This paper seeks to address three pivotal questions that explore the broader economic and social impacts of IPO activity, particularly its role in influencing stock market participation through localized attention and wealth effects. This paper addresses the challenge of accurately measuring the performance of individual private equity funds by developing a new benchmarking method that reduces noise in existing performance metrics. The authors propose an improved approach that better accounts for systematic risk and common factor shocks.

Risk-Adjusted Returns of Private Equity Funds: A New Approach

- Arthur Korteweg and Stefan Nagel

- The Review Of Financial Studies, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The main research questions addressed in this paper can be summarized as follows:

- How accurate are commonly used performance evaluation metrics, such as the Public Market Equivalent (PME) and Generalized Public Market Equivalent (GPME), in assessing individual private equity (PE) fund performance?

- Can a new benchmarking method that removes common factor shocks provide a more precise measure of individual PE fund abnormal returns compared to PME and GPME?

- How does the proposed alpha (α) performance measure improve the evaluation of private equity fund characteristics, such as performance persistence and the relationship between fund size and returns?

What are the Academic Insights?

By studying comprehensive private equity fund cash flow data sourced from hundreds of Limited Partners (LPs) that comes from Burgiss, a provider of investment decision support tools in private equity markets, the authors find:

- Commonly used metrics like PME and GPME are too noisy for evaluating individual private equity (PE) fund performance. While GPME is useful for assessing aggregate PE performance, it fails to remove common factor shocks at the individual fund level. This noise makes it difficult to draw meaningful conclusions about a single fund’s abnormal returns.

- YES-The new benchmarking method removes common factor shocks by constructing a benchmark portfolio that matches the systematic risk of PE cash flows. This approach reduces noise in performance estimates, making fund-level abnormal returns more precise. Compared to PME and GPME, it provides a clearer signal of individual fund performance, improving reliability in fund evaluation.

- The α performance measure improves fund evaluation by reducing noise and enhancing statistical power in analyses. It provides more precise estimates of the relationship between fund size and returns, reducing standard errors in regressions. Additionally, α better predicts future fund performance, especially for top-quartile venture capital funds and buyout funds. This makes it a more reliable tool for studying performance persistence in private equity.

Why does this study matter?

This study improves how private equity (PE) fund performance is evaluated, which is crucial for investors making allocation decisions. Traditional metrics like PME and GPME are too noisy at the individual fund level, leading to inaccurate assessments. By introducing a more precise benchmarking method, the study helps investors, pension funds, and endowments make better-informed investment choices. It also enhances academic research on performance persistence and the impact of fund characteristics, contributing to more robust financial decision-making in the PE space.

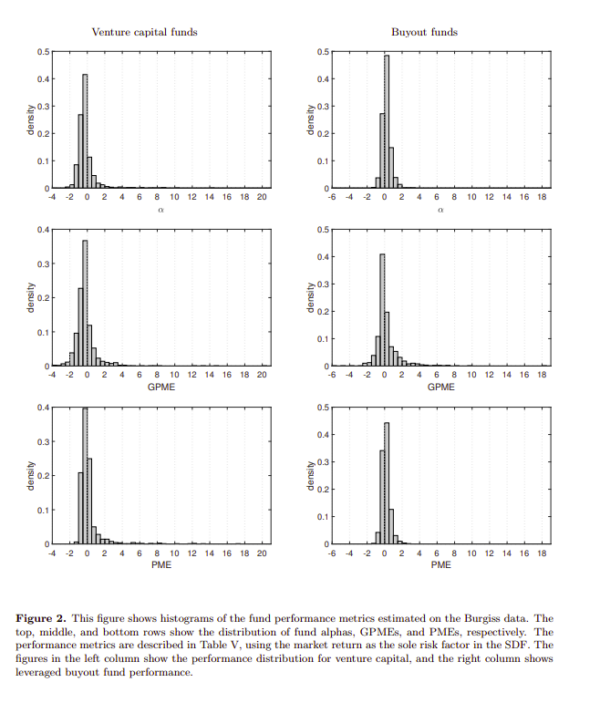

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

This paper introduces a new approach to benchmarking the performance of individual private equity funds. The new metric, α, is substantially less sensitive to noise in individual fund cash flows compared to the popular public market equivalent (PME) measure and its generalized version (GPME), while having the same aggregate pricing implications for private equity as GPME. We illustrate in simulated data that α is an overall more accurate measure of risk-adjusted fund returns than both PME and GPME. For a large data set of private equity fund cash flows, the standard deviation of α across venture capital funds is 20% lower than PME and GPME. For buyout funds, PME and α are quite close, but the metrics deviate in subsamples where beta is different from one. Our more accurate performance metric increases the statistical power in regressions of performance on fund size, and improves performance predictability of managers’ future funds.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.