This article explores why stocks that have been performing well tend to continue doing so, a phenomenon known as “momentum.” Researchers analyzed data from various countries to see if explanations found in U.S. markets also apply internationally. They discovered that when information about a company comes out gradually, investors might not react strongly, leading to momentum. Other factors, like how a company’s value is perceived, also play a role, but to a lesser extent.

Empirical determinants of momentum: a perspective using international data

- Amit Goyal, Narasimhan Jegadeesh, and Avanidhar Subrahmanyam

- Review of Finance, 2025

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

Key Academic Insights

Stocks Rise When News Spreads Slowly: When new information about a company is released bit by bit, investors take time to react, causing stock prices to keep rising.

What People Think About a Company Matters: If investors believe a company is valuable, its stock may keep going up, but this is not the main reason for momentum.

Momentum Is Stronger in Certain Markets: Stocks are more likely to keep rising when the overall market is doing well and not too unpredictable.

Practical Applications for Investment Advisors

Watch How News Comes Out: When companies release information slowly, it can create momentum, which may offer investment opportunities.

Look at the Market’s Condition: Momentum works best in markets that are stable and rising, so consider this when making investment choices.

How to Explain This to Clients

“Sometimes, when a stock starts doing well, it keeps going up because not everyone reacts to the news right away. By paying attention to these patterns, we can find good investment opportunities that fit your financial goals..“

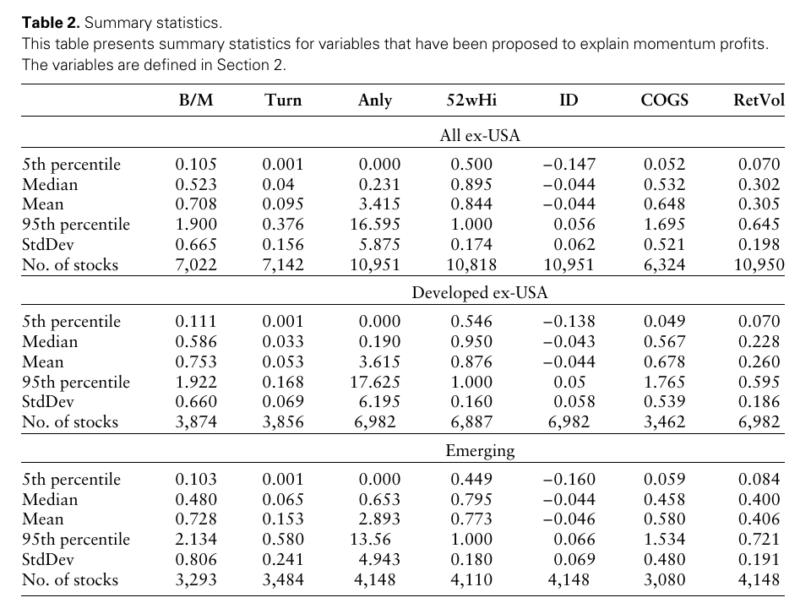

The Most Important Chart from the Paper

This table visually presents the momentum profits observed outside the United States. The table shows how stocks that have performed well in the past continue to do so in various international markets, reinforcing the momentum effect globally. This evidence supports the idea that momentum is a widespread phenomenon, not limited to the U.S. market, and highlights the need to understand its underlying causes in different economic environments.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Although momentum exists in many markets throughout the world, explanations for momentum have largely been tested using US data. We investigate the extent to which US-based momentum explanations extend to the international context, using regression-based and portfolio approaches. Among the several hypotheses we consider, we find reliable support for the hypothesis that due to limited attention, investors underreact to information arriving in small bits rather than in large chunks, which results in momentum. We also find secondary support for the overconfidence hypothesis for momentum. Finally, we find that momentum is stronger in up-markets and less-volatile markets in the international context just as in the USA. This finding also accords with the investor overconfidence hypothesis, under the proviso that investors are more confident in rising, low-volatility markets.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.