If you’re an investor with a large position in a single stock—maybe you’re a founder, early employee, or long-term shareholder—you know the dilemma:

- Stay exposed to concentrated single-stock risk and cross your fingers, or

- Sell to diversify and trigger a painful capital gains tax bill.

This isn’t just a theoretical problem. We work with investors and advisors facing this exact trade-off all the time. You want to get diversified. You also wish to preserve the value you’ve already built. The good news? There’s a third way.(1)

A Better Way Forward: Diversify Without Triggering Taxes

At Alpha Architect, we’re always on the lookout for ideas that align with our investor-first, transparency-focused mission. That’s why we’ve partnered with Cache Advisors, LLC—a firm focused on modernizing how exchange funds work.

Exchange funds allow investors to contribute concentrated stock positions into a pooled fund and receive a diversified basket of assets in return—without triggering immediate capital gains. (See Jose’s explainer blog here).

This strategy isn’t new. In fact, its been around for decades! But Cache is giving it a modern overhaul, making it more accessible, transparent, and tech-forward. And our strategic alliance is designed to make this solution available to more investors and advisors. Here is a link to Cache’s blog on their latest innovation in the exchange fund space and how they’ve married exchange fund and ETF technology into a unique solution.

Why The Cache Solution Matters: Tax Drag Is a Real Wealth Killer

Let’s illustrate the benefit of tax deferral with a simple example.

Assume a $100,000 investment, compounding at 10% annually over 30 years, and a 24% capital gains tax rate. The difference in outcomes between paying taxes annually vs. deferring them until the end is striking:

This isn’t a sales pitch—it’s just math. The ability to defer taxes keeps more capital compounding over time. That’s the potential benefit an exchange fund structure can unlock for concentrated stock positions.

What About Concentration Risk?

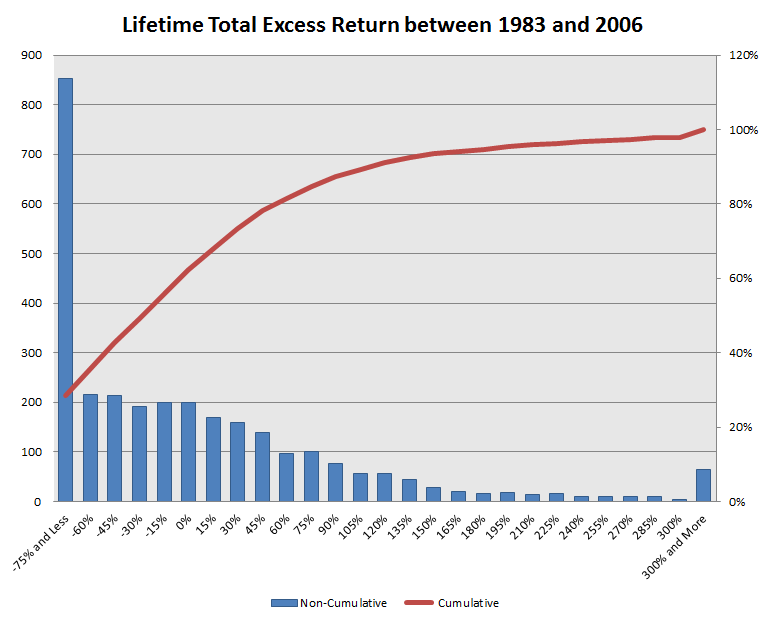

Tax isn’t the only issue. Holding too much of your wealth in a single stock is very risky. We’ve written about this before, but here’s the punchline from the chart below:

From 1983 to 2006, 63% of individual U.S. stocks underperformed the broad market. Only 37% outperformed.

Translation: betting big on a single stock might feel comfortable, but it’s often not a durable path to wealth.

Diversification matters. The challenge is finding a way to diversify without paying a massive tax bill. That’s what exchange funds aim to solve.

The Solution: Cache’s Exchange Fund Platform

Cache is reimagining the traditional exchange fund structure. They’ve built a modern platform that streamlines the process of contributing stock, enrolling in a fund, and receiving a diversified portfolio over time.

Key Features:

- Tax-efficient access to diversification

- S&P 500-aligned exchange fund structure

- Technology-first interface for onboarding and document management

- Institutional-grade execution, tailored for high-net-worth investors and their advisors

Interested? You can learn more or begin enrollment at usecache.com. Questions? Reach out directly to their team at [email protected].

Who’s Eligible?

Exchange funds are restricted to:

- Accredited Investors or

- Qualified Purchasers

Before participating, you’ll need to review:

- Cache’s Form ADV Part 2A

- Solicitor Disclosure Document

- Eligibility criteria and risk factors

You can find full legal and compliance documentation at: usecache.com/legal/terms-of-use

Why Alpha Architect is Involved

We’re supporting Cache as a strategic partner, helping power their exchange fund and coupling that with our ETF capabilities. However, we are not affiliated with Cache. This partnership is part of our broader mission: bring institutional-grade tools to more investors with a focus on transparency, tax efficiency, and affordability.

Together, we’re trying to achieve the following goals:

- Reducing complexity for advisors handling concentrated positions

- Expanding access to smart, tax-sensitive investment structures

- Building infrastructure for the future of personalized wealth management

Final Thoughts

Concentrated stock positions can be a blessing—and a burden. We believe investors deserve better tools to manage that risk without giving up the tax advantages they’ve earned.

Our partnership with Cache is designed to do just that: empower investors with modern solutions that are transparent, investor-friendly, and backed by real infrastructure.

References[+]

| ↑1 |

Please note that Alpha Architect and affiliates are not affiliated with Cache. While we do not exchange funds directly, we have partnered with Cache Advisors, LLC (“Cache”), an investment firm specifically designed to assist with concentrated stock positions, to provide a solution. We have worked with the team and can say that they are experienced and share a common philosophy regarding diversification and long-term investing. Interested investors can visit Cache to begin enrolling and invest in an exchange fund. Have questions? Please email [email protected] to explore next steps. As a reminder, Exchange Funds are open to either Accredited Investors or Qualified Purchasers. To participate, you’ll need to confirm with Cache that you have received and reviewed Cache’s Form ADV, Part 2A, and that you need to review our disclosures and ensure you meet the Eligibility Criteria listed within the Solicitor Disclosure Document. About Cache: Founded in January 2022, Cache Financials Inc., “Cache,” is on a mission to help investors maximize the value of their large stock positions. Cache spent over two years in stealth mode, building the technical and financial infrastructure necessary for its modern exchange funds. Cache, through its subsidiaries, operates both a broker-dealer and an investment advisor, Cache Securities LLC, Member FINRA and SIPC, which distributes Cache’s products. Cache Advisors LLC, an SEC-registered investment Advisor, is the advisor to the Cache Exchange Funds. Additional Disclosure Documents are available here: https://usecache.com/legal/terms-of-use. For additional information about Cache Advisors, LLC, please visit www.adviserinfo.sec.gov. Disclaimer: Alpha Architect, LLC and its affiliates (“Alpha”) and Cache Advisors, LLC and its affiliates are not affiliated entities. Alpha is not directly compensated for referring clients to Cache. Alpha will receive a management fee for all assets invested in its ETF Fund offerings. |

|---|

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.