This study investigates whether firms’ divestitures of pollutive assets genuinely contribute to environmental sustainability or merely serve as greenwashing tactics. Analyzing transactions involving industrial plants, the authors find that while firms often sell off their most pollutive assets following environmental incidents, these divestitures do not lead to actual reductions in pollution. Instead, sellers benefit from improved ESG ratings and reduced regulatory scrutiny, despite the environmental impact remaining unchanged. This research highlights the need for investors and regulators to critically assess the authenticity of firms’ sustainability claims.

Sustainability or Greenwashing: Evidence from the Asset Market for Industrial Pollution

- RAN DUCHIN, JANET GAO, QIPING XU

- Journal of Finance, 2025

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

Key Academic Insights

Divestitures Often Lack Environmental Impact: Firms tend to divest their most pollutive assets in response to environmental incidents. However, these transactions do not result in significant reductions in pollution levels, suggesting that the environmental benefits are superficial.

Improved ESG Ratings Post-Divestiture: Despite the lack of environmental improvements, firms still enjoy better ESG ratings and lower regulatory costs. This highlights the ongoing issue with ESG metrics: they often reflect perceived effort rather than real outcomes. As discussed in another post on ESG ratings, these ratings can be inconsistent and potentially misleading.

Continued Access Through Business Ties: Sellers often maintain access to divested assets via supply chain relationships or joint ventures with buyers, allowing them to benefit from the assets without bearing the associated environmental responsibilities.

Practical Applications for Investment Advisors

Scrutinize ESG Claims: Advisors should critically evaluate firms’ ESG improvements, distinguishing between genuine sustainability efforts and superficial changes. There’s often a tension between what looks sustainable on the surface and what actually drives real-world impact.

Assess the Substance of Divestitures: When firms announce asset divestitures as part of their sustainability strategy, it’s essential to analyze whether these actions lead to tangible environmental benefits or merely serve to enhance ESG profiles without real change.

Incorporate Comprehensive Due Diligence: Integrate assessments of firms’ environmental practices, including the outcomes of asset sales, to ensure that investment decisions align with authentic sustainability objectives.

How to Explain This to Clients

“While companies may claim to be becoming more sustainable by selling off polluting assets, research indicates that these actions often don’t lead to actual environmental improvements. Instead, firms might benefit from better ESG ratings without making meaningful changes. As your advisor, I focus on identifying investments where sustainability claims are backed by real, measurable environmental progress.”

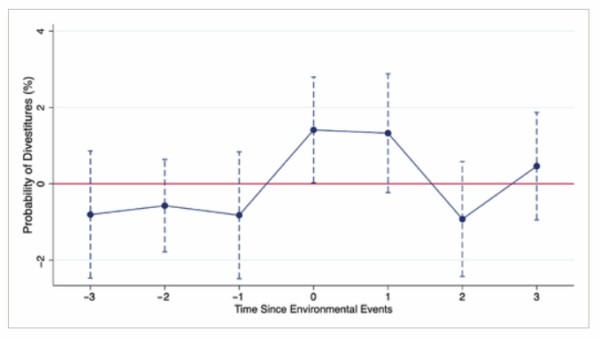

The Most Important Chart from the Paper

This figure presents estimates from a dynamic regression model that traces the likelihood of divesting pollutive plants in the three years before and after an environmental risk incident. The model regresses the Sell (Pollutive) indicator on a series of interaction terms between Env. Event and dummy variables indicating years around environmental risk incidents. Sell (Pollutive) equals one if the firm divests a pollutive plant in a given year. Pollutive plants are plants in the Toxic Release Inventory Program of the U.S. Environmental Protection Agency. Env. Event is an indicator that equals one if Reprisk reports an environmental risk incident for the firm in a given year. The regression includes firm and year fixed effects. The dashed vertical lines represent 90% confidence intervals based on standard errors clustered at the firm level.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We study the asset market for pollutive plants. Firms divest pollutive plants in response to environmental pressures. Buyers are firms facing weaker environmental pressures that have supply chain relationships or joint ventures with the sellers. While pollution levels do not decline following divestitures, sellers highlight their sustainable policies in subsequent conference calls, earn higher returns as they sell more pollutive plants, and benefit from higher Environmental, Social, and Governance (ESG) ratings and lower compliance costs. Overall, the asset market allows firms to redraw their boundaries in a manner perceived as environmentally friendly without real consequences for pollution but with substantial gains from trade.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.