Low volatility funds are everywhere.

The reasons for their proliferation are clear:

- Who wouldn’t want to own something with the label “low volatility” and

- Recent performance has been great.

Open the AUM floodgates!

But perhaps not all is well in low volatility land. A recent snippet by Josh Brown hints at the idea that perhaps low volatility is overdone. Charles Bilello at Pension Partners takes Josh’s sentiment a bit further and highlights that the valuation on the securities associated with the typical low volatility fund is richly valued relative to the typical high volatility fund (Jason Zweig has a related piece). For example, Charles shows that SPLV (a low volatility fund) has an average P/E of 21.47, whereas SPHB (a high volatility fund) has an average P/E of 17.89.

No matter what the strategy, if it suggests that you buy expensive growth stocks, that should give you pause since in general buying growth stocks has proven to be a bad idea in the past.

Of course, the biggest splash of cold water on low volatility funds came indirectly from Rob Arnott, a pioneer of “smart beta.” His piece, “How can smart beta go horribly wrong,” which, if you haven’t seen it, states the following:

Large asset flows into low beta [i.e., low volatility] products are now driving valuation levels far above their historical norms.

Arnott suggests–fairly bluntly–that low volatility strategies are in for some expected pain in the future.

But is this true? Perhaps, but understanding why is more complex…

Two takeaways from the paper we investigate:

- The research we highlight suggests that low volatility strategies, even when deployed during periods when low volatility stocks are expensive, can still serve a role in a portfolio. One wants to avoid periods when low volatility portfolio valuations are extremely expensive relative to high volatility portfolios, but just because low volatility stocks are expensive, doesn’t mean they can’t help an investor’s portfolio, in expectation.

- Of course, this assumes that an investor can’t already access targeted exposures to active value and momentum exposures. If an investor can already deploy value and momentum strategies, low volatility strategies don’t do much for a portfolio except in cases when the valuations on low volatility portfolios are extremely cheap relative to high volatility portfolios.

Let’s dig a little deeper…

What are we to make of the low volatility debate? Is pain on the horizon?

We don’t disagree with much of the sentiment identified above, and we’ve done some fairly extensive analysis of the low-volatility anomaly here, here, here, and here. As naturally-inclined value investors, buying anything that is expensive receives a knee-jerk answer: “No.” But over the years I’ve come to appreciate trend-following and momentum philosophies. So while I’ll never be deterred from the value investing credo, I also understand that it isn’t the only answer. Low volatility falls in an interesting camp, even if it isn’t necessarily a “value investing” camp. However, our interest in low volatility investing comes with reservations. We’ve covered some research that hints that the low-volatility anomaly isn’t robust here, here, and here. More work needs to be done.

In other words, I’m still confused. But I went looking for recent recent work in the peer-reviewed literature and ran across the paper, “Low-Volatility Cycles: The Influence of Valuation and Momentum on Low-Volatility Portfolios.

Here is a shortened abstract from the paper:

Research showing that the lowest risk stocks tend to outperform the highest risk stocks over time has led to rapid growth in so-called low-risk equity investing in recent years….Our results suggest time-variation in the performance of low-risk strategies is likely influenced by the approach to constructing the low-risk portfolio strategy and by the market environment and associated valuation premia.

Bottomline: Valuations do matter when it comes to low volatility investing. But low volatility only completely loses its mojo when valuations are extreme.

What does the paper say?

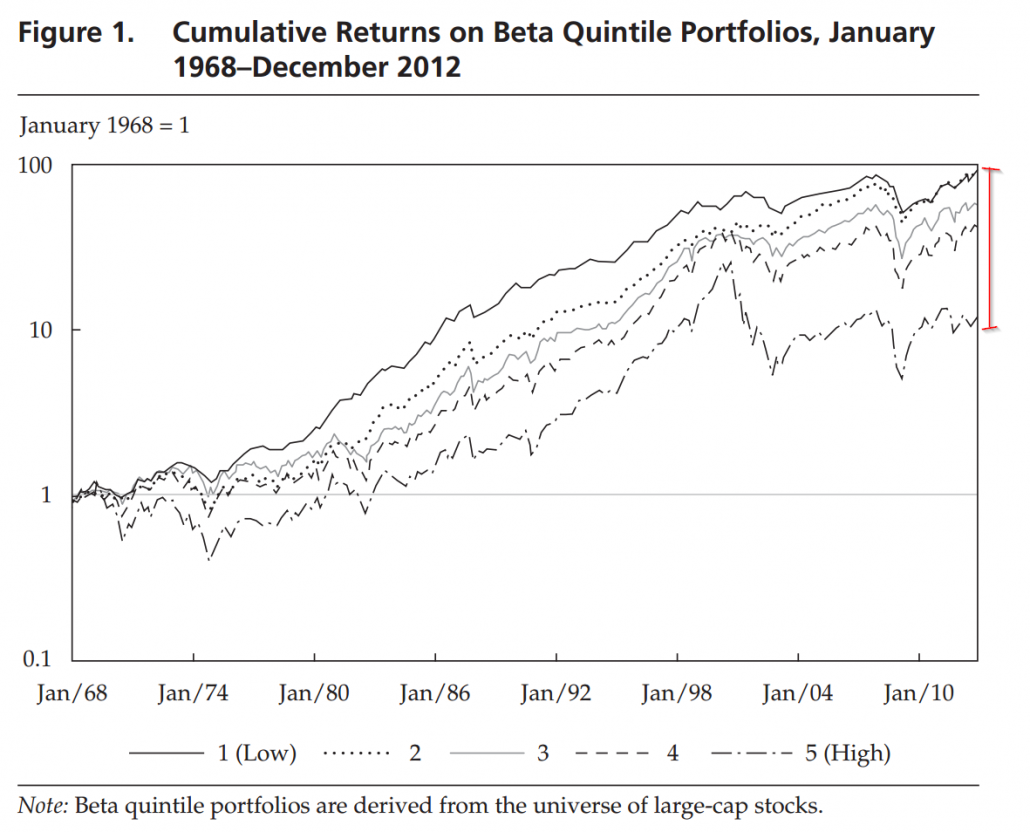

First, the paper identifies that low volatility stocks beat high volatility stocks — confirming what we all already knew. Below is a chart from the paper outlining the cumulative returns for the 5 beta quintiles (1 = low beta, 5 = high beta).

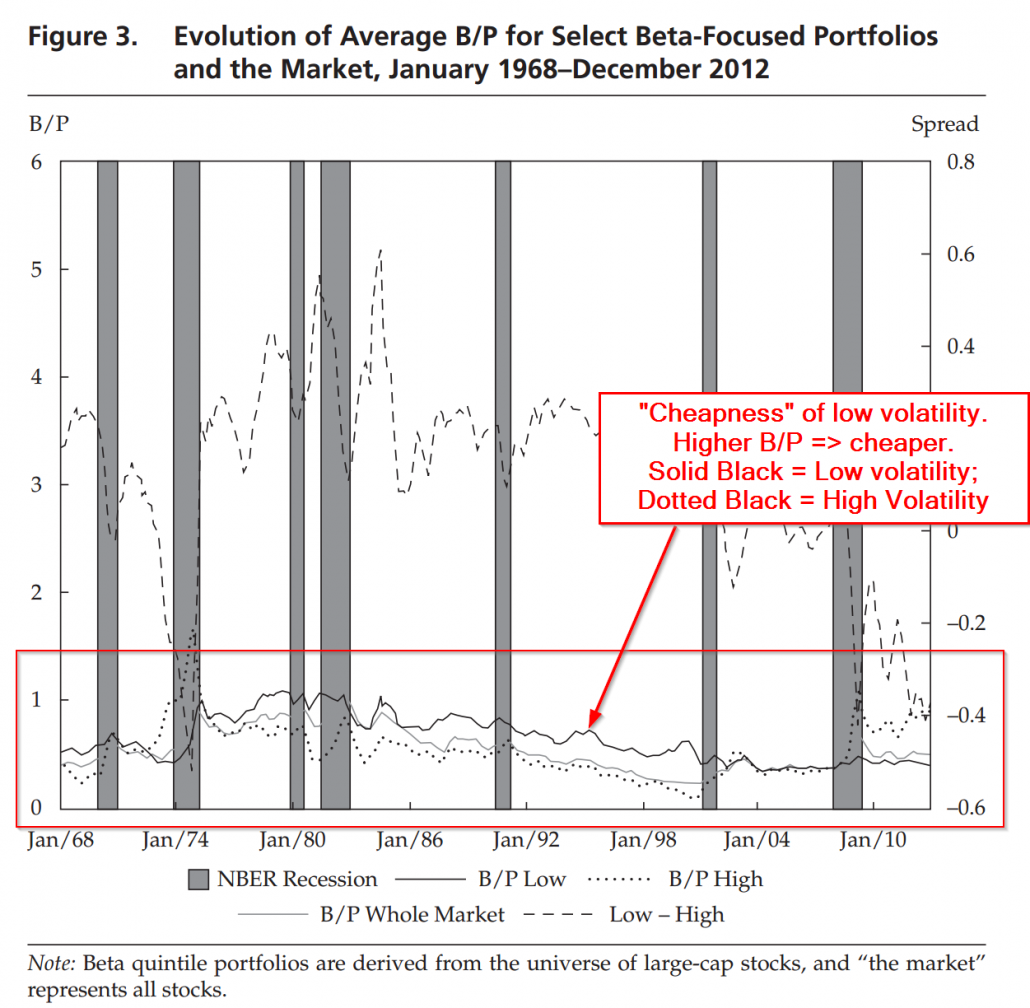

But here is where it gets interesting. The authors look at the time series behavior of the average “cheapness” for the low volatility portfolio and the high volatility portfolio over time. The figure below summarizes their analysis:

Note that historically there is a positive spread in the “cheapness” characteristic between low volatility and high volatility portfolios (i.e., low volatility portfolios look like value and high volatility portfolios look like growth). Put another way, in general, low volatility stocks have also tended to be cheap (value) stocks; by contrast, high volatility stocks have also tended to be expensive growth stocks.

But how does this affect the performance of the strategy? Does it matter whether low volatility stocks are especially cheap, or not especially cheap? A common hypothesis is that low volatility only works when it is cheap, but it fails when it is expensive (the hypothesis proposed by Arnott).

The authors assess this in Table 2 of their paper. The far left column sorts portfolios based on 5 valuation regimes identified based on the spread in valuation metrics between low volatility and high volatility portfolios (pictured in the figure above).

Here’s how it works. The authors take a given month and divide the market into 5 volatility quintiles. Thus, at the extremes, there will be a high volatility quintile, and there will be a low volatility quintile. Next they say: “Given we have both a high volatility quintile and a low volatility quintile in this month we are looking at, how cheap are the stocks in these 2 extreme quintiles relative to each other?” That is, is there a large spread or is there a small spread? If the spread is large, this outcome will be captured in a high B/P spread quintile. If the spread is small, this outcome will fall in a low B/P spread quintile.

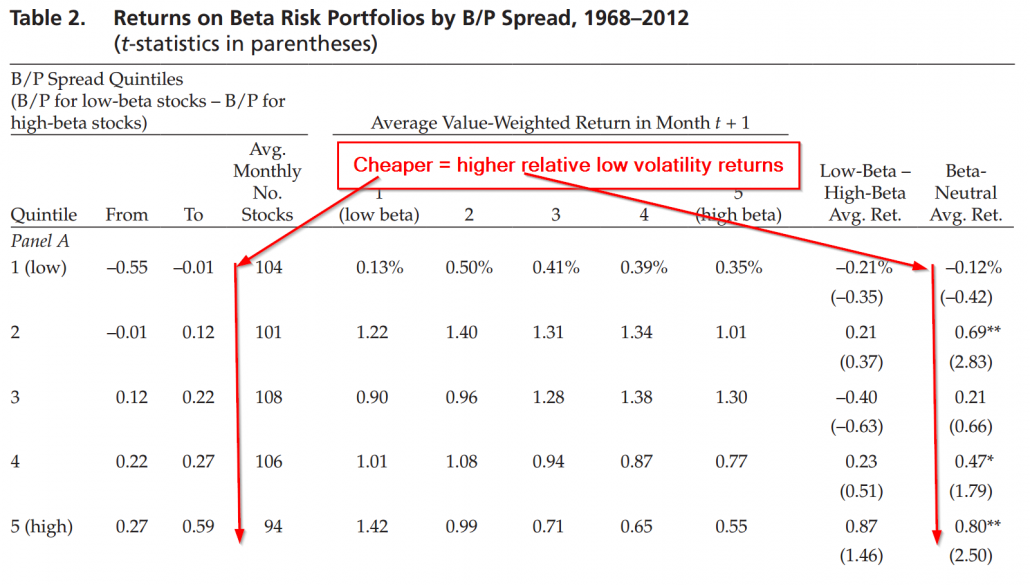

Next, now that we have identified valuation 5 spread “regimes,” for the high vol-low vol spreads, we can go ahead and further sort these regimes into volatility quintiles. That is, we can ask questions like, “given a regime where valuation spreads were very high across low and high vol portfolios, within this valuation regime, did volatility do a good job of separating winners from losers, or a bad job?”

Quintile 5 represents the answer to this particular question. At times when there was a large B/P valuation spread between the high and low the volatility portfolios, volatility appears to do a good job of further separating winners from losers. Average value-weight returns go from 0.55% for high beta, all the way up to 1.42% for low beta. Low beta seems to work well when valuation spreads are large! Good job!

Meanwhile, Quintile 1 represents times when there was a small B/P spread between the high and the low volatility portfolio. What happens here? Volatility does not do a good job versus how it did in Quintile 5 at further separating winners from losers. Here, average value-weight returns actually decreased, going from 0.35% for high beta, down to 0.13% for low beta. Low beta is actually working against us! Bad job!

The far right column is the average return calculation during these valuation regimes and represents the spread in returns between low volatility and high volatility portfolios.

The beta neutral spread (100% long low volatility and 25% short high volatility, which is roughly beta neutral) has positive returns in all valuation environments, except the most extreme (-12bps), where it breaks down. In fact, even when low volatility minus high volatility valuation spreads are pretty extreme (quintile 2), there is a 69bp spread in avg returns, which is close to the avg return in regimes when low volatility stocks are really cheap relative to high volatility stocks (80bps).

Is this really just another value and momentum story? Kinda…

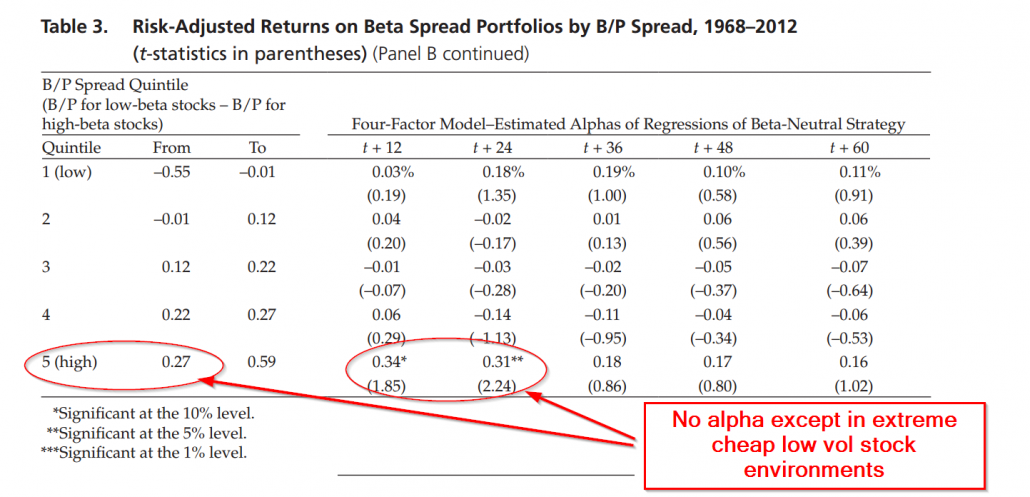

All this analysis perhaps begs a question: is low volatility really just an exposure to value and momentum? The authors examine this via factor regression analysis in table 3 Panel B. Interestingly, “alphas,” or the average excess return associated with the strategy after controlling for exposures to the market, size, value, and momentum, are only reliably positive in the regime when low volatility stocks are way cheaper than high volatility stocks.

Perhaps I’m misinterpreting (wouldn’t be the first time), but the results seem to suggest that low volatility is much ado about nothing, EXCEPT, when the spread in valuations between low vol and high vol are most extreme (i.e., quintile 5).

So this brings us back to the original question from the beginning of this post, i.e., is low vol investing overdone, given current market conditions?

Based on the analysis from the paper above, the answer has to do with whether valuation spreads are large or small today. As many authors have pointed out, the valuation spread between low volatility and high volatility portfolios is pretty extreme.

As highlighted in the paper, low vol only gets really interesting when spreads are large. But today, spreads are not large; they are negative! When spreads are negative like they are today, you can engineer the same risk exposures promised by “low vol” strategies, by leveraging value and momentum. So what’s the point?

Maybe there is some mojo left in low volatility, but for the most part, value and momentum already capture most of the benefits, at least that’s what it looks like based on the research paper and the current state of affairs on low volatility portfolio valuations.

Curious to hear thoughts from others and we’ll have to do some more research on this subject in the future. The case is not entirely closed on low volatility, but identifying how to best exploit the effect will take some thinking…

Low-Volatility Cycles: The Influence of Valuation and Momentum on Low-Volatility Portfolios

Garcia-Feijoo, Kochard, Sullivan, and Wang

A version of the paper can be found here.

Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

Research showing that the lowest risk stocks tend to outperform the highest risk stocks over time has led to rapid growth in so-called low-risk equity investing in recent years. We examine the performance of the low-risk strategy previously considered in the literature and of a beta-neutral low-risk strategy more relevant to practice. We demonstrate that the historical performance of low risk investing, like any quantitative investment strategy, is time-varying. We find that both of our low-risk strategies exhibit dynamic exposure to the well-known value, size, and momentum factors and appear to be influenced by the overall economic environment. Our results suggest time-variation in the performance of low-risk strategies is likely influenced by the approach to constructing the low-risk portfolio strategy and by the market environment and associated valuation premia.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.