Bond Exchange-Traded Funds (ETFs) help people invest in bonds without having to buy them one by one. Instead, they let investors buy a mix of bonds all at once, making it easier and cheaper to trade. This is especially helpful for bonds that are usually harder to buy or sell. Because of bond ETFs, more people can invest in bonds, and they can do it faster and at lower costs.

Market Accessibility, bond ETFs and liquidity

- Craig W. Holden and Jayoung Nam

- Review of Finance, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

Key Academic Insights

- Easier to Trade Bonds: Bond ETFs let people buy and sell bonds in groups, instead of one by one, making trading easier.

- More Choices for Investors: Many bonds, especially less common ones, were hard to buy before. Bond ETFs make these bonds available to more people.

- Lower Costs: Buying bonds through ETFs is cheaper because investors don’t have to pay high fees for individual bond trades.

Practical Applications for Investment Advisors

Diversification: Bond ETFs allow clients to invest in a wide range of bonds through a single investment, enhancing portfolio diversification.

Cost Efficiency: Utilizing bond ETFs can reduce transaction costs associated with buying individual bonds, making bond investing more cost-effective for clients.

Improved Liquidity: Advisors can offer clients more liquid investment options through bond ETFs, facilitating entry and exit from bond positions.

How to Explain This to Clients

“Investing in bond ETFs is like buying a ready-made basket of various bonds. This approach makes it easier and cheaper for you to invest in the bond market, providing diversification and flexibility in your investment portfolio.”

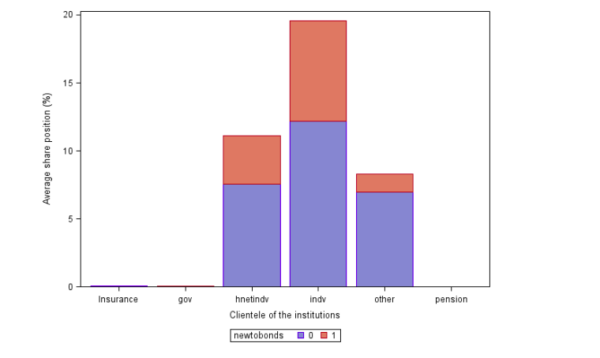

The Most Important Chart from the Paper

Figure 2 shows how bond ETFs have attracted new investors who previously never owned bonds or bond funds. It divides investors into groups, including wealthy individuals, regular individuals, government entities, and institutions like mutual funds and hedge funds. The chart highlights that many ETF investors are newcomers to the bond market, meaning bond ETFs have made it easier for more people and institutions to start investing in bonds. This trend shows that ETFs are increasing access to bond investments, allowing a wider range of investors to participate in the market.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We develop a stylized model that generates the following empirical predictions: the less (more) accessible the underlying market is ex ante, the more its liquidity improves (deteriorates) when basket trading becomes available. We empirically test these predictions using corporate bonds before and after the introduction of ETFs. Consistent with the model’s prediction, liquidity improvement is larger for highly arbitraged, low-volume, and high-yield bonds, and for 144A bonds to which retail investor access is prohibited by law. Our paper leads to a more nuanced understanding of the impact of basket security introduction than previous research suggested.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.