ESG Investing: Marketing or Substance? (Ryan Kirlin)

By Wesley Gray, PhD|September 18th, 2019|ESG, Podcasts and Video|

Here is a link to our podcast on "The ETF [...]

Factor Investing from Concept to Implementation

By Wesley Gray, PhD|September 17th, 2019|Factor Investing, Research Insights, Academic Research Insight, Active and Passive Investing|

Factor Investing from Concept to Implementation Eduard van Gelderen, Joop [...]

The Failure of Value Investing explained

By Tommi Johnsen, PhD|September 16th, 2019|Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Value Investing Research|

Explaining the Demise of Value Investing Baruch Lev and Anup [...]

Value: Don’t Call it a Comeback, it’s Been Here for Years

By Josh Russell, PhD, CFA|September 12th, 2019|Research Insights, Factor Investing, Value Investing Research|

Value and Momentum each had back to back extreme returns [...]

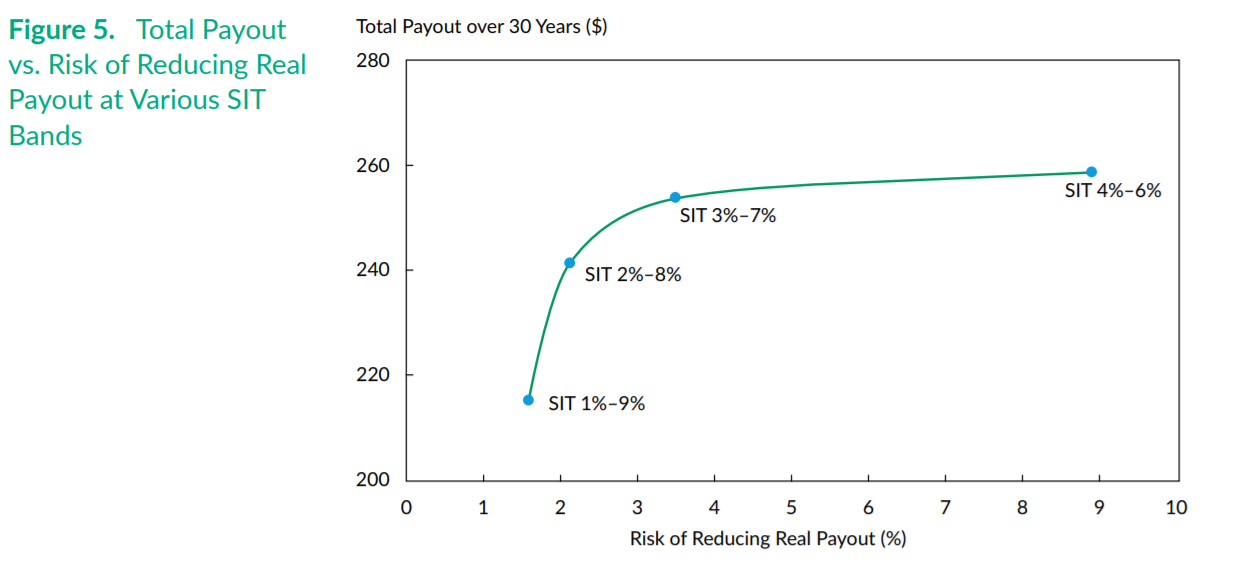

Spending Policies in a Low Return Environment

By Wesley Gray, PhD|September 9th, 2019|Financial Planning, Research Insights, Basilico and Johnsen, Academic Research Insight|

Evaluating Spending Policies in a Low Return Environment Peng Wang, [...]

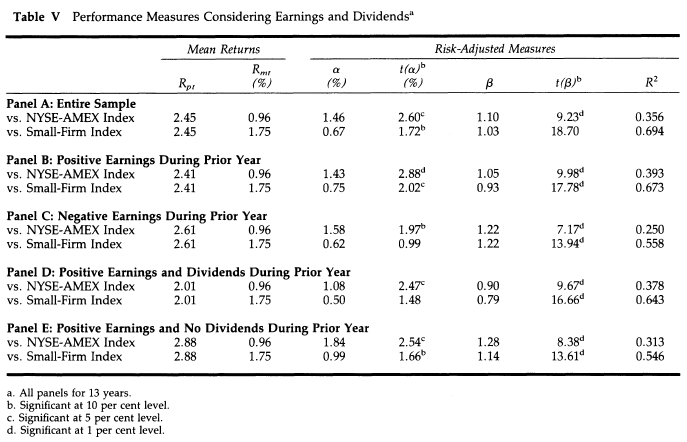

An Analysis of “Benjamin Graham’s Net Current Asset Values: A Performance Update”

By Gaurang Merani, CPA|September 5th, 2019|Research Insights, Academic Research Insight, Value Investing Research|

Henry R. Oppenheimer A version of this paper can be [...]

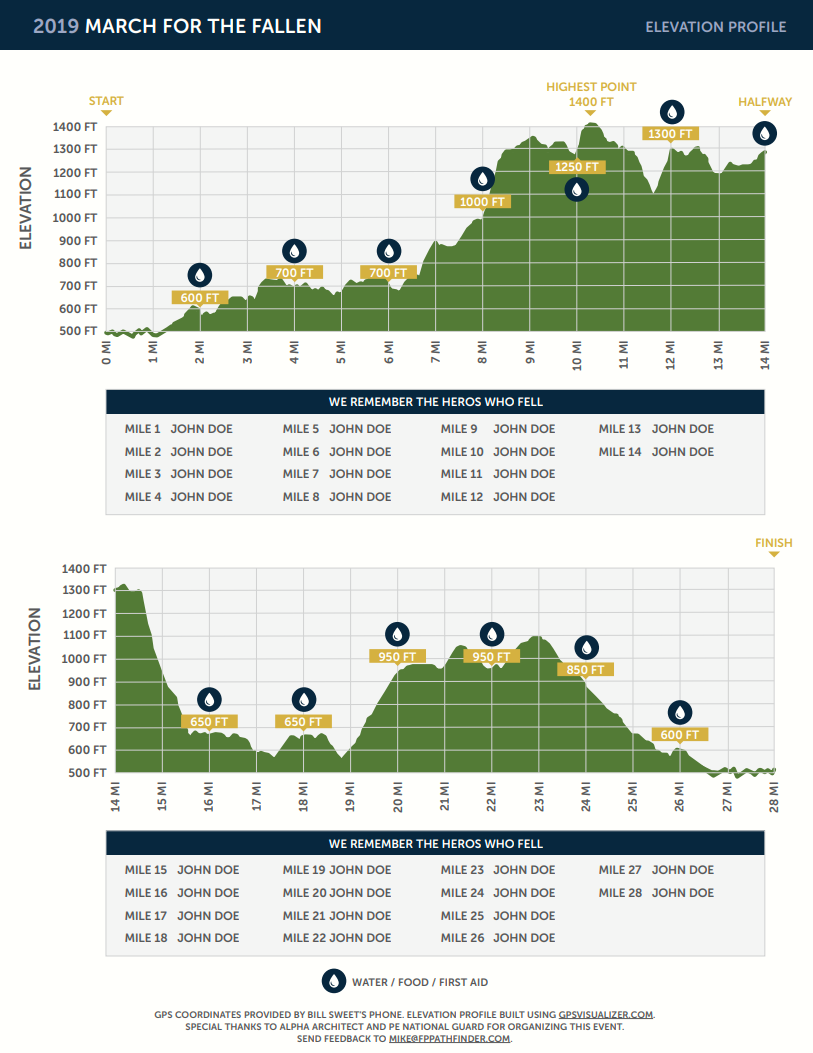

March for the Fallen 2019: Detailed Logistics Outline and What to Expect

By Wesley Gray, PhD|September 5th, 2019|Training Section, MFTF Training Series|

Action Item: Please let us know your trip details so [...]

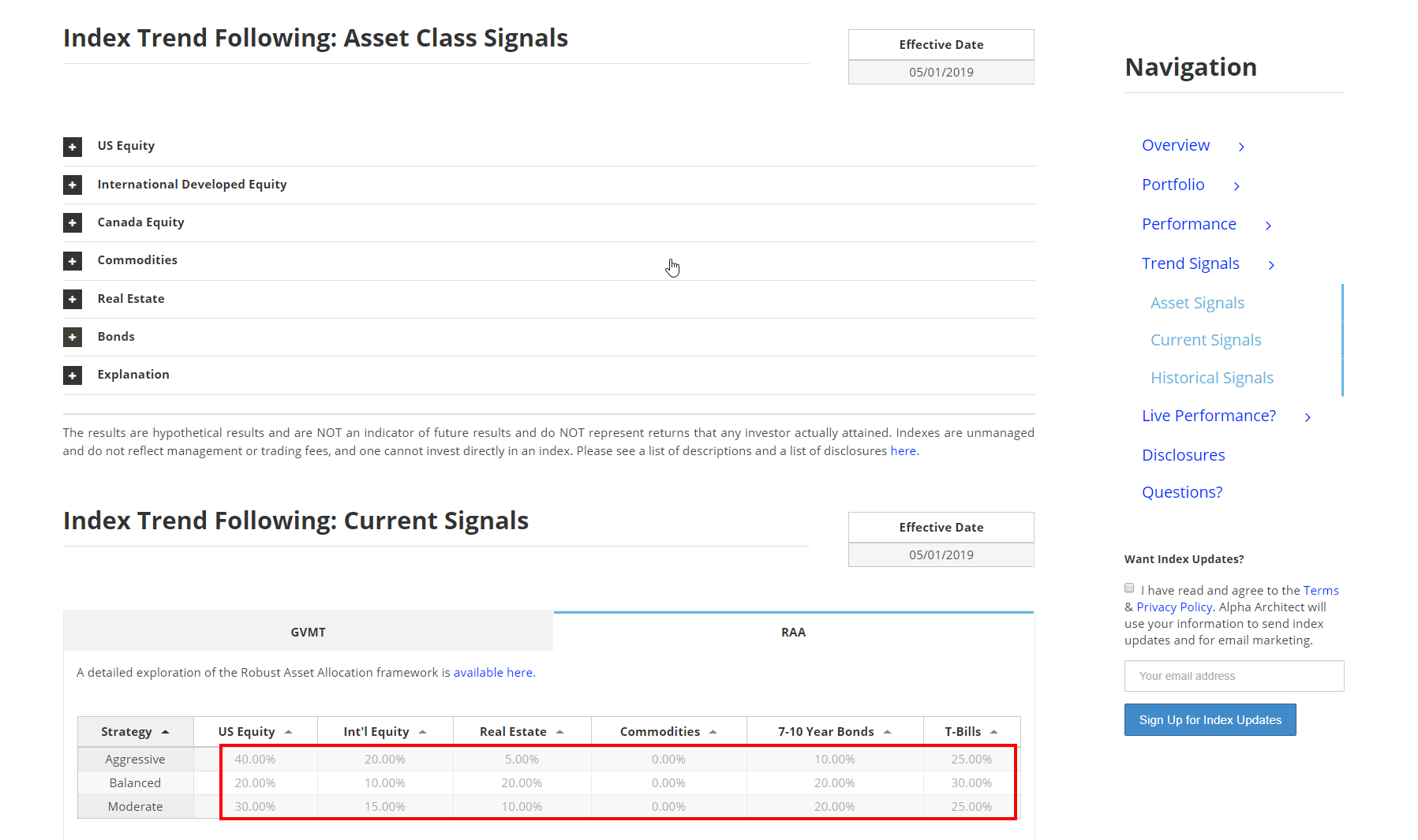

DIY Asset Allocation Weights: September 2019

By Ryan Kirlin|September 3rd, 2019|Index Updates, Research Insights, Tool Updates|

Do-It-Yourself tactical asset allocation weights for the Robust Asset Allocation [...]

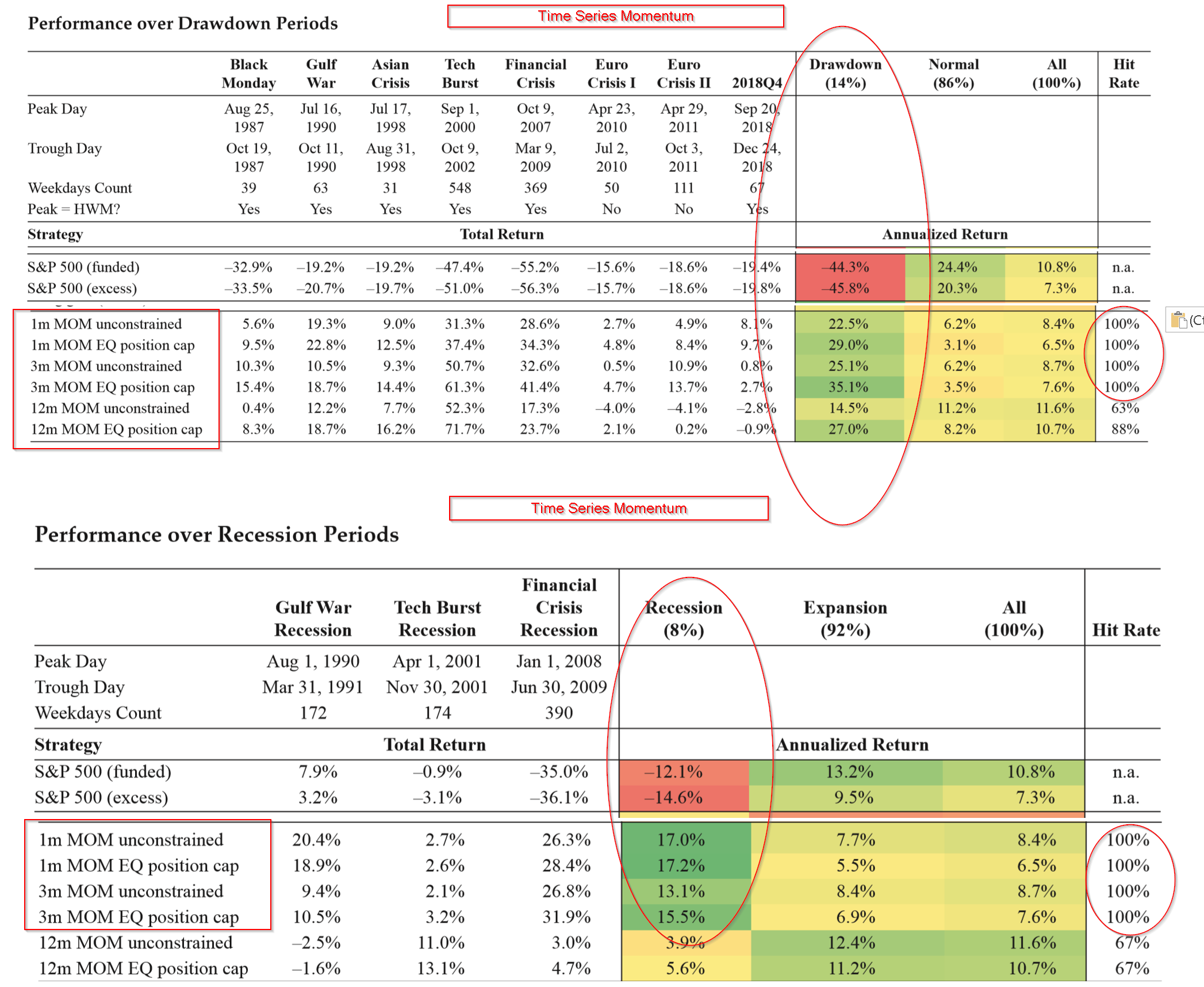

Crisis proof your portfolio: part 2/2

By Tommi Johnsen, PhD|September 3rd, 2019|Quality Investing, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Active and Passive Investing|

The Best of Strategies for the Worst of Times: Can [...]

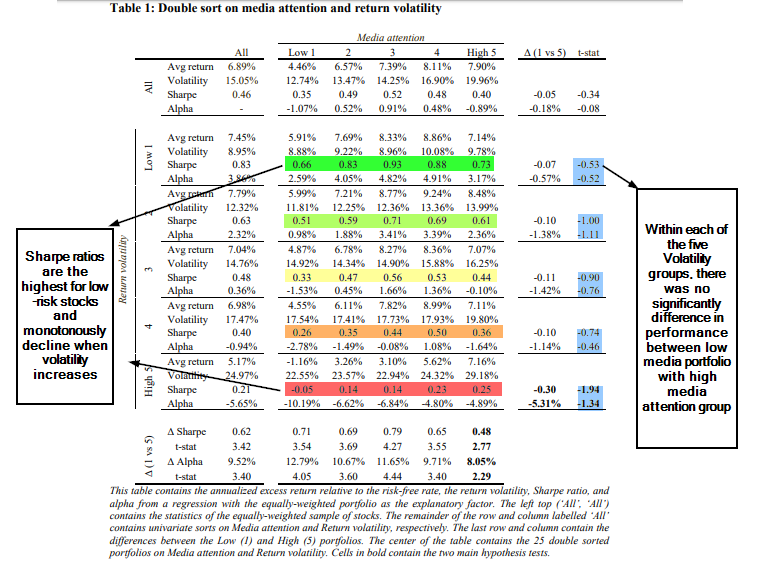

Can We Explain the Low Volatility Anomaly?

By Larry Swedroe|August 29th, 2019|Larry Swedroe, Factor Investing, Research Insights, Academic Research Insight, Low Volatility Investing, Active and Passive Investing|

One of the big problems for the first formal asset [...]