The most therapeutic way I want to address overconfidence (probabilities associated with outcomes are bias. For example, I am “90% confident the market will be at 1000 next year”), is to share with the world my personal anecdotes about suffering from this behavioral bias.

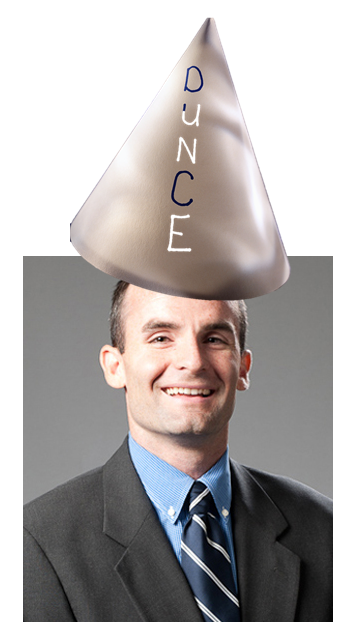

In the end, the hope is that I can convince myself that I am a true idiot and that I should not be trusted to make decisions based on my “feelings.” Is this a humiliating humbling, and ridiculous masochistic exercise? Yes. Does it help remind me that I am no better than average at figuring out where the market is going in the future? Yes. Mission accomplished.

First, a story about the most ridiculous bout of overconfidence I have ever witnessed

In April 2009, a $200mm hedge fund called Ridgeback Capital had over 92%of their assets invested in one position—Sequenom, Inc.–a biotech start-up for all intents and purposes. The fund managers at Ridgeback were clearly suffering from some form of overconfidence. Suffice to say, on April 29th Sequenom released information that the data on their diagnostics tests was compromised and the stock ended the day down almost 80%. I’d like to say I feel sorry for the Ridgeback Capital investors, but I feel no remorse—anyone who gives someone $200mm and allows them to invest it in essentially one stock, deserves to lose their shirt!

Second, a story about the second-most ridiculous bout of overconfidence I have ever witnessed

The following quotes are taken from an investor letter I wrote in December 2008. The ideas and propositions sound eerily similar to a lot of the investor letters I read today–strong on story, weak on data/results.

Our overall portfolio is conservatively postured going into 2009 and well positioned to capitalize on a handful of special situations with which we are currently involved. I’m confident our portfolio will preserve capital, while concurrently positioning the fund with the opportunity to earn attractive returns. Forecasting for the general stock market into 2009-2010 is a daunting task, and unfortunately, we have no crystal ball. Many analysts are bullish that government intervention will ameliorate the current economic crisis by injecting massive amounts of liquidity into the economy. However, we are skeptical: in addition to concerns about long-term debt and/or inflation, we believe that government intervention ultimately cannot mitigate the past several decades of overspending, exuberant leverage, poor corporate governance, and an “easy-money culture.” There will be no easy answers to turning around the worst financial crisis since the Great Depression, and the last time we checked, wealth didn’t grow on printing presses. Our bet is that the economy (and perhaps the stock market) in 2009 and well into 2010 will be similar to 2008—FUBAR.

Wait for it…wait for it…HERE COMES MORE OVERCONFIDENCE!

Despite our pessimism, we are hopeful that 2009 will bring more good news than 2008. However, we feel that pragmatism is more important than fairy tales. Many on Wall Street (who vehemently opposed any form of government intervention before 2008 and predicted that the S&P 500 would end 2008 at 1500) are now banking on the success of a massive and logistically-intensive government intervention to save the world economy. The current consensus “bottoms up” estimate for 2009 S&P 500 earnings is $81.80. This number assumes that government intervention will result in a mid to late 2009 economic recovery—not to mention wishfully hoping that credit markets and housing will stabilize, financials will start making money, enormous pension underfunding charges will vanish, and consumers will start spending and borrowing money they can’t afford to spend. This “government-saves-the-economy” scenario could happen, but if it doesn’t, we expect the more realistic “tops down” 2009 S&P 500 earnings estimate of $42.24 to come true. Applying a 7x-12x bear market multiple to a $50 earnings stream results in a 350 to 600 target on the S&P 500—a scary, but plausible outcome. Nobody knows if the S&P 500 will actually reach these levels, but it cannot be ruled out.

I estimate I would have put a 75-80% probability that the market would blow up…boy, was I wrong!!!

Anyway, feel free to share your bad calls and overconfidence. Trust me, it is liberating, humbling, and might force you to go on a vacation. Aye carumba. Thank God I got a computer I can blame all my problems on from here on out!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.