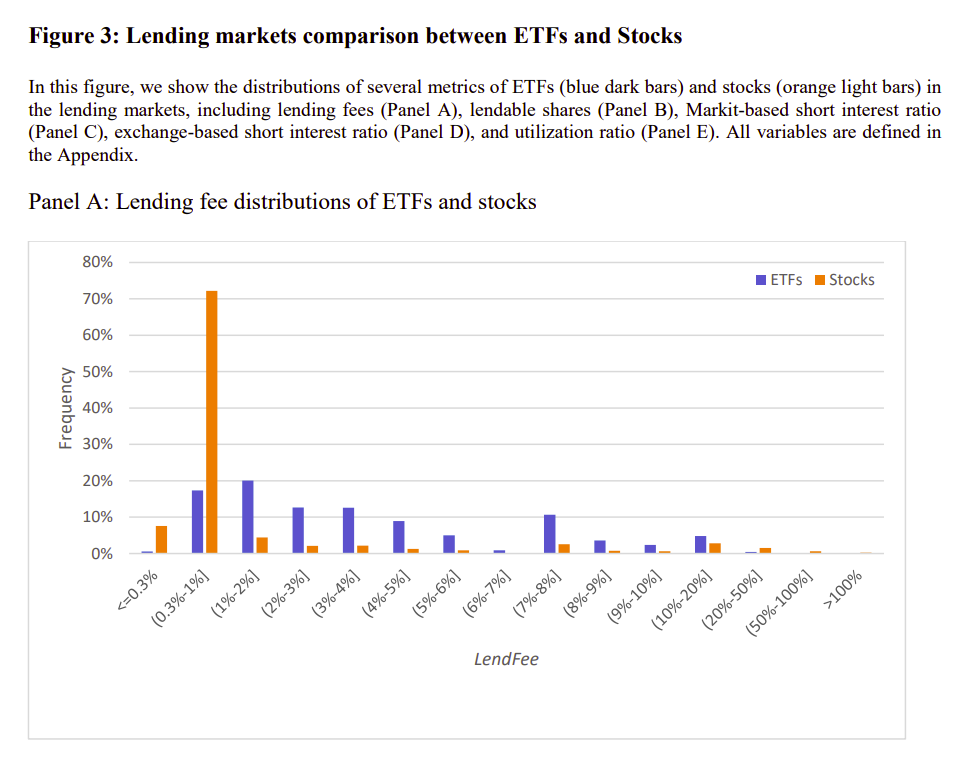

Shorting ETFs: A look into the ETF Loan Market

By Elisabetta Basilico, PhD, CFA|April 11th, 2022|Transaction Costs, Research Insights, Basilico and Johnsen, Academic Research Insight, ETF Investing|

We find that exchange-traded fund (ETF) lending fees are significantly higher than stock lending fees. Two institutional features unique to ETFs play significant roles in explaining the high fees. First, regulations restrict investment companies, such as mutual funds and ETFs, from owning ETFs. As these institutions are key lenders, their absence reduces the lendable supply in the ETF loan market. Second, while the create-to-lend (CTL) mechanism alleviates supply constraints when borrowing demand increases, its efficacy is limited by the associated costs and frictions. Our results speak to the limits to arbitrage in the ETF markets.